Asian equities in 2021

Geoffrey Wong, CFA, Head of Emerging Markets and Asia-Pacific Equities gives his view on what to focus on in Asia equity markets in 2021

Asian equities in 2021– key takeaways

Asian equities in 2021– key takeaways

- Valuations for Asian and Emerging Markets equities are currently looking reasonable;

- Asian companies are in good shape from a balance sheet perspective;

- Asian and Emerging Markets offer large opportunities for active returns because of two key factors: market inefficiencies and long-term fundamental trends that create winners and losers.

Valuations for Asian and Emerging Markets equities are currently looking reasonable at a time when the economic cycle is turning and when other major asset classes are looking expensive compared to historical levels.

MSCI Asia ex-Japan PB (January 31, 1997-October 31, 2020)

MSCI Asia ex-Japan PB (January 31, 1997-October 31, 2020)

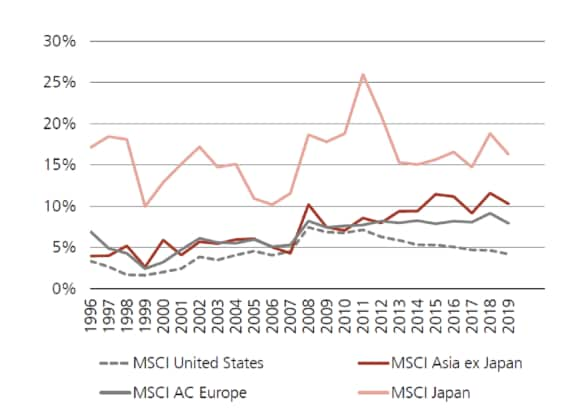

Asian companies are in good shape from a balance sheet perspective. In terms of cash as a share of market cap and net debt as a proportion of equity, Asian companies are more defensive, especially when compared to the US and Europe.

Asian and Emerging Markets offer large opportunities for active returns because of two key factors: market inefficiencies and long-term fundamental trends that create winners and losers.

Cash as % of market cap, 1996-2020

Cash as % of market cap, 1996-2020

Turning specifically to fundamental trends, a good active manager capable of spotting winners can create a lot of value for clients’ portfolios.

Trends like the shift to premium and discretionary spending in Asia, aging populations, industry consolidation, and expanding financial inclusion have the potential to create attractive returns for investors in the future.

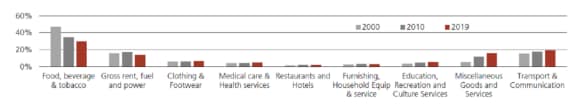

India’s change in wallet share, 2000-2019

India’s change in wallet share, 2000-2019