Policy clarity meets recession fears

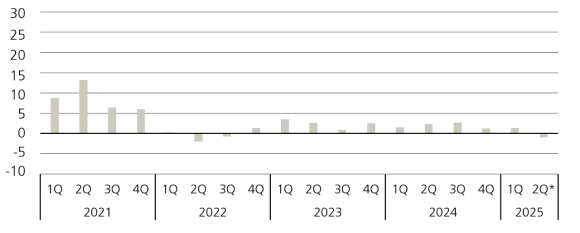

Heading into year-end, private equity investors have significantly more policy clarity than in H1 and it is mostly good news. A rocky tariff rollout in the US has created some winners (companies with limited exports, primarily home-country exposure and services) and losers, but increased clarity has undeniably helped markets. Few private companies are showing obviously broken business models under the tariff regime, though more will likely emerge over time. Policymakers have recently delivered more good news for investors in the form of interest rate cuts. This will make borrowing cheaper and generating returns more straightforward, which could unlock additional exit activity. Global M&A activity has already reached USD 3 trillion in 9M25 and in another encouraging sign, IPO momentum appears to be accelerating. These have translated to improving distribution profiles for US buyout funds over the past several quarters. It will be difficult to disentangle the effects of rates, tariffs, and macro factors, but the exit environment may look brighter in the quarters ahead.

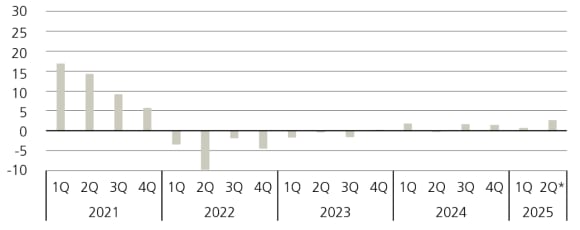

Recession fears still loom over global markets, which have seen exceptional asset price growth in recent years. While cost-related pressures have eased significantly (sometimes stabilizing at higher levels), sponsor and management attention has shifted to top-line growth, which has become more elusive, resulting in a forecast for negative quarterly fund returns in 2Q25. Companies across industries are finding it harder to raise prices and win new business as demand softens and both consumers and businesses seek value and trim costs. In the latter case, accelerating corporate layoffs are the latest sign of a ‘do more with less’ management mentality. Private companies with indispensable products and services are best positioned, while those with more tenuous value-add are struggling.

All of this has manifested in slower deployment by private equity funds, which recognize that a poor vintage in today’s market will be punished by investors more severely than in exuberant times when the raise-invest-raise cycle was running hotter. We observe funds deploying over 3-4 years, rather than the 2-3 years common in 2021-2022.

Figure 1: Venture capital quarterly fund returns (%)

PE fundraising challenges

Fundraising remains challenging and US exceptionalism is on full display as Europe – and especially Asia – raises have struggled. Managers are setting more conservative targets and securing anchor and existing investor support well in advance of coming to market to avoid the negative signal associated with a struggling fundraise. First-close fee discounts are anecdotally more common, though still offered by a minority of funds. Top-performing managers continue to raise hard-capped funds, even in today’s market.

Venture capital all-in on artificial intelligence (AI)

The speed with which venture capital has funded AI-related companies is astonishing; just a few years ago, many investors believed that the VC model of the 2010s – grow users regardless of profitability, which is sure to follow later – had been sunset. Accounting for 63% of VC dollars invested in Q3, according to PitchBook, the story of venture capital is now one of translating AI progress into economic value. This may not be a straightforward proposition; consider, for example, the widely publicized MIT report stating that 95% of AI pilots fail to materialize into enterprise-level solutions.

VCs and investors, as ever, are motivated by the substantial potential return behind picking a market leader, possibly a generational return opportunity, given AI investment and impact numbers routinely quoted in trillions. Against this backdrop, investors appear more willing to participate in VC funds than they were a few years ago, despite exits and distributions remaining extremely hard to come by; at least the promise of up-rounds has returned in force, and vintages being raised today will have performance numbers unencumbered by the difficulties of 2022.

Figure 2: Private equity quarterly fund returns (%)

Private equity sector performance outlook

Region | Region | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="light-green-bullet"] | [ubs:icon type="light-green-bullet"] | [ubs:icon type="dark-green-bullet"] Positive | [ubs:icon type="dark-green-bullet"] Positive |

|---|---|---|---|---|---|---|---|---|---|---|---|

Region | Americas | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | None | [ubs:icon type="light-green-bullet"] | Venture capital, Growth equity, Buyouts | [ubs:icon type="dark-green-bullet"] Positive | Secondaries |

Region | Europe | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Venture capital | [ubs:icon type="light-green-bullet"] | Growth equity, Buyouts | [ubs:icon type="dark-green-bullet"] Positive | Secondaries |

Region | Asia | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Venture capital | [ubs:icon type="light-green-bullet"] | Growth equity, Buyouts | [ubs:icon type="dark-green-bullet"] Positive | Secondaries |