A stabilizing force in a fractured world

Bullish sentiment for infrastructure

Bullish sentiment for infrastructure

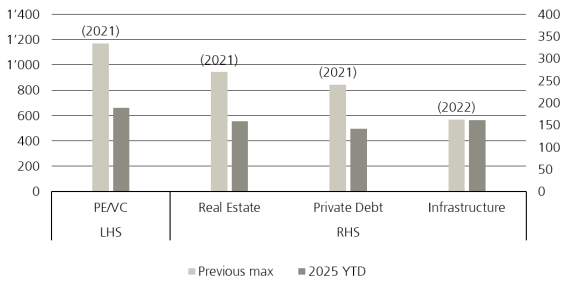

Investor sentiment toward infrastructure has shifted decisively more positive in 2025. At a time when most private market asset classes remain well below their historic fundraising peaks, global infrastructure fundraising is on track to reach a new record this year (see Figure 1).

Infrastructure has attracted significant inflows despite elevated geopolitical tensions, political uncertainty, and macroeconomic volatility, as investors view the asset class as a safe haven in an increasingly unpredictable world.

Figure 1: Private markets fundraising (USD m)

In addition, the asset class now sits at the center of several powerful secular themes. First, growth in AI is increasing the need for digital infrastructure, energy and grid investments. Second, despite unfavorable policies targeting renewable energy in the US (refer to our recent paper, ‘Antifragile?’), decarbonization remains a global secular tailwind that will endure political and economic cycles. Finally, onshoring policies have accelerated the demand for traditional infrastructure across all sectors, as reindustrialization has become a national priority.

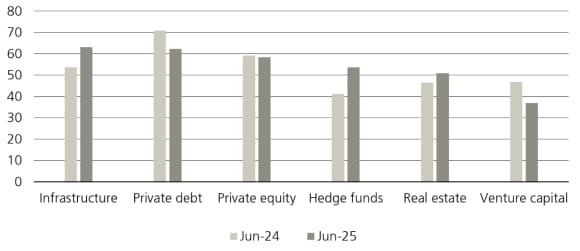

This infrastructure fundraising momentum is reflected not only in capital already raised. In a recent institutional investor survey, infrastructure ranked as the most preferred asset class for capital commitments over the next 12 months (see Figure 2).

Figure 2: Preqin Investor Sentiment Index

Cracks in the old-world order

Cracks in the old-world order

However, beneath the bullish sentiment and secular investment themes lies a deeper level of unease.

At an investment level, the growth of AI is raising bubble concerns. At a human level, ordinary citizens are questioning how AI will reshape their lives – and whether governments they increasingly distrust can protect them from the disruptions ahead. At a global level, the world is also shifting to an era of strategic rivalry and nationalistic policies that is breaking down the old-world order.

President Trump’s second term in office is accelerating a trend that was already underway. Infrastructure is no longer viewed as a simple enabler of economic activity but as a symbol of sovereignty and soft power.

This shift has become widespread around the world:

- Germany announced a EUR 500 billion infrastructure fund to modernize its energy and transportation networks.

- Canada has established a Major Projects Office designed to accelerate permitting and execution of large scaled infrastructure projects – including LNG terminals, pipelines, ports, nuclear power etc.

- The UK released its latest 10-year infrastructure strategy aimed at ‘crowding in’ private capital (refer to our recent paper, ‘UK policy warms on private capital’).

- France announced over EUR 100 billion in investments to build a domestic AI ecosystem.

These are not temporary stimulus programs or knee-jerk reactions to Trump’s presidency. They are deliberate, structural repositioning strategies that will continue to shape international geopolitics and domestic policies, especially in a new multipolar world order.

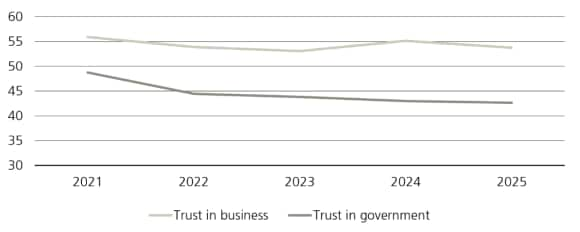

Domestic politics are equally polarizing and contentious. Trust in government institutions across OECD countries has declined meaningfully in recent years, even though trust in business has (surprisingly) remained higher and relatively more stable (see Figure 3).

Figure 3: Edelman Trust Barometer (OECD countries)

The implication is that governments face mounting pressure to deliver tangible improvements to their citizens’ daily lives, even though fiscal constraints limit their ability to achieve this. Private capital will therefore increasingly become an important part of the solution to address the basic needs of citizens.

Infrastructure as the backbone for social cohesion

Infrastructure as the backbone for social cohesion

Although the shift toward populism is well acknowledged and understood, we believe markets remain too focused on short-term policy changes and news headlines. Beyond political and economic cycles, we believe infrastructure can serve as an antidote to the structural problems plaguing societies around the world.

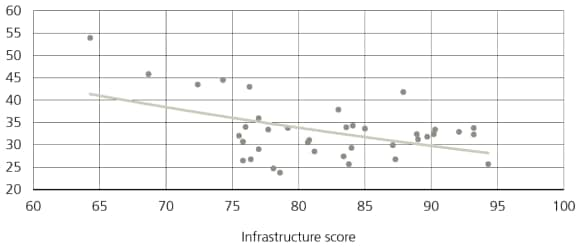

Basic infrastructure can act as a great equalizer for fractured societies. It provides essential services to citizens and offers a direct way to improve their quality of life. There is already a causal relationship linking higher-quality infrastructure to lower inequality (see Figure 4).

Figure 4: Infrastructure score vs. income inequality (OECD countries, Gini coefficient)

This is quite intuitive, as lower-income populations tend to be more exposed to the consequences of poor infrastructure and climate change. For example, lower-income households spend a larger share of their income on energy and transportation.1 Better broadband connectivity is also associated with higher wages and access to more job opportunities.2 A study also showed that shorter commute times are the strongest predictor of upward mobility for low-income families.3

This underscores one of the most important points of the current moment: infrastructure can play a stabilizing role in societies experiencing political polarization, distrust in elites, and widening perceptions of inequality. If done right, it can rebuild social cohesion and restore political legitimacy to traditional institutions.

We need more infrastructure not just because it creates economic value. We need it because it may be the last shared project that citizens of each country have left – the thing that holds societies together when almost everything else is pulling them apart. In other words, the case for infrastructure is existential.

Private infrastructure sector performance outlook

Country | Country | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="light-green-bullet"] | [ubs:icon type="light-green-bullet"] | [ubs:icon type="dark-green-bullet"] Positive | [ubs:icon type="dark-green-bullet"] Positive |

|---|---|---|---|---|---|---|---|---|---|---|---|

Country | Europe | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Oil & gas, utilities | [ubs:icon type="dark-gray-bullet"] Neutral | Toll roads, ports, conventional power | [ubs:icon type="light-green-bullet"] | Airport, railroads, logistics, fiber, telecom towers, data centers | [ubs:icon type="dark-green-bullet"] Positive | Energy transition |

Country | US | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Ports | [ubs:icon type="dark-gray-bullet"] Neutral | Oil & gas, energy transition, fiber, toll roads | [ubs:icon type="light-green-bullet"] | Airport, railroads, logistics, telecom towers | [ubs:icon type="dark-green-bullet"] Positive | Utilities, conventional power, data centers |