Powering a new era of income

Corporate credit

Corporate credit

Despite the sensational headlines, the fundamental outlook for the corporate direct lending strategy remains stable. Company earnings have generally been positive, as the borrower universe has shown high single-digit EBITDA growth alongside stable, healthy margins. Furthermore, as we peel back the onion, the credit profile of the underlying borrowers has also remained strong. Non-accrual rates for Unified Global Alternatives (UGA) investments have generally remained low, ranging from 0.2% to 0.3% over the past four quarters, without any material increases. In addition, there does not appear to be any significant change in the percentage of loans on the GPs’ watch lists.

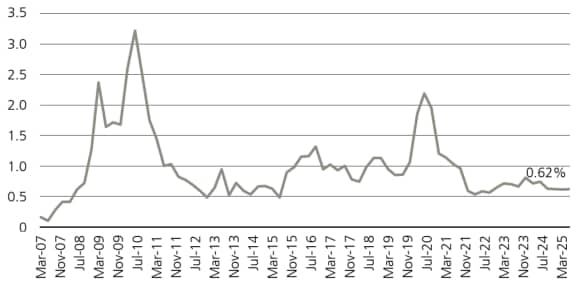

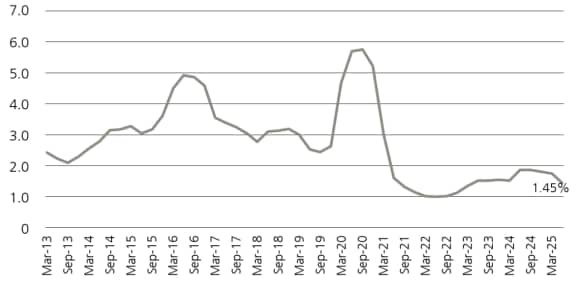

Looking at broader corporate direct lending industry (CDLI) trends, we have observed fairly consistent patterns in credit performance. Although not necessarily a leading indicator, the non-accrual rate for the CDLI Index has essentially remained unchanged over the past four quarters, finishing 2Q25 at 0.62% (see Figure 1). Furthermore, the BDC universe default rate was 1.45% as of 30 June 2025 and is actually lower on a YoY basis (see Figure 2). While there have been a few high profile corporate defaults over the past two quarters (Q2-Q3), these credit issues appear to be primarily idiosyncratic and not indicative of significant stress within the broader sub-investment-grade universe. Beyond the non-accrual rates, UGA has also observed stabilizing-to-improving interest coverage ratios, despite interest rates remaining elevated in recent years. Declining loan spreads and base rates should provide additional support for interest coverage ratios and borrower cash flow.

Figure 1: CDLI non-accrual rate (%)

Figure 2: BDC trailing four quarter default rate (%)

While most of the credit indicators reflect a fairly stable profile, there are some signs that a segment of the borrower universe could be under stress. At the industry level, UGA has observed an upward trend in payment-in-kind (PIK) interest as a percentage of total income. While there are certainly both ‘good’ and ‘bad’ instances of borrowers utilizing PIK interest, the increase is notable and we continue to monitor the evolution and drivers behind the growth in PIK utilization. In addition, we expect to see greater dispersion in credit performance. Due to the varied effects of tariffs on different businesses, as well as the persistent underperformance of the lower-earning consumer base, we anticipate some companies will struggle if their business fall foul of a downside scenarios.

