China: out of lockdown - into recovery?

As China's lockdown eases, will the economy recover in 2020 and 2021? What is the investing outlook for China equities and bonds?

China was the first to experience Covid-19, but it is the first to emerge from lockdown. What does the future hold for China's economy, is there a recovery, and what themes should investors watch out for? We covered all this and more at our exclusive webinar, read it all here.

Key Webinar Takeaways

Key Webinar Takeaways

- China's economy is recovering from Covid-19, but has yet to return to normal;

- Indicators like traffic congestion and coal consumption have shown a meaningful improvement, but we are not yet at the full recovery stage;

- Covid-19 has revealed a number of behavioural changes in China, such as the shift from offline to online, which present investment opportunities in sectors like after-school tutoring, financial services and healthcare;

- Leading companies will benefit from ongoing consolidation in many industries as small firms struggle;

- As world bond markets shifts to negative yields, China government bonds offer a unique value proposition to investors based on low correlation & volatility as well as attractive yields;

- Despite concerns about data quality, we remain confident in the data being released by the Chinese government.

Barry Gill, Head of Investments

Barry Gill, Head of Investments

On February 6th this year I participated in a podcast in which the host wanted to discuss the market's reaction to the unfolding coronavirus outbreak in China.

The Chinese A-share market had been formally closed over the end of January due to Chinese New Year, but the unfolding drama, including the quarantining of Hubei province, manifested in a 10% sell-off when it opened on February 3rd. By the time of my podcast it had recovered by 80% and then went on to hit a 12-month high in early March.

I framed my responses to the podcast questions in the context of the market focusing on the second derivative - forward looking indicators would trump real time poor economic data.

Ten weeks later I am struck by the simplicity and naïveté of my line of reasoning, particularly given the former option-trader in me fully understands the value of focusing on tail risks.

'When the US sneezes the rest of the world catches a cold'. But look at what has happened: from the start of the year, China A-shares are down a modest 5%, troughing down 14%, while the S&P 500 is down 12% having bottomed down 31%. Why is this?

Covid-19, China and the world economy

Covid-19, China and the world economy

I had not factored in the contagion dynamics of the virus, nor the fact that Chinese share of global GDP had quadrupled since the SARS outbreak in 2003.

Furthermore, I had not fully considered that in many senses we had been riding our luck when it came to pandemics and that Covid-19 exposed the lack of preparedness for this type of tail event in the western healthcare system.

This illustrates how hard it is to forecast the market's moves in the short term. Remember, equity markets hit new highs equity markets hit new highs later in February, although the bond market once again seems to have sniffed out a problem before the equity market.

In the same interview, though, I reiterated the bullish secular views we have held on Chinese equities and bonds at UBS.

We have witnessed lengthy quarantines around the world, which may structurally change how we work, play, learn and travel. We have also witnessed monetary and fiscal responses equal to or greater than what were experienced in the Great Recession after the 2008-2009 Global Financial Crisis.

China is different, but why?

China is different, but why?

The global mantra is one of acting quickly and forcefully, to avoid any rot taking hold. That is, everywhere except China. Policy responses in China stand out for how muted they have been, in contrast to the $4tn wall of money they spent from 2009-2011. Why is this?

Also, an old saw goes, 'When the US sneezes the rest of the world catches a cold'. But look at what has happened: from the start of the year, China A-shares are down a modest 5%, troughing down 14%, while the S&P500 is down 12% having bottomed down 31%.

Similarly, US 10 year Treasury yields have plummeted 120bps to generational lows, while Chinese government bonds of a similar maturity have lost half that amount and now yield 180bps more than US Treasuries.

What is happening? How much of what is happening is a temporary aberration and how much is structural in nature? What are the big opportunities that investors are too hesitant to take advantage of? China led us into this current crisis - can it lead us out?

Bin Shi and Hayden Briscoe will each now seek to answer some of these questions.

China led us into this current crisis - can it lead us out?

Bin Shi, Head of China Equities

Bin Shi, Head of China Equities

Covid-19 is a global issue, but if you observe some of the trends between countries the trajectory is similar.

Countries that took early action have been more successful at reducing the growth rate of new cases than those that delayed.

