Investment activity bounces back in third quarter

Global strategy update and outlook

Global strategy update and outlook

The impact of tariffs is starting to feed through to US consumer prices, with the latest inflation print at 3.0% for September, up from 2.7% in July, but still below the 4.0% initially feared following the ‘liberation day’ announcements in April. We have yet to see the full impact of tariffs come through, with an expected one-off uptick in inflation, and there remains a constant threat of further changes to tariff levels. However, risks appear tilted towards a softening of the US jobs market rather than accelerating inflation. Unemployment edged up to 4.4% in September, with job gains having slowed over the course of the year. Much lower immigration under the Trump administration is a factor curbing jobs growth and dragging down the figures. During the period of the US government shutdown, labor market data were delayed, though market estimates suggested that conditions remained weak.1

Despite this, the US economy has held up well so far, with the third estimate for 2Q25 GDP showing strong growth at an annualized pace of 3.8%, revised up from the initial estimate of 3.0%. The government shutdown also delayed the release of the third-quarter GDP figures. Growth forecasts have been revised upward, and we continue to believe that recession will be avoided, though risks remain. The Fed appears set to remain cautious, and may cut rates again in December, having started the second leg of its rate-cutting cycle in September, with a 25bps cut, followed by another 25bps cut in October.1

The Bank of England last cut interest rates in August to 4%, but kept them on hold in November. Another cut is expected, possibly in December. UK inflation remained unchanged in September for the third consecutive month, at 3.8%. The European Central Bank (ECB) held its deposit rate at 2% in September, while eurozone headline inflation edged up to 2.2%, strengthening the ECB’s case for keeping rates on hold for an extended period. The Bank of Japan has kept rates steady since January, though a 25bps hike in December now appears possible due to upward revisions in growth and inflation projections, driven by the resilience of the US economy. Moreover, Japan’s new government seems committed to fiscal stimulus.

Eurozone growth for 3Q25 was 0.2% QoQ, compared to 0.1% QoQ in 2Q25. Although still modest, the result was stronger than expected and held up by Spain and France, despite French political turmoil. In the UK, GDP grew 0.1% in August after contracting 0.1% in July. Overall, UK growth has slowed following a strong start to the year, with a tax-increasing and spending-cutting budget anticipated in November. China grew 4.8% YoY in 3Q25, matching expectations, but slightly below the 5.2% YoY in 2Q25. Previously downgraded growth forecasts for China have been revised slightly upward as the US economy has remained resilient.

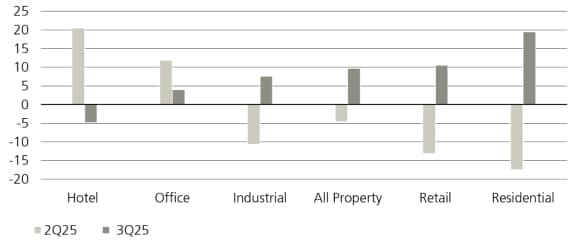

According to data from MSCI, and after accounting for seasonal effects, global real estate investment volumes in USD terms bounced back QoQ in 3Q25, following two quarters of declines as investors held back over concerns about the impact of tariffs. This indicates growing investor confidence, as economies and real estate markets have proven resilient so far. Global investment volumes were up 9% YoY in USD terms and increased QoQ across the retail, residential, industrial and office sectors. Hotels was the only sector to experience a small QoQ decline in investment activity (see Chart 1). Investment volumes also rose over the quarter across regions. We expect investment activity to continue recovering through the remainder of the year and into 2026, provided the economy remains stable and there are no significant trade and tariff shocks.

Chart 1: Global real estate transaction volumes (USD billions, seasonally adjusted, % QoQ)

The ‘liberation day’ announcements generated uncertainty and lowered expectations for global real estate returns. However, the US real estate market backdrop has improved as recession risks have faded. The latest data from NCREIF show that US all property capital values stayed flat QoQ in 3Q25. Moreover, total returns were 1.2% QoQ, the same as 2Q25, resulting in a total return of 3.7% for the first three quarters of 2025. Capital values rose for residential and hotels and were flat for industrial. US office capital values dropped another 0.5% QoQ, while retail slipped 0.1% QoQ. MSCI data showed a slightly stronger picture for the UK, with all property capital values up 0.2% QoQ, the same growth rate as the previous quarter. We expect global real estate returns to pick up in 2026, supported by capital value growth, though uncertainty persists amid a volatile economic and geopolitical backdrop.

Use debt selectively across markets and strategies

2025 GDP growth forecasts for many advanced economies have been revised upward, driven by the US economy holding up and avoiding recession, with 3.8% annualized growth in 2Q25. Subsequently, US growth forecasts for 2025 and 2026 have also been revised upward, mainly due to improved expectations for consumer spending. The 2026 forecast is projected to be more favorable globally assuming lower interest rates and a more stable tariff environment. Despite this, growth rates remain below initial forecasts at the start of the year, but economies have generally held up and avoided recession.

However, we have seen weakness in the US labor market. Demand for labor has softened, with a modest number of jobs added compared to the start of the year, while layoffs remain slow. Due to President Trump’s immigration policies, the supply of workers is growing more slowly. Alongside this, the US is grappling with higher inflation, which is starting to reflect the impact of tariffs, with the latest reading of 3.0% in September, although this is lower than expected.

