Navigating the fog

Gradual recovery

Gradual recovery

Transaction activity in US commercial real estate regained some momentum in 3Q25, with deal volumes up 17.0% YoY and investment volumes at USD 125 billion for the quarter. Momentum was broad-based, with gains across office (+38%), retail (+24%), senior housing (+21%), apartment (+13%), and industrial (+8%). Part of this activity was driven by investors returning to the market after staying on the sidelines second quarter amid debilitating uncertainty. However, in the office segment, much of the activity came from value-add and opportunistic buyers seeking largely discounted prices. Although transaction activity moderately rebounded, volumes remained 16.9% below the five-year quarterly average, indicating that a recovery is still underway.1

On the financing side, debt availability continued to expand, though still at elevated costs and with sustained lender selectivity. Debt originations were up 36% YoY during 3Q25, supporting the transaction rebound. Despite the encouraging signs, risk remains uneven across property types as some sectors face additional headwinds from trade pressures.

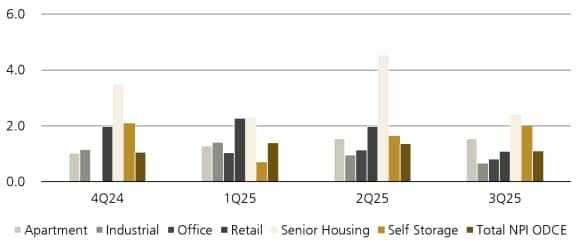

Both industrial and retail values slipped during 3Q25 after posting positive capital returns in the prior four and five quarters, respectively. Office capital returns were more negative during the quarter, while the apartment and specialty sectors posted strong positive gains. Despite negative capital returns in some sectors, income gains kept total returns positive in all sectors (see Figure 1).

Figure 1: Quarterly total returns (%)

Although values are trading at a notable discount to recent peak and early-cycle returns offer an attractive entry point, ongoing uncertainty may prolong a full recovery. Given the modest appreciation environment, the near-term emphasis for investors will be on properties with reliable net operating income and strong lease fundamentals. These will be in sectors with favorable structural tailwinds, located in strategic high-growth markets with limited supply risk.

Economic viewpoint

Economic viewpoint

The recent US government shutdown has postponed the release of third quarter gross domestic product (GDP) estimates, but UBS Investment Bank and alternative data sources point to positive economic growth during the quarter. Third quarter GDP forecasts vary considerably, with the St. Louis Fed projecting a conservative annualized figure of 0.6% and the Atlanta Fed predicting a robust annual growth rate of 3.9%. However, UBS Investment Bank expects third quarter GDP to grow at a 2.7% annual rate, which aligns with economists at Moody’s Analytics. Despite the wide variation, these forecasts suggest that the economy is expanding rather than contracting.

Key drivers of this expansion include business investment in artificial intelligence (AI) and resilient consumer spending. Even with solid growth expectations, the labor market delivered mixed results. The US labor market showed an unexpected rebound of 119,000 jobs in September, following four months of subdued growth. July and August numbers were revised down, with July gaining only 72,000 jobs and August shedding 4,000 jobs. Despite the stronger-than-expected number in September, the unemployment rate continued to climb to 4.4%, indicating continued weakness in the overall state of the US labor market.

Despite the limited flow of official economic data, policymakers reduced the federal funds rate by 25bps to a target range of 3.75% to 4.00% in October, marking their second cut this year. While inflation remains somewhat elevated – with headline and core inflation hovering around 3.0% YoY – the Fed has noted a greater downside risk to the labor market in recent months.

Looking ahead, the Fed plans to remain data-dependent and will continue to assess how inflation and employment evolve before making further cuts. Although the market initially anticipated another rate cut in December, Fed Chair Jerome Powell emphasized that a rate cut in December ‘is not a foregone conclusion’.

Shifting winds

The apartment sector1

The apartment sector1

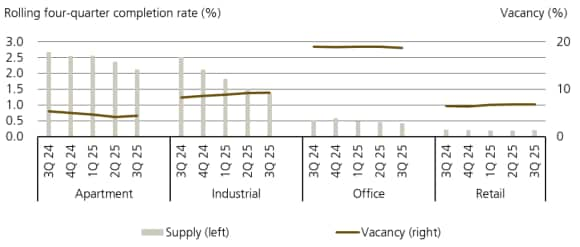

US apartment absorption moderated in 3Q25, after five consecutive quarters of outsized demand. Net absorption was just over 43,000 units, down 77.4% from the previous quarter and 56.4% below the five-year third quarter average. This slowdown was primarily driven by softer leasing activity amid broader macroeconomic headwinds and a softening labor market.

Deliveries held steady over the quarter at nearly 92,000 units, while vacancy rose modestly from 4.2% to 4.4%, remaining near historically low levels. Rent growth slowed to 1.6% YoY, reflecting rent cuts in supply-heavy markets. Despite softening fundamentals, transaction volume was 22% higher than 3Q24 levels, as a moderately improving capital market environment attracted some investors. The Open-End Diversified Core Equity (ODCE) NPI apartment sector delivered an annual total unlevered return of 5.5% for the year ending September 2025.

The industrial sector1

The industrial sector1

Industrial demand returned to positive territory in 3Q25, but levels remained subdued. Supply once again outpaced demand, though the pace of new deliveries moderated, down 31.9% from a year ago. Availability rose by another 10bps over the quarter to 9.3%, marking a new post-2015 high. YoY rent growth was effectively flat, as strength in mid-western markets was offset by rent declines in coastal markets.

Transaction activity increased by 23.7% from 3Q24, driven by momentum in build-to-suit development and owner-user acquisitions. The ODCE NPI industrial sector delivered an annual total unlevered return of 4.3% for the year ending September 2025, below the all-property index at 5.0%.

The office sector1

The office sector1

Office sector fundamentals showed early signs of stabilization in 3Q25, as demand surged back to pre-pandemic levels. After nearly five years of negative or subdued demand, the sector recorded a net absorption of 14.4 million square feet, approaching the 2019 quarterly figure of 15.5 million square feet. Return to office mandates and rapid business investment in AI contributed to the current demand.

Completions slowed to 2.7 million square feet, while vacancy declined by 30bps to 18.7%. Even with these early signs of stabilization, the sector has a long way to go before full recovery, as vacancy continues to hover near record highs. Transaction volume during the quarter was 38% higher than 3Q24 levels, with increased activity primarily coming from opportunistic buyers. The ODCE NPI office sector delivered an annual total unlevered return of 3.1% for the year ending September 2025.

The retail sector1

The retail sector1

Retail continued to outperform the other major real estate sectors in 3Q25, delivering an ODCE NPI total unlevered return of 7.5% for the year ending September 2025. Net absorption rose to 1.3 million square feet, signaling renewed tenant demand after two consecutive quarters of negative absorption.

On the supply side, the sector delivered nearly 2 million square feet of retail space during the quarter, which represents only 0.1% of national stock. Although supply slightly outpaced demand, the national availability rate for retail space held steady near record lows at 6.8%. Investor interest remained strong, with transaction volume rising 33% YoY, supported by marginally better capital market conditions.

Figure 2: Sector fundamentals