That's particularly true in China where the spread of Covid-19 virus has been brought under control.

Looking at activity indicators, we are seeing signs of incremental improvement, but we should take these indicators with a grain of salt

Why has China been so successful?

Why has China been so successful?

Two factors are important.

Firstly, the Chinese government took drastic measures. People were locked down in their homes and they closely abided by government rules.

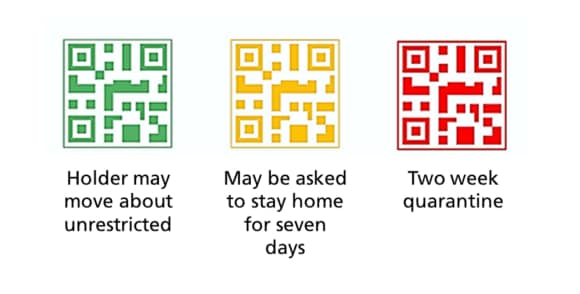

Secondly, the government has used new technology to help monitor population movements. Tencent - one of China's largest tech companies – developed health status QR codes that advised users on what to do and helped separate high risk people from low risk people by using big data to track whether users had been close to the site of an outbreak, or infected people.

Chinese tech companies are using big data and QR codes to help curb the spread of COVID-19

Chinese tech companies are using big data and QR codes to help curb the spread of COVID-19

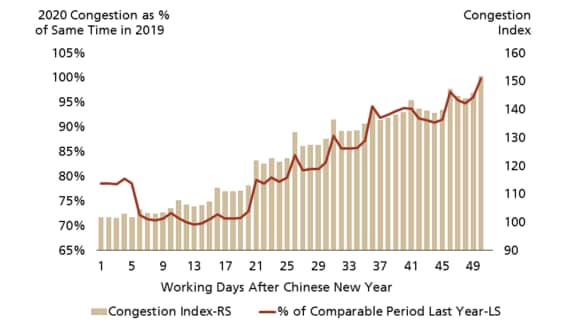

Congestion Data in Chinese Cities Show a Return to 2019 Levels

Congestion Data in Chinese Cities Show a Return to 2019 Levels

But more traffic doesn't necessarily mean a 'return to normal'

But more traffic doesn't necessarily mean a 'return to normal'

Looking at activity indicators like traffic and coal consumption levels we are seeing signs of incremental improvement.

Take congestion for example, data show that levels have approached those in 2019.

However, we should take that with a grain of salt as few people are taking public transport to avoid travelling in groups, so urban roads are full of cars.

More broadly, inter-city car travel is still low, so it is not true to say that traffic indicators - which many say is a proxy for the economy - have returned to normal 100%.

Focus on behavioral changes and new innovations

Focus on behavioral changes and new innovations

What is important when making an equity investment strategy for China is to gauge the many behavioral changes brought about, and even accelerated by the Covid-19 outbreak.

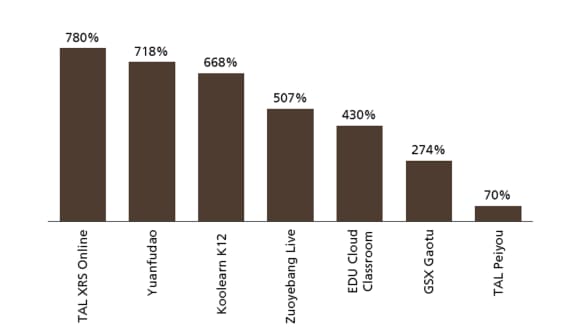

One of which is the shift from offline to online business in China. Online education is one sector to benefit from a shift. Top online education companies have seen a huge increase in downloads during the Covid-19 outbreak and we feel that the best companies in these spaces have the potential to grow market share from other online competitors.

Online games are another sector that has benefited from increased players during the outbreak period.

MoM (%) increase in Daily Active Users in February 2020

MoM (%) increase in Daily Active Users in February 2020

Premiumization thesis still holds

Premiumization thesis still holds

While retail numbers will have taken a hit in Q1, we feel that the premiumization thesis, i.e. strong demand for high-end, high-quality goods, remains intact.

