Engaging with corporate management

Our main aim is to build relationships and understand the long-term sustainability of the companies in which we invest.

Our engagement activities:

Our engagement activities:

During 2019, we held over 1400 meetings with prospective or investee companies. Of these, 358 met our definition of engagement. Approximately one third of those meetings were thematic and 19 were focused on UN Global Contact violations. They covered 231 companies across regions and sectors. The majority had global operations and supply chains but were headquartered in developed markets.

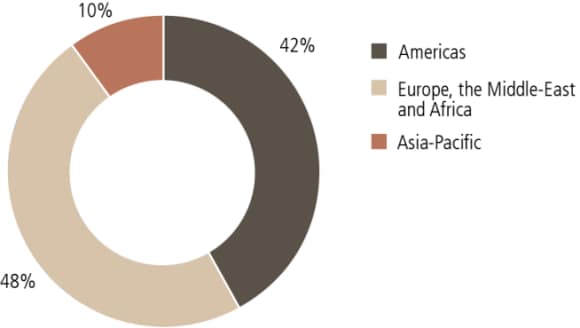

Location of companies engaged in 2019

Location of companies engaged in 2019

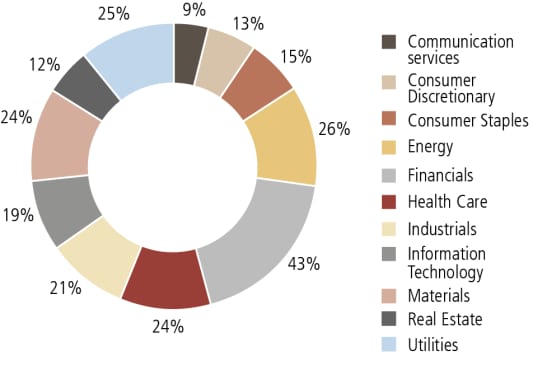

Sectors of companies engaged in 2019

Sectors of companies engaged in 2019

In 2019, we introduced an enhanced internal tracking system to assess the progress of dialogue against defined engagement objectives. As this is a new metric and for some of our engagements formalized engagement objectives have only recently been introduced, we expect future reporting to record increased numbers in terms of engagement progress.

In relation to proxy voting decisions, almost one third of our engagements provided useful and tangible insights.

We engaged with companies individually and in collaboration with other investors. Collaborating with peers helped us convey one consistent message to companies on systemic issues which could severely impact financial markets (i.e. climate change). 13% of our 2019 engagements were collaborative.

52% of our engagement meetings were held with the CEO/CFO or another C-suite representative. In approximately 34% of cases we met the Chair or an independent Board member. 31% of our engagement meetings were conducted with an ESG expert, such as the head of the sustainability department.

Topics addressed during our engagements

Our dialogue with companies covered a wide range of topics as the chart below illustrates. A large proportion of the engagements focused on governance, remuneration, business strategy and capital management.

One engagement meeting will likely address more than one topic. In total we held 358 engagements in 2019.

Level of access to companies during 2019

Level of representation | Level of representation | Number of meetings | Number of meetings | Percentage on the total | Percentage on the total |

|---|---|---|---|---|---|

Level of representation | CEO/CF0 and Other C-Suite | Number of meetings | 187 | Percentage on the total | 52% |

Level of representation | Chair and Non- Executive board members | Number of meetings | 120 | Percentage on the total | 34% |

Level of representation | Corporate secretary or legal counsel | Number of meetings | 50 | Percentage on the total | 14% |

Level of representation | IR | Number of meetings | 279 | Percentage on the total | 78% |

Level of representation | ESG expert | Number of meetings | 105 | Percentage on the total | 29% |

Level of representation | Other | Number of meetings | 39 | Percentage on the total | 11% |

Level of representation | Total engagements | Number of meetings | 358 | Percentage on the total |

|

Topics discussed with companies

Topics | Topics | Number of engagement meetings in which the topic was discussed | Number of engagement meetings in which the topic was discussed | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held |

|---|---|---|---|---|---|

Topics | Corporate Governance | Number of engagement meetings in which the topic was discussed | 191 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 53% |

Topics | Strategy & Business Model | Number of engagement meetings in which the topic was discussed | 150 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 42% |

Topics | Remuneration | Number of engagement meetings in which the topic was discussed | 138 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 39% |

Topics | Environmental Management & Climate Change | Number of engagement meetings in which the topic was discussed | 133 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 37% |

Topics | Transparency & Disclosure | Number of engagement meetings in which the topic was discussed | 107 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 30% |

Topics | Business Conduct & Culture | Number of engagement meetings in which the topic was discussed | 81 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 23% |

Topics | Capital Management | Number of engagement meetings in which the topic was discussed | 82 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 23% |

Topics | Human Capital Management & Labor Standards | Number of engagement meetings in which the topic was discussed | 63 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 18% |

Topics | Operational Management | Number of engagement meetings in which the topic was discussed | 57 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 16% |

Topics | Community Impact & Human Rights | Number of engagement meetings in which the topic was discussed | 28 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 8% |

Topics | Audit & Accounting | Number of engagement meetings in which the topic was discussed | 26 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held | 7% |

Topics | Total number of engagement meetings held | Number of engagement meetings in which the topic was discussed | 358 | Number of meetings in which the topic was discussed expressed as a percentage of total meetings held |

|