Capital Market Assumptions 2020 to 2025

Part II: Capital Market Assumptions Update

The main updates in our five-year capital market assumptions

UBS Investment Solutions provides estimates of capital market returns across a wide array of asset classes and from multiple currency perspectives.2 For this paper, we focus on our 5-yr Baseline expected geometric returns. These 5-yr Baseline estimates closely match the Base Case in the deterministic scenario projections provided above. They are built to be very consistent with each other.

Our last publication highlighted our June 2019 assumptions. Since then, equities ended the decade with an admirable 10-year record and momentum continued with new highs into February.

Then the pandemic hit and the equity markets dropped more than 30% before rallying sharply. Government bond yields across all maturities declined in the US--which lowered expected return in local terms. Credit markets have had surprising ups and downs, but are still at relatively wide levels going into the end of May.

The main updates in our five-year capital market assumptions compared to our mid-2019 report are:

- Expected equity returns in nominal terms are higher, as valuation is improved.

- Government bond yields are even lower, so expected returns are lower. European yields did not drop as much as US yields, but were lower to start with.

- In general, we lowered expected 10-year yields in developed countries in 2025 by 0.4% to 1.1%. This has offset some of the drop in yields in projected returns.

- Credit spreads are higher due to higher default risks, but returns are more attractive relative to governments. They bottomed out in early January 2020 before ballooning late in the first quarter of 2020. They tightened significantly in April and into May.

- The dollar appreciated against most, but not all currencies. Emerging markets had extremely large depreciations (Brazil -29.2% for example). In general, we view the dollar as overvalued against both developed market and emerging market currencies.

Global asset class returns

Global asset class returns

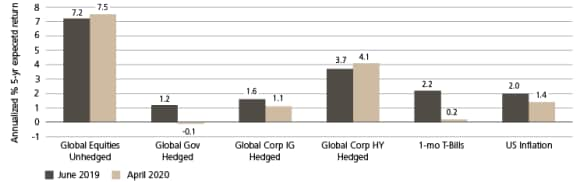

In nominal terms, the expected return of equities rises to 7.5%3 in unhedged USD terms, an increase of 0.3% from the June 2019 version. A portfolio of global government bonds is expected to return -0.1% in hedged USD terms, a large drop from the 1.2% in June 2019. Global credit drops from 1.6% to 1.3% and high yield bonds grows from 3.7% to about 4%. Cash declines the most, dropping from 2.2% to 0.2%.

In general the expected returns for risk markets have improved while the expected returns for safe assets have declined. The improvement for equities is due to improved valuations (i.e., equity prices falling more than discounted future earnings). For most markets, this improvement is quite large, but it is somewhat offset by declines in expected growth and inflation. US Large Cap equity is one significant outlier to this, as this expected return declines due to the large bounce back in valuations. US large cap returns fell to 4.9%; the valuation improvement since last June (0.5% increase) is offset by lower expected inflation (0.6% decline) and decline in aggregate earnings growth (a 0.1% decline).

In inflation-adjusted terms, prospective returns in April 2020 look a bit better than the pure nominal rates indicates. With lower inflation, the real return is boosted. In the short run, it is possible that with negative inflation and unchanged bond rates, real returns could be 2% to 3%, well within its historic performance.

Five-year expected returns in USD terms

Five-year expected returns in USD terms

Economic fundamentals

Economic fundamentals

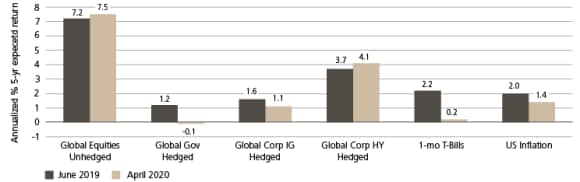

Our estimate of expected inflation dropped sharply in the last ten months. The 10-year breakeven inflation rate for the US, for example, declined from 1.7% in June 2019 to 1.1% at the end of April and reached a low of 0.9% in March.

Five-year expected returns in USD terms

Five-year expected returns in USD terms

Five-year expected inflation

Five-year expected inflation

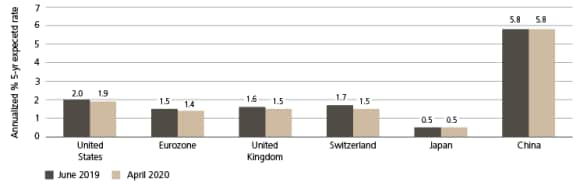

Five-year expected growth

Five-year expected growth

Equities

Equities

Over the last 10 months, there were wide variations in equity returns. The S&P 500 dropped 10.8%, but the Eurozone, UK, and Australia had larger declines (19.9%, 21.7%, and 21.3%, respectively). Japan and Switzerland had smaller declines than the US. The emerging markets dropped 18.2% in USD terms. China was one of the better equity market performers since last June, as their market fell earlier and recovered earlier.

