China Translated – April 2020

Hayden Briscoe, Head of Fixed Income, Asia Pacific, updates on a new world for investors and how fixed income investing will have to change.

Key Takeaways

Key Takeaways

- Covid-19 has created a new world for investors, and the old investing playbook will be challenged;

- Negative stock-bond correlations no longer apply, and the world of negative-yielding debt is expanding;

- Investors will now have to go beyond indices and pick countries;

- The switch to fiscal policy and the real prospect of inflation will put both developed and emerging countries under pressure;

- Investors would do well to look for countries that are net creditors and whose debt offers a positive yield;

Here in Asia, we entered a Covid-19 new world back in February - social distancing, closure of public spaces, and work-from-home arrangements - but the world of investing entered a new world quite a while ago.

Time to throw out the old playbook

Time to throw out the old playbook

Specifically around stock-bond correlations. The belief in negative correlation between stocks and bonds - stocks go up in boom times and bond prices go down and vice-versa - has shaped the industry for years, but that disappeared in 2019 when developed bond yields went to zero, and recent COVID-19-induced changes to global markets require us to rethink our approach to investing.

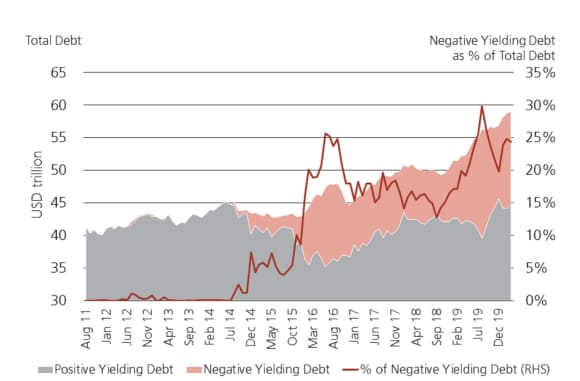

Why? Because repeated rounds of quantitative easing mean global central banks have very little firepower left to combat downturns – interest rates are at historical lows and the pile of negative yielding debt has grown to a record USD 15trn, or 24% of the global fixed income market at the end of March 20201.

Negative yielding debt in global bond markets, Aug 11-Mar 2020

Now, investors and asset managers are in a quandary. With yields in developed markets either at zero or below, the old playbook of allocating to global indices is going to have to end up in the trash. Investors will now have to go beyond indices and pick the countries.

A new world for bond investors

A new world for bond investors

But that is not going to be easy. With monetary policy having less firepower, fiscal policy will have to take up the slack and that may unleash a new world in which inflation picks up in countries across the globe.

In this potential new world where fiscal austerity is off the table and inflationary pressure is around the corner, debtor nations will be under even greater pressure from the bond markets.

That's the kind of scenario you'd associate with emerging markets, but given debt loads in the developed world, it's not beyond the realms of imagination that it can happen in developed markets too.

Start by looking for net creditor nations

Start by looking for net creditor nations

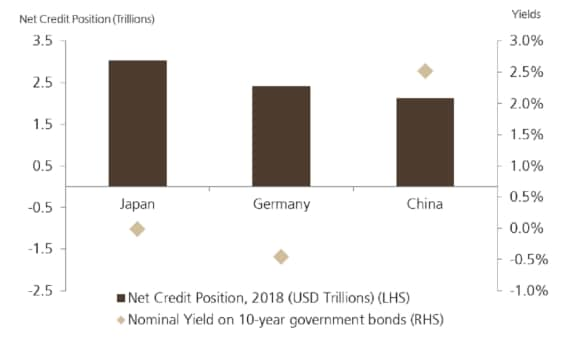

One way to navigate this new world is by looking for net creditor nations.

Japan, Germany and China are the top three net creditor nations by some distance - but only China offers a positive nominal yield right now.

Top Three Creditor Nations and Nominal Yields on 10 Year Sovereign Bonds, April 16, 2020

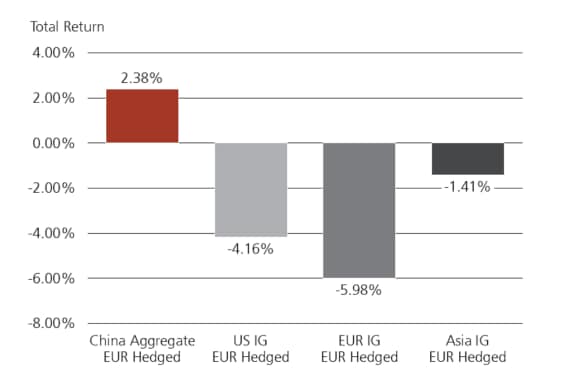

And more than yields, China fixed income is one of the few bond markets to deliver a positive total return to investors this year.

So as we enter this new world of bond investing, investors are going to have to adapt, but given the trends we have pointed out above, it needn't be too hard. We'll report back on the latest developments in both China and global markets in a month's time.

Global bond indices, Total Return YTD, Mar 31, 2020