Investors are concerned about fiscal and political instability globally. Long-term government bond yields have risen throughout 2025 across key economies, driven by a combination of escalating borrowing costs and higher government debt levels. This has, in turn, increased borrowing costs for the private sector, including real estate markets.

Although interest rate outlooks vary across economies, the rate cuts across the year have helped boost investor sentiment. A reduction in interest rates could improve economic conditions for real estate markets by lowering borrowing costs and improving affordability. The Fed may cut again in December, followed by more next year, whereas ECB rates appear to have bottomed out. Modest increases are expected in Japan, while Swiss rates may turn negative.

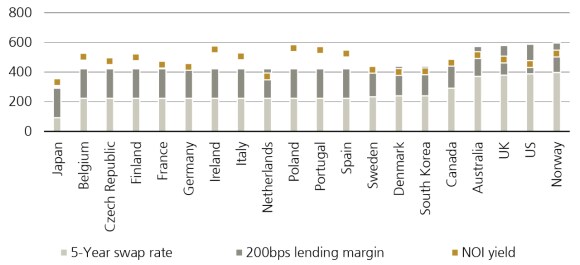

Despite upward pressure on long-term government bond yields, real estate net operating income (NOI) yields across geographies remain above bond yields, though margins have narrowed. In some markets, NOI yields are below debt costs, while in others they remain above. Figure 2 accounts for debt costs by adding a 200bps margin to 5-year swap rates. Over the past few years, NOI yields have increased while debt costs have edged slightly lower. At the global level, we expect NOI yields and debt costs to remain relatively stable over the next few years, though the outlook varies by market. As of 2Q25, NOI yields were primarily above debt costs in European markets and in certain APAC markets. Hence, investors must use debt selectively by market and strategy, with debt typically more likely to be accretive to returns in European markets and for higher-returning strategies globally. By contrast, where debt costs exceed real estate yields, such as in the US, UK and Australia, debt cannot be relied upon to drive returns, unlike during the ultra-low interest rate environment of the post-GFC decade. Instead, investors must focus on asset management initiatives to drive performance, including reducing vacancies, shortening lease-up times and improving assets to retain tenants and support rental growth.

Figure 2: All property NOI yields, swap rates and lending margins (2Q25, bps)

We believe bottom-up deal selection is critically important now, as there are only select markets where debt is accretive and because we anticipate similar market performance across sectors from a top-down perspective. Manager selection and capability are also key to seeking good investment performance.

It is our view that the residential sector remains attractive due to its strong long-term fundamentals, including structural undersupply and sustained demand driven by demographic factors. The retail sector has normalized, with grocery-anchored retail continuing to show resilience. The office sector showed flat capital movement in the UK in 2Q25, but further declines in the US. However, prime offices are showing potential and appear poised for recovery. The industrial sector, particularly in the US, has proven resilient over 2025, especially in domestic logistics. There have been pockets of capital value growth, which we expect to continue into 2026, adding to income returns that remain strong.

Unlisted real estate sector performance outlook

Country | Country | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="red-bullet"] Negative | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="light-gray-bullet"] | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="dark-gray-bullet"] Neutral | [ubs:icon type="light-green-bullet"] | [ubs:icon type="light-green-bullet"] | [ubs:icon type="dark-green-bullet"] Positive | [ubs:icon type="dark-green-bullet"] Positive |

|---|---|---|---|---|---|---|---|---|---|---|---|

Country | US | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Office | [ubs:icon type="dark-gray-bullet"] Neutral | Retail, industrial, residential | [ubs:icon type="light-green-bullet"] | Hotel | [ubs:icon type="dark-green-bullet"] Positive | None |

Country | Canada | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | Office | [ubs:icon type="dark-gray-bullet"] Neutral | Retail, residential | [ubs:icon type="light-green-bullet"] | Industrial | [ubs:icon type="dark-green-bullet"] Positive | Hotel |

Country | France | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, residential | [ubs:icon type="light-green-bullet"] | Retail, industrial | [ubs:icon type="dark-green-bullet"] Positive | Hotel |

Country | Germany | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, retail, industrial, residential, hotel | [ubs:icon type="light-green-bullet"] | None | [ubs:icon type="dark-green-bullet"] Positive | None |

Country | Switzerland | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, retail | [ubs:icon type="light-green-bullet"] | Residential | [ubs:icon type="dark-green-bullet"] Positive | Industrial, hotel |

Country | UK | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, industrial, residential, hotel | [ubs:icon type="light-green-bullet"] | Retail | [ubs:icon type="dark-green-bullet"] Positive | None |

Country | Australia | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, industrial, hotel | [ubs:icon type="light-green-bullet"] | Retail, residential | [ubs:icon type="dark-green-bullet"] Positive | None |

Country | Japan | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office, industrial | [ubs:icon type="light-green-bullet"] | Retail, residential, hotel | [ubs:icon type="dark-green-bullet"] Positive | None |

Country | Singapore | [ubs:icon type="red-bullet"] Negative | None | [ubs:icon type="light-gray-bullet"] | None | [ubs:icon type="dark-gray-bullet"] Neutral | Office | [ubs:icon type="light-green-bullet"] | Retail, residential, hotel | [ubs:icon type="dark-green-bullet"] Positive | None |