Partnership is key to everything we do. Our expertise and scale can help you achieve your index investment goals. Specialist global teams, proprietary technology, and an ability to customize solutions are all made possible by our influence as the largest European-based index manager1.

We offer a wide range of index investment choice - accessible via ETFs, pooled funds and segregated mandates. Our breadth across asset classes includes equities, fixed income, commodities, alternative beta, currency hedging, sustainability, and real estate.

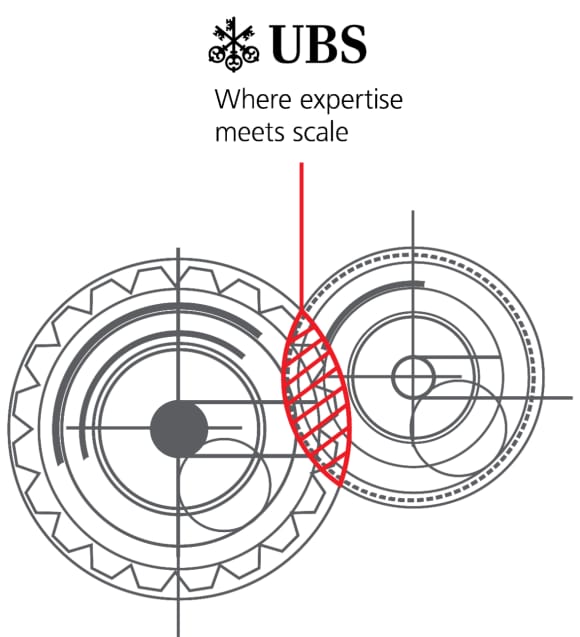

Where expertise meets scale

Scale

#1 European-based Index manager with USD 874 billion ETF/Index funds2

Breadth of choice with 400+ funds and 200+ indices3

Options across markets, asset classes, funds, ETFs and customized solutions

Clients in over 30 countries

Expertise

Over 35 years of experience managing index strategies

More than 50% of index assets are in customized solutions4

Proprietary technology incorporates client objectives to balance risk, budget and trading costs

Innovative climate strategies

Note: This is not a recommendation to sell or purchase any security. For marketing and information purposes only. Not all offerings are available in all jurisdictions.

Our offering

ETFs

Partner with one of the world’s fastest growing ETF managers with the expertise to deliver a wide range of solutions to meet your needs, and experience earned from over 30 years of excellence.

Index solutions

Explore our indexing approach and the strategies we offer.