Is gender diversity a game changer for investment decision makers?

Gender diversity matters — and Claire Tucker, Senior Investment Officer, UBS Hedge Fund Solutions, explains why with a specialist investor panel followed by an interactive audience Q&A.

Claire Tucker

UBS Hedge Fund Solutions Senior Investment Officer

Giuliana Bordigoni

Director of Specialist Strategies, MAN AHL

Li Ran

Chief Investment

Officer, Half Sky Capital

Women in the hedge fund industry have been under-represented in top positions, making up just 5% of senior investment management roles,1 despite a lack of evidence this is justified by skill or performance disparities.

At UBS Hedge Fund Solutions (HFS), we are working hard to ensure a diverse and inclusive culture while continuously exploring ways to drive positive change in our industry. We proactively source third party female hedge fund talent to allocate to what HFS believes to be high quality women-led strategies.

Claire Tucker, Senior Investment Officer with UBS Hedge Fund Solutions moderated an all-female panel to discuss why diversity matters.

Within the hedge fund industry, representation is low with just 1 in 20 senior portfolio hedge fund managers being women. What has been your experience coming up in the industry?

Within the hedge fund industry, representation is low with just 1 in 20 senior portfolio hedge fund managers being women. What has been your experience coming up in the industry?

Li Ran, Chief Investment Officer, Half Sky Capital: For anyone to be successful in finance, which is so intellectually demanding and intense in terms of time requirement, education and support are the key elements of success. My story really began almost 80 years ago, in post-World War II after the Japanese occupation of China, when women were involved in the rebuilding of China. That equality meant education. My mother was one of the first classes that returned to Beijing University, and there was a saying ‘everyone should be involved; women hold up half the sky,’ which is the reason we are called Half Sky—it is a tribute to that.

Within one generation, a huge shift took place—from my grandmother with bound feet, to my mother becoming a Molecular Biologist. What really allowed that to happen was this view that women should be educated and should be allowed to work, and they should have support. When I was growing up, I was taken care of by my grandparents so that my mother could further progress her career, which gave me the confidence to achieve my goals—Harvard for undergrad, Goldman Sachs, Lone Pine and eventually starting my own firm, Half Sky.

In addition to education, second to this is having a lot of support. I cannot stress childcare enough. After a year of the pandemic, I really wanted to travel to Asia to see how economies behaved in countries where they were managing COVID quite well and where the domestic economy was essentially completely open. I was able to travel to Singapore earlier this year with the help of my in-laws. Education and childcare are key!

Giuliana Bordigoni, Director of Specialist Strategies, MAN AHL: I studied math as an undergraduate and really didn't have a career in finance in my mind. I enjoyed proving results and used these results to prove further results, and then towards the end of my degree I discovered mathematical finance and decided to pursue my PhD. Within academia, I realized it was a very lonely existence and came to Man AHL as an intern 13 years ago. In my time here, my job has changed a lot. When I started, I was working on our core momentum models and then moved into fixed income. I stayed in fixed income for a few years and then my remit expanded to alternative markets (i.e. non-standard futures and forwards). Now I look at any strategies or asset classes that require specialist knowledge like machine learning. So as you can imagine, it’s been a quite a journey, but I'm still learning.

How have you found that journey coming up through the ranks in a big organisation?

How have you found that journey coming up through the ranks in a big organisation?

Giuliana: I have learned that if I don’t ask for what I want, I won’t get it because people aren’t really thinking about what I want and what's on my mind. My needs are not their priority, so I've learned that I need to make it very clear what I want, and when I want it. I don't think it's a matter of a big organization or a small organization, it is about making it clear what you want in general, and I wasn't like that like 13 years ago.

Claire: Shifting gears, I’d like to talk from the allocator perspective and some of the issues around visibility and capital raising. One of the challenges during our research was that benchmarks and data sources weren’t reliable, but this is changing as the industry is becoming more focused on the topic.