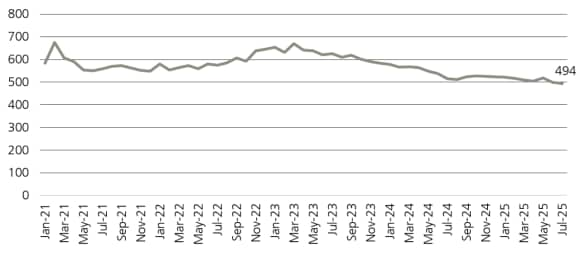

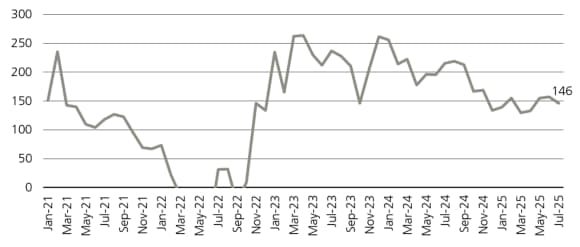

As it relates to expected returns for the corporate direct lending strategy, the base case is for healthy, albeit lower, returns in 2026 compared to the prior three years. The main rationale for the lower expected returns is both lower base rates and tighter valuations. As a reminder, direct loans are typically structured as floating rate loans and therefore fluctuate with changes in base rates. The US Federal Reserve has announced a total of 50bps of rate cuts since September 2025, and markets are projecting additional interest rate cuts over the next twelve months. Along with the reduction of base rates, credit spreads are at the lower end of their historical range due to positive credit performance and relatively muted deal flow. Private credit has been one of the best performing private capital asset classes in recent years as a result of tighter credit spreads and lower base rates. As such, the corporate direct lending strategy is expected to deliver marginally lower returns in 2026 compared to the past two years. Despite the compression in spreads, corporate direct lending continues to offer an illiquidity premium to public credit markets, and platform managers are anticipated to generate 150bps to 200bps of excess returns above the syndicated loan market. At the market level, first lien direct lending spreads are currently pricing inside 500bps (see Figure 3) but continue to offer an approximately 150bps illiquidity premium compared to the syndicated loan market (see Figure 4).

Figure 3: First lien direct lending new issue spreads

Figure 4: First lien direct lending illiquidity premium

In summary, the corporate direct lending strategy has maintained a stable fundamental profile, characterized by strong operating performance and limited defaults within the underlying borrower universe. Although we expect dispersion to increase as a portion of the borrower universe could experience additional stress in the future, the fundamental outlook is expected to be supported by expected interest rate cuts by the Federal Reserve. However, lower base rates will likely result in marginally lower expected returns and distribution rates for the strategy. Nevertheless, we believe corporate direct lending managers remain well-positioned to deliver a quality, risk-adjusted returns.

Residential real estate credit

Residential real estate credit

Our outlook on the residential real estate market has remained fairly consistent. The market is currently characterized by competing tailwinds and headwinds. From a tailwind perspective, the US housing market benefited from conservative underwriting in the years following the GFC and the vast majority of the mortgage origination (90%+) over the past 15 years has been 30-year fixed-rate mortgages. In addition, borrowers who obtained a mortgage prior to 2022 have built up significant equity in their homes and continue to benefit from low interest costs due to the fixed-rate nature of their mortgages. As a result, UGA remains constructive on the fundamental outlook for seasoned US residential mortgages. On the headwind side, US mortgage rates remain elevated compared to the past five years, with current 30-year conforming mortgage rate at 6.2%. While these mortgage rates are not particularly high when viewed over a multi-decade period, the substantial increase has resulted in stretched affordability metrics. US home prices have only risen marginally (+1.5%) over the past 12 months, and there has been an increasingly large amount of price dispersion across different markets and cities. While UGA is constructive on the credit risk profile of the US housing market, our base case is for flat home prices over the next several years.

Consequently, in terms of capital deployment, we continue to see reasonable opportunities in residential real estate private credit and remain focused on short-duration financing strategies, with a preference for approaches that are less reliant on home price appreciation (HPA) growth to achieve their target returns. We remain particularly active in the homebuilder finance sector and continue to target investments characterized by quality counterparty risk and additional forms of credit enhancement. We have observed additional capital entering some of these financing markets and are closely monitoring credit spreads on new origination as a result.

Commercial real estate credit (CRE)

Commercial real estate credit (CRE)

Commercial real estate markets continue to exhibit a wide range of performance outcomes given the impact that higher interest rates have had on the sector. At the property level, values remain lower compared to three years ago due to the increase in capitalization rates, although most property types have stabilized at current levels. As a result, transaction volumes in CRE have accelerated throughout 2025. In addition, a cohort of seasoned loans has experienced refinancing challenges as certain properties have been unable to refinance due to loans having a loan-to-value rations (LTV) that is too high or a debt service coverage ratio that is too low. Furthermore, there has been a material amount of dispersion in refinancing success rates by property type, as sectors such as industrial and multifamily have outperformed relative to office.

In terms of the opportunity set, UGA is focused on a number of CRE credit opportunities. Regarding lending strategies, we are targeting new originations on deals and properties with conservative LTVs at fresh valuations. The opportunity set in transitional lending on multifamily properties is particularly compelling and we have preferred lending programs that offer a high probability takeout. Given the number of loans that have experienced refinancing challenges, we have also been active in deploying capital into opportunistic strategies, which can either involve buying non-performing loans or providing capital to existing sponsors who are unable to refinance their current loan with the incumbent lender. Additionally, we have identified opportunistic investments in select segments of the non-agency commercial mortgage-backed security (CMBS) market.

