Demand for Swiss real estate remains high

Continuously challenging environment

Continuously challenging environment

The Swiss economy grew by 0.8% in 1Q25, driven mainly by early export activities ahead of Liberation Day. However, momentum slowed in Q2, with GDP growth at just 0.1%, though still stronger than expected. According to the State Secretariat for Economic Affairs, a decline in the industrial sector was balanced by growth in services. For the whole year, Swiss GDP is expected to grow by 1.3% in 2025 (excluding sporting events). Inflation remains low at 0.2% for the first nine months of 2025, placing it at the lower end of the Swiss National Bank’s (SNB) target range. Following two 25bps rate cuts in March and June, the SNB policy rate now stands at 0.0%, with expectations for sideways movement, although downside risks remain.

US tariffs announced on 31 July and implemented on 7 August were higher than anticipated, rising to 39% instead of the 31% announced in April. About 60% of Swiss exports to the US, representing 10% of total exports, are subject to these tariffs. On 14 November, it was announced that Switzerland and the US had agreed on a trade deal, which will lower the US tariff rate for Swiss exports to 15%, bringing it in line with the rate applied to EU exports. Swiss companies, in turn, have committed to invest around USD 200 billion in the US, with a large portion coming from the pharma sector. While the trade deal supports industries that were heavily affected by the increased tariffs, pressure on the economy remains. At around 1%, the Swiss economy is expected to grow below average in 2026 as well.1

Demand for Swiss real estate investments is high

Demand for Swiss real estate investments is high

In times of uncertainty, investors seek safe havens. Since income from real estate is generated domestically and therefore largely insulated from any further trade policy disputes, the popularity of this asset class, already traditionally regarded as a ‘safe haven’, is increasing further.

Aside from the flight to safety, the increased demand for real estate investments can be explained by the higher attractiveness of the risk premium compared to 2022 and 2023. From its low point of just 15bps in the fourth quarter of 2022, the premium rose to 170bps by the second quarter of 2025. In addition to the decline in yields on Swiss government bonds, the correction in net initial yields on prime real estate between mid-2022 and early 2024 contributed to this. Since then, prime real estate yields, as reported by Wüest Partner, have largely stabilized, with occasional compressions since the second half of 2024.

The high momentum for real estate investments is reflected in the high year-to-date capital market transaction volumes and the concurrent positive premium (agio) development (see the SRES article for more details).

Residential market: Scarce supply remains crucial factor

Residential market: Scarce supply remains crucial factor

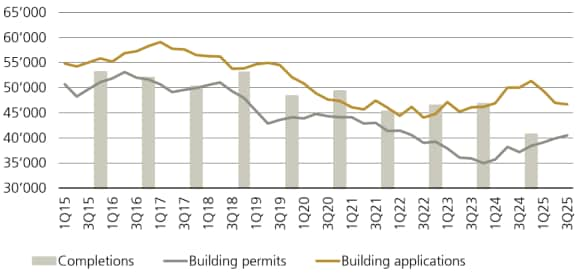

Also in the occupier market, demand for rental apartments in Switzerland remains high. In the second half of 2024, the total Swiss population crossed the 9 million mark. In 2025, net immigration has declined significantly compared to the high levels of previous years. From January to September 2025, immigration stood at 50,000, about 14% below the previous year's level. On the supply side, planning activity has picked up somewhat since the low point in 2023, partly because construction prices are proving to be more stable. Compared to the second half of 2024, construction prices rose by 0.6% in the first half of 2025. Although still 16.4% higher overall than in 2020, the pace of inflation has slowed significantly since 2023. The increase in planning applications observed since mid-2022 is reflected, with some delay, in the rise in building permits, where the annual total climbed to about 40,500 in the third quarter of 2025 (Figure 1). Despite the somewhat higher momentum in planning activity, it will take time before building permits translate into supply, meaning a further low in the number of completed units is still likely. Furthermore, following the increase between mid-2022 and mid-2024, the number of planning applications has fallen sharply again in 2025.