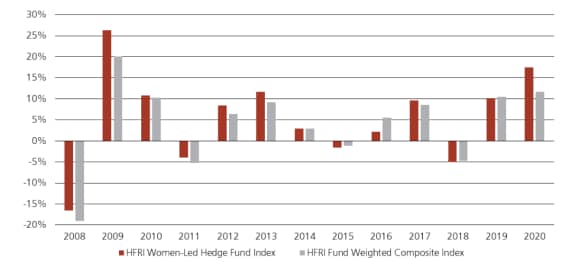

We don't believe performance is sacrificed when allocating to women run strategies from a bottom up perspective. Clearly with the scale and experience of HFS, we are able to use this edge to both back emerging talent, but to also build strategic partnerships with established managers. This allows us to give our clients access to differentiated strategies that perhaps have a high barrier to entry. The HFRI Women-Led Hedge Fund Index has held up very well compared to the broader hedge fund universe since 2008.

We believe it's important to be open minded and to focus purely on manager talent rather than their gender.

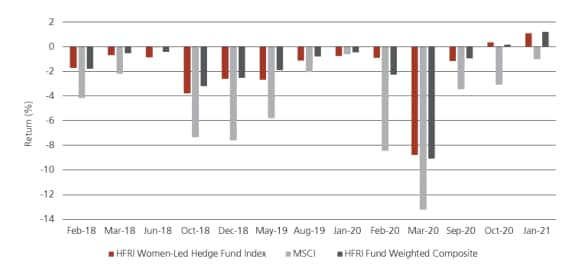

But why are we doing this? I would like to point out that we don't think it's purely an impact aim. There are real benefits to having more diversification in hedge fund portfolios and via this effort, we can offer clients access to some more idiosyncratic alpha streams. And that's actually well borne out in the correlation data. The HFRI Women-Led Hedge Fund Index has been performing well in terms of lower downside capture to the MCI world in negative months. So that's encouraging.

Performance of women-led hedge funds

Performance of women-led hedge funds

2008-2020

Returns during negative MSCI World months since January 2018

Returns during negative MSCI World months since January 2018

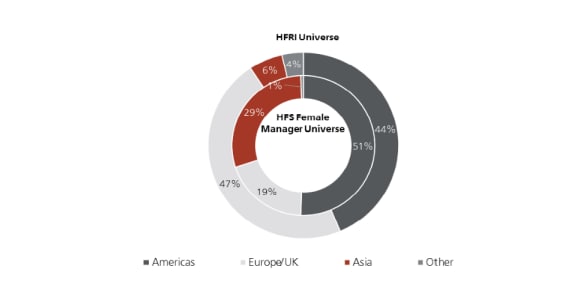

In terms of the representation, the geographic breakdown of the HFS Female Manager Universe compared to the broader hedge fund universe shows larger representation from Asia. With regard to Europe, you can see that the HFS universe is actually on the other end of the spectrum, with very low female representation in terms of hedge fund managers, compared to the broader universe. There may well be some workplace, cultural and societal reasons for that compared to Asia and the US.

Geographic comparison of broader hedge fund universe vs. HFS female manager universe

Geographic comparison of broader hedge fund universe vs. HFS female manager universe

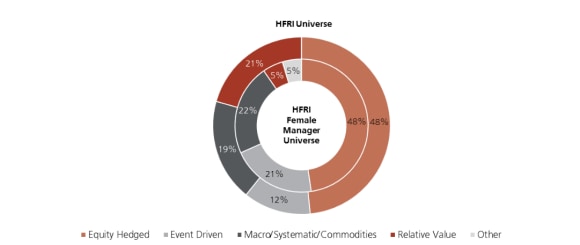

The strategy breakdown of the HFS universe compared to the broader hedge fund universe shows greater representation on the fundamentals side, so in equity and credit bottom up type strategies. On the flip side, there is very low representation in macro, discretionary macro specifically, and particularly in relative value strategies as well. So, fixed income relative value and quantitative strategies have very low representation from women.