Private credit 2.0

Specialty finance

Specialty finance

As previously discussed, specialty finance covers a wide range of asset classes, including consumer credit, small business lending, litigation finance, receivables and royalties. From the perspective of consumer and small business credit, we remain relatively cautious. Select segments of these markets (e.g., unsecured consumer, subprime auto) have exhibited persistently elevated losses charge-offs despite tightening underwriting from originators. We continue to observe persistent underperformance among the lower FICO / lower-earning consumer base. Since the inflation pressures began several years ago, there has been a ‘K-shaped’ economy, as lower-earning consumers have been negatively impacted by higher inflation, rising rents, and slower wage growth compared to higher-earning consumers. As a result of these dynamics, coupled with the cyclicality of these sectors, UGA has taken a cautious approach toward allocating to this segment of private credit. Our allocations have been specific and targeted toward small business financing strategies and have primarily allocated to lending strategies that are senior in the capital structure and include additional credit enhancement, as opposed to buying the consumer or small business financings directly.

Reinsurance

Reinsurance

The reinsurance strategy has been a strong performer in 2025. Entering the year, valuations were particularly compelling due to wider catastrophe bond spreads and elevated no-loss yields for collateralized reinsurance. As a result, UGA – Private Credit elected to maintain a higher exposure to the strategy. The 2025 hurricane season proved to be one of the most benign in terms of insured losses that the industry has seen. There were no major hurricanes hits on the US and the strategy experienced minimal losses outside of the California wildfire event earlier in the year. Due to the elevated positive returns experienced this year, risk premiums have begun to compress. Cat bond spreads tightened by over 100bps in 2025 and UGA is currently expecting a 10% to 15% reduction in pricing for collateralized reinsurance risk for the 2026 season. While this strategy has been a profitable allocation in 2025, UGA is planning to reduce exposure for 2026 due to tighter pricing.

Conclusion

Conclusion

In conclusion, the investment outlook for these credit strategies remains stable but cautious. Corporate direct lending maintains solid fundamentals, with strong borrower performance, low defaults, and healthy margins. Although select areas may encounter stress from rising PIK interest and specific industry challenges, overall credit performance remains robust, aided by steady interest coverage and the potential for further Federal Reserve rate cuts. Tighter spreads and declining base rates make the strategy less attractive on an absolute basis, however, it continues to offer attractive risk-adjusted returns and an illiquidity premium over public markets.

In real estate credit, both residential and commercial sectors present opportunities despite unique challenges. We believe residential real estate private credit is compelling, particularly with short-duration strategies that are less reliant on home price appreciation. Higher interest rates in commercial real estate have impacted values and refinancing, but UGA’s focus is on conservative lending, especially in the multifamily sector. Opportunistic investments, such as acquiring non-performing loans or assisting sponsors unable to refinance, reflect adaptability in a changing market. Specialty finance and reinsurance also add diversification and risk management, with reinsurance delivering strong 2025 returns but requiring caution as spreads tighten for 2026.

Overall, these strategies highlight the importance of diversified portfolio management approach and prudent selection of investment strategies. By actively monitoring risks and seeking quality opportunities, investors could remain well-positioned for stable income from private credit investments as markets evolve.

Private credit sector performance outlook1

Category | Category | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="light-green-bullet"] | [ubs:icon type="light-green-bullet"] | [ubs:icon type="dark-green-bullet"] Positive | [ubs:icon type="dark-green-bullet"] Positive |

|---|---|---|---|---|---|---|---|---|---|---|---|

Category | Corporate credit | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Direct lending | [ubs:icon type="light-green-bullet"] | Special situations | [ubs:icon type="dark-green-bullet"] Positive | None |

Category | Structured corporate credit | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | CBO equity | [ubs:icon type="dark-gray-bullet"] Neutral | CLO equity | [ubs:icon type="light-green-bullet"] | None | [ubs:icon type="dark-green-bullet"] Positive | CLO warehouses |

Category | Commercial real estate | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Stabilized lending | [ubs:icon type="dark-gray-bullet"] Neutral | Transitional lending | [ubs:icon type="light-green-bullet"] | Construction lending | [ubs:icon type="dark-green-bullet"] Positive | Opportunistic bridge-to-agency |

Category | Residential real estate | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Buy-to-rent | [ubs:icon type="dark-gray-bullet"] Neutral | None | [ubs:icon type="light-green-bullet"] | Transitional lending | [ubs:icon type="dark-green-bullet"] Positive | Construction finance |

Category | Specialty lending | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Consumer | [ubs:icon type="dark-gray-bullet"] Neutral | Small business | [ubs:icon type="light-green-bullet"] | None | [ubs:icon type="dark-green-bullet"] Positive | Niche ABL |

Category | Reinsurance | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Cat bonds | [ubs:icon type="light-green-bullet"] | Cat bonds Collateralized re-insurance | [ubs:icon type="dark-green-bullet"] Positive | None |