Are you climate aware?

Ten index investor questions about managing climate risk

Passive equity investors face a variety of options for bringing their index investments in line with sustainability objectives. In this paper, our SI and indexing specialists share their views on the various factors related to climate change and the potential (unintended) consequences. Read more.

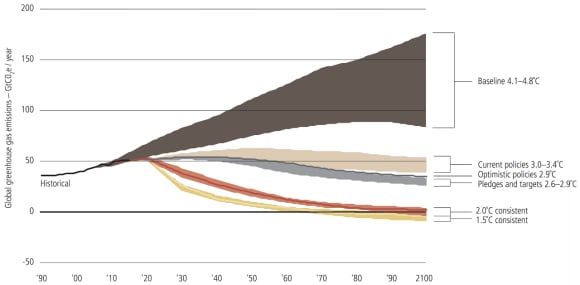

Exhibit 1: 2100 warming predictions

Exhibit 1: 2100 warming predictions

The Climate Action Tracker is an independent scientific analysis that tracks government climate action against the globally agreed Paris Agreement aim of holding warming well below 2°C, and pursuing efforts to limit warming to 1.5°C by 2100.

Many investors are uncertain how best to align their passive equity investments with the global transition toward a lower-carbon future. A common response is divesting high carbon-output companies by investing in tracker funds that are benchmarked to ex-fossil fuel indices. But there are consequences to this choice. By excluding fossil fuel investments, the indexed investor avoids some risks but also misses opportunities: some ‘oil majors’ are among the largest investors in alternative energy.

Also, it is clear that a transition to a lower-carbon world will take time, and anyone who simply excludes those companies is unable to exert shareholder influence on the means and timing of needed changes.

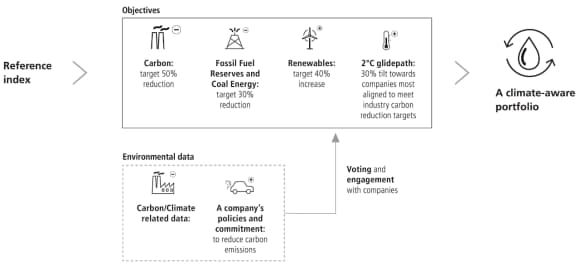

We believe the more responsible approach may be for investors to maintain a thoughtful allocation to carbon-emitting companies with the twin goals of supporting positive change through proactive engagement with the companies that appear to be the least well positioned while also supporting companies that are developing new, lower carbon technologies. At the same time, the more the portfolio is re-shaped away from the index benchmark the greater the chance that the investment returns will diverge. UBS Asset Management’s Climate Aware strategy seeks to provide index investors with an innovative, rules-based strategy, designed to capitalize on the long-term transition to a low greenhouse-gas (GHG) emissions economy by investing more in companies at the heart of this transition as well as those adapting their operating models.

In 2019, UBS-AM surveyed over 600 institutional investors worldwide, representing more than €19 trillion in combined AuM about their view of sustainable investing. A majority said they believe environmental factors will matter more to their investments than traditional financial criteria over the next five years.

This paper answers the 10 questions we hear most often from investors about managing climate risk in their passive equity portfolios and how the Climate Aware strategy addresses those issues. The first three questions are listed below. Download the full paper to read more.

Are you climate aware? Ten index investor questions about managing climate risk

Are you climate aware? Ten index investor questions about managing climate risk