Strategy comparison of broader hedge fund universe vs. HFS female manager universe

Strategy comparison of broader hedge fund universe vs. HFS female manager universe

What's your view on this low representation of female managers in quant strategies?

What's your view on this low representation of female managers in quant strategies?

Giuliana: When we hire a junior quant, we may look for somebody with a PhD. It’s not a requirement, but it's a plus because a person with a PhD has been spending the last few years doing research. This skill is one that can be applied in a career to really solve any other problem.

When I was pursuing my PhD, there were a maximum of two women in a group of 10-15. You can see there was very low representation, and then when you look at CVs we received last year, roughly 10% were from women. So what I'm trying to say is that it's difficult to get find a strong pipeline of female candidates in this area.

The best people suited for this are women in finance because what you want to see is another woman sharing her experience such as problems faced and helpful tips.

Claire: We need to address the problem earlier on in schools and raise awareness of the variety of careers that are available in finance. For myself, I ended up studying math by accident because biology was full at the time.

How can investors and hedge funds partner up to help address this issue and improve the diversity in the industry? What are hedge funds doing today? We do see that some are trying to widen the talent pool by, for example, setting up internal coaching programs for assistant portfolio managers, some are hiring directly from universities. Obviously, the hiring pipeline from banks is no longer as fertile post prop trading.

What you're doing in your own firms today, and do you see yourselves as role models?

What you're doing in your own firms today, and do you see yourselves as role models?

Li Ran: Being a small firm, we don't have an explicit hiring quota or system. We hire the best athletes for the job, but quite often because we're a global investment firm, I find that diversity is very helpful. To have that diversity of perspective and experience, be it gender or nationality or any background really.

So, if I look at Half Sky, we are a very diverse firm. The firm is actually half women, again, completely by accident. I believe a variety of backgrounds adds value. Having experienced change in one's life, makes one more empathetic. So that gives them the ability to look at business, not as they are today, but how they can become in the future. And that's a really important trait as an equity investor.

We value diversity when we look at CVs. We value people who can speak multiple languages, as pretty much everybody here does. We value first generation immigrants, people that have lived in different parts of the world. And it’s important for people to see other women in finance. We can attract more women into the industry, so we're very happy to be supporting endeavors such as yours, and we look forward to partnering with the HFS program.

Giuliana: We have a company-wide initiative called ‘Paving the way’ with the aim to address the pipeline issues and bring a more diverse pool of talent to our firm. This is not a problem that a single company can sort on their own.

Inside the main initiative umbrella, there are resources and recruiting and internal progression. For resourcing and recruiting, beside diversity focused recruitment policy, we do organize quite a lot of events at universities, and we partner with organizations like Bright Network that help us to identify the brightest people from different backgrounds. We also supported the Kings Maths School, and we have been doing it for a couple of years now.

It is a state funded school for gifted mathematicians aged 16 to 19 years. There are several initiatives, but we run seminars visiting students to talk about our work and topics that interest them. This is important because one of the aims of this school is to have a more diverse group of students, and in fact about 37% of the students are female, which is huge compared to the two women when I did my PhD and 10% of CVs coming in. The numbers are going in the right direction, but we need to work on them.

And then of course internal progression. We have a mentoring program which is open to all employees. But there are also more targeted events for some groups of employees like a return-to-work scheme for people that are coming back to work after a career break.

I also believe very much in everyone playing a little bit of a part in our small space, so what can I do? I have regular meetings with every woman on the investment side. I believe that if you have regular catch up and there is a problem, they will be more open with you. It’s about attracting and retaining people and creating a good culture.

Claire: It’s wonderful to hear from both of you as a successful women in hedge funds. From our perspective as an allocator, we are engaging with our hedge fund relationships as a partner. We are also asking those hard questions for example, if there are no women on the investment team, we are asking them why.

We're looking to measure the diversity, equity and inclusion of our invested funds, and we're also looking through to the portfolio manager level for future fund managers or ideas for managed account strategies.

Q&A

Q&A