How climate aware are you?

COVID-19 has amplified the climate change challenges faced by investors and highlighted the need for resilience and adaptable infrastructure. Will this lead to a turning point in the climate challenge and make investors more climate aware?

While a lot is being done to invest for a lower-carbon world, investors are signaling the need to be more ambitious and move faster. Our own research has shown that allocators want to use their capital in a climate-smart way and help close the climate gap.

De-carbonizing existing portfolios won’t be enough. Waiting for data to be perfected or legislation to be put in place only prolongs the delay, while placing faith in the ingenuity needed to support economic growth with net negative CO2 emissions could prove misplaced.

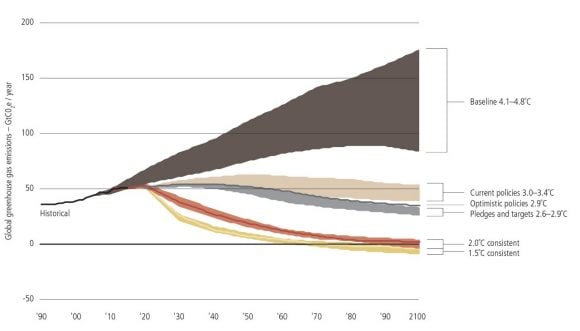

2100 warming predictions

2100 warming predictions

Investors need actionable tools and techniques: methodologies that guide them in a changing and uncertain world, providing greater certainties so they can allocate their capital in ways that drive the low-carbon transition. And most importantly, they need to be able to act today, not wait for tomorrow.

We recognize these shortcomings which is why we are proposing a methodology to help investors become fully ‘climate aware’.

Moving away from a dependence on backward-looking data and toward a forward-looking model can help them to position their portfolio for a climate-smart future.

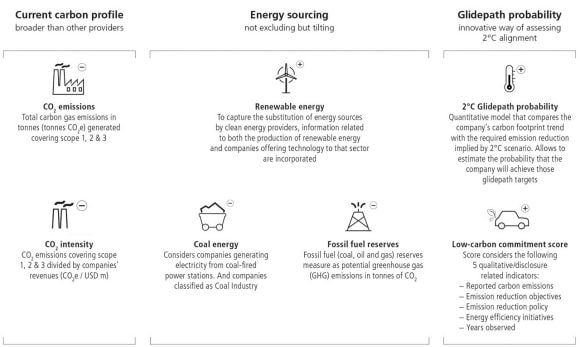

Our methodology contains three key elements:

- Portfolio mitigation: Lowering investment exposures to carbon risks

- Portfolio adaptation: Increasing investment exposures to climate-related innovation and solutions

- Portfolio transition: Aligning investments to the requirements of a lower-carbon economy

It is a pragmatic, flexible, investor-led approach. Minimizing allocations to companies most negatively affected by climate change should help to mitigate the downside risk, while increasing exposure to companies with climate-smart business models and offerings may maximize the upside opportunity.

By balancing each of these three elements investors can:

- Achieve a holistic, forward-looking approach to tackling the uncertainties and challenges of climate change

- Adjust one or more of the individual elements as circumstances change

- Have an opportunity to make better informed investment decisions and use their weight of capital to influence change

Minimizing allocations to companies most negatively affected by climate change should help to mitigate the downside risk.

At any given point in time, investors can dial up or dial down one or all of the three elements, to better balance their climate risks and objectives.

A program of active engagement underpins the methodology, which is essential. It looks to provide deeper insights to the actions and progress which companies are making toward a climate-smart future. Those insights mean that investors can directly link the adjustments they make to investments in their portfolios to actions that investee companies are taking to address climate change.

Through this combination of portfolio strategy and collaborative engagement, investors may have a significant impact on efforts to tackle climate change. We call this combination of portfolio adjustment and active engagement the ‘Climate Aware’ framework.

Increasing exposure to companies with climate-smart business models and offerings may maximize the upside opportunity.

It can serve as a blueprint for investors to address the historic challenges presented by climate change. The climate aware framework is based on a UBS investment strategy developed in conjunction with a UK pension fund. It aims to meet current investment goals while taking into account climate change objectives such as lower-carbon footprint, reduced exposure to fossil fuel reserves, and greater exposure to renewable energy opportunities. By including engagement, it has also been designed to be forward-looking.

The framework in practice

The framework in practice

Modelling climate change, especially in the context of equity and fixed income portfolios, means using sophisticated assumptions around the uncertainties of climate change, given we don’t yet know its full implications. To add clarity to our own modelling, UBS has been working in several innovative areas. For example, we look at factors like supply chain patents, and improvements to qualitative data, such as greater levels of disclosure by companies around target emissions. As data availability improves we expect the opportunities for integrating these types of metrics into portfolios to increase. We believe similar mitigation approaches can also be applied more generally to support a broad investment portfolio.