Sustainable investing

The value of a green transition

A model for including decarbonization in company valuation

Can sustainable investing help drive the low-carbon transition?

Can sustainable investing help drive the low-carbon transition?

The world is faced with an existential crisis, manifested by undeniable shifts in our planet’s climate system. Driven by this crisis, the financial community is rethinking its purpose. Greenhouse gas emissions are largely corporate, so what part do we play as asset owners?

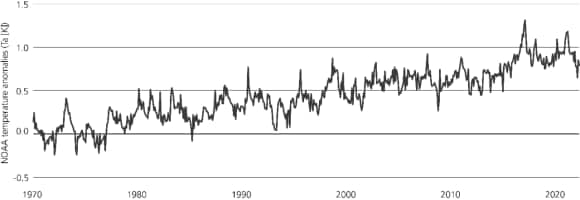

NOAA global surface temperature. The earth has already reached around 1°C warming

NOAA global surface temperature. The earth has already reached around 1°C warming

As a planet, we are still moving fast in the wrong direction.

At UBS, we are actively seeking to reimagine investing – this is explicitly part of our Purpose Statement . We want our investments to deliver financial returns, but also to deliver solutions to the climate crisis. Therefore, we are looking beyond superficially ‘greening’ portfolios to greening the assets in them.

The key is to engage some of the biggest polluters-- legacy sectors that traditionally emit the most carbon, but that are vital to society. They must find efficient ways to reduce their emissions, typically at their own expense, a process referred to as a ‘green transition.’ At UBS, we want to support these transitions while meeting investment goals.

In this white paper, we present a new valuation framework that embeds the cost of emissions and a systematic approach to emission abatements developed in collaboration with Material Economics. The purpose is to quantify valuation impacts of green transitions, and engagement with companies on specific steps for emission reductions. A science-based framework, demonstrating the economic cost vs. benefit of reducing emissions, should help companies to become more confident and ambitious in their climate efforts.

We believe investing in companies that aggressively transition is a commercial opportunity, well-aligned with our fiduciary duty to deliver returns and manage risk. From an investor point of view, tackling transitions requires the full package: world-class investment capabilities, impactful company engagement and a will to go above and beyond. The framework presented in this paper provides the foundation for UBS's efforts in supporting mission critical green transitions.