Infrastructure spending reviving the economy?

With vast amounts of infrastructure spending expected in the next 20 years, will the private infrastructure sector see a surge in popularity?

24 Nov 2020

3 min read

Declan O’Brien

Head of Infrastructure Research and Strategy

Alex Leung

Analyst, Research & Strategy Infrastructure (North America, Asia)

The pandemic and volatility in global stock markets this year has driven interest rates lower, and highlighted the need for investors to diversify in search of high-yielding assets that can provide a stable source of income.

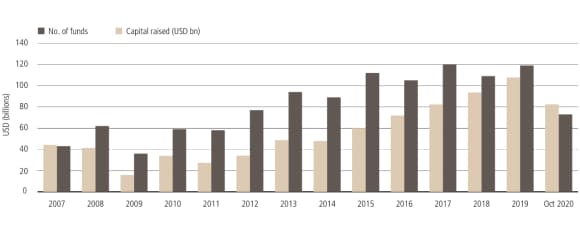

Despite the extraordinary circumstances of 2020, the private infrastructure industry did not skip a beat. In the first nine months of the year, the industry raised USD 74 billion (see chart below), which may lead to a record year. With the infrastructure universe growing globally, we believe that the asset class looks well positioned to deliver the desired long-term income stream for investors, particularly with trillions of dollars of investment required globally in infrastructure projects.

Private infrastructure on track for near-record fundraising year

Private infrastructure on track for near-record fundraising year

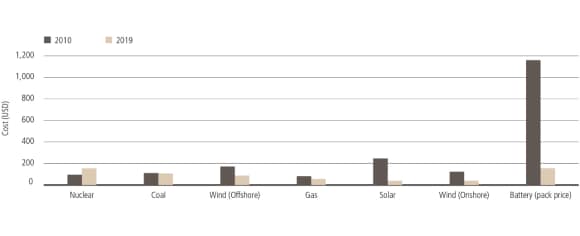

The relative stability of infrastructure investments has become particularly appealing during times of public market volatility. In addition, extreme weather events have highlighted the need for low-cost and reliable clean energy, especially since the economics of renewables continue to improve (see chart below). In contrast, commodity price volatility has weighed on the fossil fuels industry.

Renewables and batteries have become cost competitive

Renewables and batteries have become cost competitive

The current economic crisis has provided a rare opportunity for countries to hit the reset button, and reprioritize their long-term development goals. Infrastructure spending is a tried-and-true way to alleviate unemployment and kick-start stagnant economies. But unlike past infrastructure stimulus packages, the next wave of investments will likely have a greater emphasis on addressing environmental, social and sustainability issues.

For example, the EUR 1 trillion European Green Deal Investment Plan has now taken on even greater importance, not only as a way to tackle climate change, but also to revive local economies. The EU’s action plan is for Europe to be climate neutral by 2050 by investing across green energy, transportation, energy efficient buildings, and other environmentally-friendly technologies. This presents vast opportunities given the scale of investment needed.

The EU recognizes that the public sector cannot bear the entire burden of decarbonization and will use a budget guarantee to allow the European Investment Bank (EIB) and other partners to invest in higher-risk projects while “crowding in” private investors.

In the US, President-elect Joe Biden's policies could help boost green infrastructure investments. His USD 2 trillion climate plan promises to invest across green transportation, electricity and building sectors, while creating millions of new jobs. However, if Republicans retain control of the Senate after the January runoff elections, they will likely push back on these plans. We believe investors can still remain cautiously optimistic, as there is actually more bipartisan support for renewable energy than what the headlines suggest. For example, red states such as Texas and Oklahoma actually have the largest wind power capacity in the US, while swing states such as Arizona and Nevada boast the highest solar power potential. There are incentives for both parties to reach a consensus.

Telecommunication is another sector that has received significant attention during the pandemic. High speed internet has enabled working-from- home and remote-learning. However, rural areas and low-income neighborhoods generally have poor access to high speed internet, and have essentially been deprived of these essential services during lockdowns.

In a recent poll by the Internet Innovation Alliance, 90% of respondents support Congress using federal funds to expand broadband internet network infrastructure to areas that currently do not have access, and 88% support Congress increasing support to those who cannot currently afford broadband internet. The next wave of telecommunication infrastructure investments will therefore need to address the current digital divide across different communities.

Looking ahead, it is clear to us that the mega-trends of energy transition and digital transformation are here to stay, and that infrastructure is an ideal way to gain exposure to these long-term themes. The private Infrastructure industry, equipped with over USD 200 billion of cash reserves, will likely play a significant role in the next wave of infrastructure investments.