One way to gauge this is to look at wholesale baijiu prices. If demand was weakening, wholesale prices would fall, but prices have remained firm during the past couple of months. This is of course one indicator, but we haven't seen any convincing evidence yet to suggest that either demand or the willingness to pay premium prices for high-end goods has suffered as a result of the Covid-19 crisis.

Hayden Briscoe, Head of Fixed Income, Asia Pacific

Hayden Briscoe, Head of Fixed Income, Asia Pacific

I'll speak from a structural point of view about how Covid-19 is affecting both markets and the asset management industry, and what this means for investors.

Time to pick the countries

Time to pick the countries

In the past, asset allocators would build bond portfolios by following indexes but now, because of the breakdown in the stock/bond correlation and the shift to zero or negative yields, they will have to spend a lot more time picking the countries for their portfolio.

In this context, the Chinese bond market has a place in everybody's portfolio today. Investors look for diversification and low volatility and Chinese bonds score well on these two measures.

Over the years, Western bond markets have become much more correlated with each other, but that's not really the case with China.

And it’s a similar picture when it comes to market volatility, which have stayed comparatively stable as volatility on world markets has ticked up.

The Chinese bond market has a place in everybody's portfolio today. Investors look for diversification and low volatility and Chinese bonds score well on these two measures.

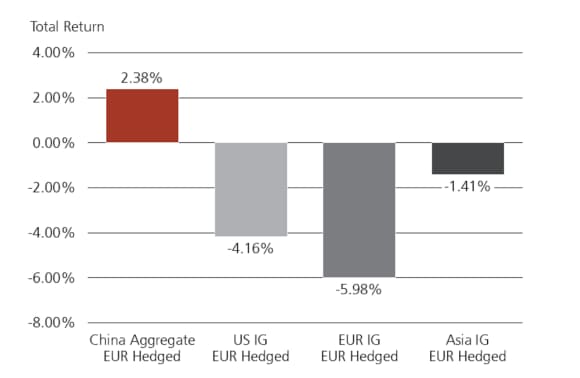

China is a top performer, with attractive yields

China is a top performer, with attractive yields

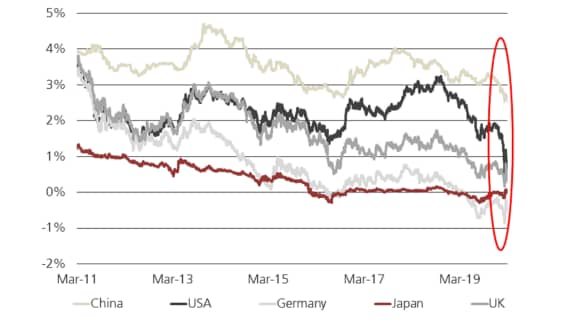

These factors are bolstering the case for Chinese government bonds as a safe haven. And if we look at performance over the past year, China has outperformed in terms of total return.

Additionally, yields of between 2% to 3% currently look highly attractive compared to the zero to negative yields available in most developed markets around the world.

No time to wait

No time to wait

Most people around the world have a zero to low allocation to Chinese bonds. If investors are waiting for global indexes to factor China bonds at the weight that reflects China's significance in the global economy, they will have a long time to wait.

That's why moving away from indices and picking the right countries will become increasingly important and we believe China has to be part of investors' global portfolios. And the case is strong: it offers diversification, low volatility, yield and low credit risk in the government space since China remains a net creditor nation.

Nominal yields on 10-year sovereign bonds

Nominal yields on 10-year sovereign bonds

Additionally, if we do see a global recession, China is one of the best spaces to be invested in because it is a market that can rally by say 200bps, and there is limited scope to do that in many other developed markets.

What is China's 2020/2021 economic outlook?

What is China's 2020/2021 economic outlook?

China's economy will grow an estimated 1.2% y-o-y in 2020 and 9.2% y-o-y in 2021, according to the most recent estimates by the International Monetary Fund (IMF). Global economic growth will drop by 3.0% y-o-y in 2020, and grow 5.8% y-o-y in 2021, according to IMF estimates released on April 14, 2020.

Q&A:

Q&A: