Turning heads in Asia

Asian equity markets have a number of unique characteristics that make them attractive to active investors in general and to long/short equity hedge funds in particular.

Interview with Adolfo Oliete

Interview with Adolfo Oliete

Head of Asia-Pacific Investments, UBS Hedge Fund Solutions

What is the investment environment in Asia really like? Adolfo Oliete shares his take on the opportunities he sees in high-volatility, high-turnover Asian markets.

What is the current opportunity set in Asia?

What is the current opportunity set in Asia?

As we build our case for the year ahead, we take into account rapid structural and secular changes that could provide investment opportunities in emerging Asia, particularly China. The rapid growth of China is underpinned by several reinforcing factors like the consumption upgrade cycle, urbanization and aging—with consumption at the forefront of China's overall economic growth. An increased demand for social services caused by factors including urbanization, has expanded education needs at the same time as aging communities have ever greater healthcare needs. Income growth has also prompted a shift in consumption trends as retail markets grow and online access increases. Additionally, there has been a big push for innovation and automation.

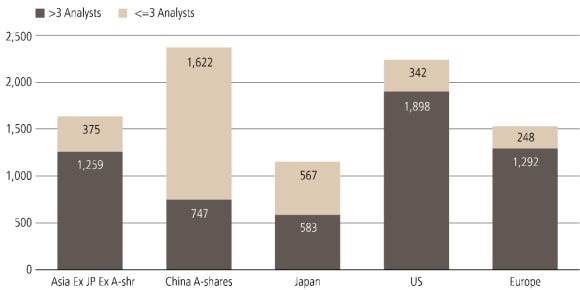

Exhibit 1: Coverage of companies with USD 500m market cap

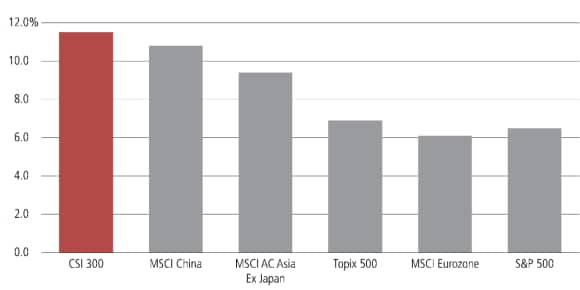

Exhibit 2: High dispersion of returns in China

How are you factoring market conditions into hedge fund portfolios?

How are you factoring market conditions into hedge fund portfolios?

We continue to favor Asia, and our allocation mainly consists of Equity Hedged managers that have shown outsized alpha generation and the ability to manage risk during high levels of volatility. In addition, we look for managers who have the ability to perform in volatile or dislocating markets by providing liquidity to the market, for example Multi-Strategy managers. In the near future, pending QFII regulation changes, we expect to be able to allocate to some Onshore China strategies that have not previously been accessible to offshore capital. Based on historic risk and return characteristics, we believe that these strategies are likely to provide strong diversification benefits.

As we look ahead, the evaluation of risk relative to reward remains paramount. With risk premia compressed across most asset classes, we are focused on identifying idiosyncratic opportunities. Most importantly, we focus on active management in the region. In an Asian hedge fund universe demonstrating high return dispersion, manager selection and exit decisions are paramount to the delivery of investment outcomes.