Trends suppressing bond yields

For fixed income investors looking to enhance portfolio returns, does Asia hold the key to finding income in a low yield environment?

24 Nov 2020

4 min read

Charlotte Baenninger

Head of Fixed Income

Hayden Briscoe

Head of Fixed Income, Asia Pacific

Find detailed insights below

Find detailed insights below

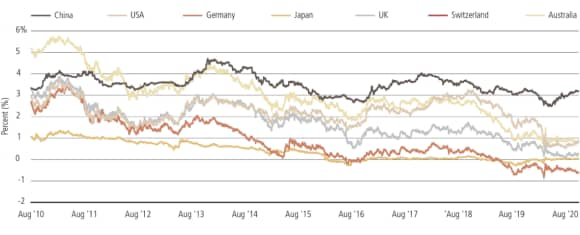

The era of negative bond yields in developed markets has continued to present challenges for fixed income investors with approximately USD 15 trillion1 or the equivalent of 24% of the investment grade fixed income universe yields currently zero or below.

A recent JPMorgan study also found that 76% of all developed market sovereign bonds had a negative real yield.2

Lower yields for longer

Lower yields for longer

The trend of ultra-low yields in developed markets is likely to persist for three main reasons. Firstly, with developed market central bank policy rates at or near the lower bound, longer-dated government bonds have become a policy tool for central bankers – now active across the yield curve.

Although the Bank of Japan was the first to enact yield curve control and set a zero percent target for 10-year Japanese Government Bonds (JGB) in 2016, other central banks such as the Fed and the Reserve Bank of Australia seem likely to do so albeit at the front end of the curve.

Given the dramatic expansion of fiscal policy across many developed markets, governments will need bond yields to remain low and therefore bond purchases via quantitative easing to stimulate economic growth seem likely for the foreseeable future.

Secondly, central banks are trying to get more creative in moving inflation, and inflation expectations, above target. If successful, and if nominal yields are well anchored, then real yields (yields after inflation) could move even lower.

The Fed recently indicated that it would hold rates at very low levels even as prices start to rise to allow inflation to run above target. We believe other developed market central banks will likely follow.

Central banks have committed to buying corporate bonds and ETFs, effectively crowding out private capital. While their interventions in corporate bond markets have diminished recently, their role as market makers of last resort could continue. Additionally, ageing populations in developed countries mean increased savings and demand for fixed income assets are driving yields down even further.

Active fixed income investors can pull on several levers such as interest rate management, asset allocation and security selection to achieve attractive returns despite low entry yields.

So with yields back down to sub-zero levels and income now scarce, where should investors be looking in their search for yield in 2021?

We believe pockets of opportunity exist in emerging markets where only 17%3 of sovereign bonds are negative yielding after adjusting for inflation.

GDP growth by region, 2020 vs 2021 (f)

Asia offers growth – and unrivalled yield

Asia offers growth – and unrivalled yield

In Asia many economies are already in recovery mode, with China leading the way. This is largely due to Asian countries pursuing a multi-tiered response, including credit support, fiscal stimulus, and well-designed pandemic response measures.

On the monetary policy side, Asian governments have been more reluctant to cut rates − opening a substantial yield margin to take advantage of in Asian high yield markets compared to Europe and the US.

We believe this presents an excellent investment opportunity as yields remain attractive; and investors may further benefit from spread compression.

Asian high yield is also less exposed to commodities and consumer cyclicals than European and US high yield.

China remains a standout

China remains a standout

But looking deeper into Asia, China’s onshore bond market remains a standout opportunity, and particularly Chinese government bonds given the attractive real yields, low correlation to global markets and backing from one of the world’s few remaining net creditor nations. We believe this is a compelling risk-reward tradeoff.

Chinese government bonds sold off in 2Q20. However, China is now tightening credit expansion and this, combined with a challenging outlook for the global economy, means China’s rapid rate of growth may slow from mid- 2021. We think further rate cuts are likely in 2H20.

Focus on Asia for 2021

Focus on Asia for 2021

These segments of the rapidly-growing Asian fixed income universe are just two of many yield opportunities in Asia. An Asia allocation can provide investors exposure to a region poised to bounce back in 2021, as well as strategic long-term positioning as Asia evolves as the world’s key growth driver.

Nominal yields on 10-year sovereign debt, Aug 2010-Aug 2020