When market shocks create opportunities

A recovery from COVID-19, propelled by unprecedented amounts of stimulus, could see investors shift risk profiles and readjust portfolios. So how should investors react to the acceleration of trends and rethink investment portfolios?

23 Jun 2020

4 min read

Massimiliano Castelli

Head of Strategy and Advice, Global Sovereign Markets

A decade after the Global Financial Crisis (GFC), the global economy is weathering another recession triggered by COVID-19 that will be much deeper, possibly the worst on record in the post-war period.

The GFC and COVID-19 crises originated in different countries but quickly spread globally as a result of increased global economic integration. The GFC unleashed a powerful regulatory response intended to reduce international linkages in the financial system, and paved the way for the rise of nationalism and unilateralism, culminating in protectionism, reduced global trade growth and rising geopolitical tensions.

COVID-19 could be the final blow that puts into reverse the globalization trend that began just after the end of World War II.

Similarly, COVID-19 unveiled the risk of complex international value chains, and this is likely to unleash a similar political response which will materialize in the years to come. According to some, COVID-19 could be the final blow that puts into reverse the globalization trend that began just after the end of World War II.

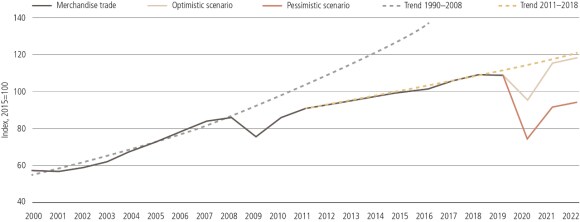

We believe international trade in manufactured goods, which stagnated following the GFC, will drop sharply in 2020.

World merchandise trade volume, 2000 - 2022

World merchandise trade volume, 2000 - 2022

According to the World Trade Organization (WTO), international trade in manufactured goods and in services will suffer double-digit declines in 2020 with an uncertain pace of recovery.

COVID-related trading costs – e.g., higher cargo prices, more stringent border controls and travel restrictions – are equivalent to a 3.4% global tariff, according to the WTO, a substantial increase in the global average tariff it estimated was 8% in 2018. But more importantly, frozen international supply chains might not be reactivated or could be shortened as corporates manage the risk of future severe global events, making the 'COVID tariff' a long-term issue, even once the pandemic is finally under control.

Accelerating changes

Accelerating changes

The post-pandemic world may be less global, but it will also be more digital. Some changes in consumption habits — i.e., the rise of online shopping and home-working, will become permanent, accelerating the disruption across companies and sectors, especially real estate and transport infrastructure.

The shift to digital currencies and digital payments is also likely to accelerate. Some countries – for instance China — are already experimenting with Central Bank Digital Currencies and it is just a question of time before these currencies are adopted on a vast scale. Digitization is a disruptive trend. The winners will be those companies capable of reinventing themselves by embracing the digital revolution.

Public debt levels rose after the GFC and were never reduced, a trend that will continue post COVID-19 in advanced and emerging markets. In some countries, debt will rise to unsustainable levels, while countries with more space for fiscal expansion will emerge faster and suffer less economic damage.

There will be winners and losers with some countries capable of recovering faster than others thanks to a more robust fiscal response. The rise in debt levels and the massive acquisition of public bonds by central banks will also test the boundaries between monetary and fiscal policy with implications for the independence of central banks.

Rethinking investment portfolios

Rethinking investment portfolios

So how should investors react to the acceleration of these disruptive trends? Before COVID-19 investors were increasingly focusing on the impact of these long-term trends toward digitalization, emerging market growth and debt awareness, among others, on their portfolios. Further, institutions with a very long-term investment horizon – for instance Sovereign Wealth Funds – have already started incorporating these trends into their investment framework. This trend will accelerate in the future as institutions will need to diversify not only across asset classes but also across these structural long-term themes.

In a lower-forever environment, even risk-adverse investors with large fixed income allocations will have to consider more diversification, particularly into listed equity; for investors with a higher risk appetite, we think the trend towards private markets will continue in the search for adequate returns.

- The clear distinction between winners and losers from the crisis and the persistent divergence between value and growth might ultimately bring old paradigms into question, including the one that there may be no advantages to branching out from passive investment strategies, particularly in developed markets. For sophisticated investors, finding the right mix between core and satellite strategies will be crucial.

- We expect institutional investors to adopt thematic investment strategies, for example, into healthcare, the digital transformation and sustainable consumption to capture enduring opportunities and to reduce portfolio risk.

- For institutional investors, it will be crucial to keep investment strategies and governance models up-to-date and aligned with fast-changing industry best practices. Applying an interdisciplinary mindset will be crucial to execute necessary changes when adapting portfolios to the post-COVID-19 world.

For institutional investors and those with long-term investment horizons, the pandemic may be something of a wake-up call to look beyond tactical or traditional allocations to incorporate ongoing changes that are already shaping society globally, and are merely underscored by the pandemic. Investors with a very long-term view may find they are able to weather unexpected storms with more certainty.