Figure 1: Construction and planning activity on the Swiss residential real estate market (total over 12 months, number of residential units)

Thus, although there are some signs of easing in the rental housing market, there is still no real recovery. As a result, the vacancy rate, published by the Federal Statistical Office, fell further in 2025, from 1.08% to 1.00%. The decline in vacant apartments is mainly driven by rental units, where the vacancy rate has now dropped to a historically low 1.4%.2

Yet, compared to the record high rental growth of 4.7% in 2024, there is a certain calming in rental growth. According to Wüest Partner, asking rents continued to rise in 2025, growing by 1.5% YoY in 3Q25. Existing rents, on the other hand, are subject to downward pressures. In Switzerland, existing rents are linked to the mortgage reference interest rate, which reflects the volume-weighted average interest rate of outstanding mortgage loans from Swiss banks. If this increases, as in 2022 and 2023, rents may be raised; if it falls, tenants may demand a rent reduction. Due to the high proportion of fixed-rate mortgages, the decline in mortgage interest rates, that began in 2024 has affected the reference interest rate with some delay. However, the reference interest rate published in March 2025 fell again from 1.75% to 1.5%. In September, we saw another decline in the underlying average rate to 1.37%, exactly the threshold needed to push the reference interest rate from 1.5% to 1.25%. From here, a sideways movement is expected.

Commercial market: Economy provides little tailwind

Commercial market: Economy provides little tailwind

Even if the impact of the high US tariffs on the overall Swiss economy should be limited, an economic slowdown tends to affect commercial space the most. Nevertheless, the situation in the rental market is better than might be expected under the circumstances.

The tailwind of strong employment growth, which supported the office space market over the past two years, has eased to some extent. Employment growth has declined over the last few quarters and was negative in the first quarter of 2025, not only in industry (where it was already negative in the previous quarter) but also in the service sector. In 2Q25, employment turned positive again, but momentum remains low. With employment growth falling below 20,000 full-time equivalents over the past 12 months, the need for additional office space driven by employment has reduced significantly. Despite these challenges, the Swiss office space market remains robust. ‘Return-to-office’ mandates have positively impacted the market, mitigating the decline in space requirements caused by remote work. Although take-up is currently lower than the long-term average, net absorption remains positive, and the vacancy rate has stabilized. Across Switzerland, the vacancy rate has decreased from a peak of 6.4% in the fourth quarter of 2023 to 6.1% in the third quarter of 2025. Office rents are also on an upward trend, with JLL prime rents rising by 6.9% in the third quarter of 2025 compared to the previous year. Average rents have increased for the fifth consecutive quarter, up 2.6% YoY in the third quarter of 2025.3

The retail space market faces ongoing structural challenges through online competition and the difficult economic environment. Consumer sentiment has improved since the end of 2022 but remains volatile and below the long-term average. Retail sales have struggled, with a 1% YoY increase in the first quarter of 2025, followed by a 0.5% decline in the second quarter and a slight upside of 0.3% in the third quarter. Asking rents have increased significantly since the low point in 2022, but they remain well below the levels of 10 years ago.4

The logistics and industrial space market is potentially most affected by trade policy disruptions due to its stronger export orientation. However, as many facilities are owned by the occupying companies, significant market movements are not expected in the short term. Despite these headwinds, positive structural factors support the logistics segment, which continues to show low supply ratios and rising prime rents.

The Swiss hotel industry remains very strong in 2025, despite economic challenges. With 34.4 million overnight stays between January and September 2025, the industry is on track for a record year. The main driver continues to be the increase in overnight stays in urban centers, supported in 2025 by major events such as the ESC (Eurovision Song Contest) in Basel and the Women’s European Football Championships. In addition to the big events, the strong results in the cities were also driven by the continuing strong demand from American guests. They were not deterred by the strong nominal appreciation of the Swiss franc against the US dollar and once again recorded 8% more overnight stays in the first half of 2025 than in the same period of the previous year.

Positive performance expected

Positive performance expected

Swiss real estate values increased by 1.1% in 2024, according to the MSCI Wüest Partner Switzerland Property Index, driven particularly by residential real estate, where values grew by 1.8%. Office properties also recovered slightly last year following the decline in 2023, recording a 0.2% increase in value. A similar trend is expected for the current year. Retail space was a positive surprise last year, with a 0.6% increase in values. We expect an appreciation of 0.8% for 2025. The fact that the increase in value here is more pronounced than for offices can be attributed to consolidation and the comparatively low growth in retail values in the years before the pandemic, as well as the turnaround in interest rates. In addition, international demand for high-quality retail space is rising noticeably again, while office space remains difficult to place on the transaction market. An average increase in value of 2.5% is expected for residential properties in 2025 due to continued high demand and positive market fundamentals.

A somewhat more subdued performance is expected across all segments in 2026. In the residential sector, the reduction in reference interest rates, increasing regulatory pressure and lower net migration could have an impact. In the commercial segment, the low economic momentum is likely to be felt, as well as the anticipated rise in interest rates toward the end of 2026 due to increasing inflationary pressure stemming from heightened infrastructure and defense spending in Europe.