For prospective returns, our 5-year Baseline estimates in local nominal terms have increased with the glaring exception of the US where returns are down slightly. For the US, the prospective valuation improves, but this is exactly offset by a lower inflation rate and growth path. Interestingly with inflation declining, expected real returns have generally increased.

There are some large increases in expected equity returns in USD terms for several regions: Eurozone, UK, China4, and Australia. Most of the gain is through expected currency appreciation, as the dollar has soared in the last 10 months. We expect the large increase in the dollar in the last 10 months to abate and reverse slightly.

Emerging market countries are expected to have the higher return, but this is accompanied by the highest risk as well.

Equity market 5-year expected returns

Equity market 5-year expected returns

June 2019

Market | Market | Local | Local | USD Unh | USD Unh |

|---|---|---|---|---|---|

Market | US Large Cap | Local | 5.1 | USD Unh | 5.1 |

Market | Eurozone | Local | 8.3 | USD Unh | 9.1 |

Market | Switzerland | Local | 7.3 | USD Unh | 7.3 |

Market | United Kingdom | Local | 8.6 | USD Unh | 9.5 |

Market | Japan | Local | 5.7 | USD Unh | 8.3 |

Market | China | Local | 8.2 | USD Unh | 8.0 |

Market | Australia | Local | 8.5 | USD Unh | 8.7 |

Market | Canada | Local | 6.8 | USD Unh | 7.6 |

Market | Global | Local | - | USD Unh | 7.2 |

Market | Developed Markets | Local | - | USD Unh | 6.6 |

Market | Emerging Markets | Local | - | USD Unh | 11.2 |

Market | Dev Mkts x US | Local | - | USD Unh | 8.7 |

Market | Inflation | Local | - | USD Unh | 2.0 |

April 2020

Market | Market | Local | Local | USD Unh | USD Unh |

|---|---|---|---|---|---|

Market | US Large Cap | Local | 4.9 | USD Unh | 4.9 |

Market | Eurozone | Local | 8.6 | USD Unh | 10.5 |

Market | Switzerland | Local | 7.2 | USD Unh | 7.7 |

Market | United Kingdom | Local | 8.7 | USD Unh | 10.6 |

Market | Japan | Local | 5.9 | USD Unh | 8.6 |

Market | China | Local | 11.3 | USD Unh | 11.4 |

Market | Australia | Local | 9.4 | USD Unh | 10.2 |

Market | Canada | Local | 7.0 | USD Unh | 8.5 |

Market | Global | Local | - | USD Unh | 7.5 |

Market | Developed Markets | Local | - | USD Unh | 6.8 |

Market | Emerging Markets | Local | - | USD Unh | 11.8 |

Market | Dev Mkts x US | Local | - | USD Unh | 9.6 |

Market | Inflation | Local | - | USD Unh | 1.4 |

Real returns of Unhedged USD

Market | Market | June 2019 | June 2019 | April 2020 | April 2020 |

|---|---|---|---|---|---|

Market | US Large Cap | June 2019 | 3.1 | April 2020 | 3.5 |

Market | Eurozone | June 2019 | 7.1 | April 2020 | 9.1 |

Market | Switzerland | June 2019 | 5.3 | April 2020 | 6.3 |

Market | United Kingdom | June 2019 | 7.5 | April 2020 | 9.2 |

Market | Japan | June 2019 | 6.3 | April 2020 | 7.2 |

Market | China | June 2019 | 6.0 | April 2020 | 10.0 |

Market | Australia | June 2019 | 6.7 | April 2020 | 8.8 |

Market | Canada | June 2019 | 5.6 | April 2020 | 7.1 |

Market | Global | June 2019 | 5.2 | April 2020 | 6.1 |

Market | Developed Markets | June 2019 | 4.6 | April 2020 | 5.4 |

Market | Emerging Markets | June 2019 | 9.2 | April 2020 | 10.4 |

Market | Dev Mkts x US | June 2019 | 6.7 | April 2020 | 8.2 |

Market | Inflation | June 2019 | - | April 2020 | - |

Fixed income

Fixed income

In the last ten months, government bond yields in the developed markets dropped for most countries. In particular, the US saw its 10-year Treasury yield drop from 2.0% to 0.7% – one of the largest drops – and most other DM nations saw more modest declines. Germany saw only a 0.1% decline in already negative 10-year Bunds and the UK 10-year Gilt dropped 0.5%. Switzerland and Japan recorded slight increases.

In developing our intermediate views we have lowered the path of bond yields in the developed markets in the last ten months. In general, we have lowered them anywhere from 40 bps to 100 basis points.

10-year Government Bond yields and expected changes

10-year Government Bond yields and expected changes

June 2019 baseline

Market | Market | Starting yield | Starting yield | In 5 yrs | In 5 yrs | Rise in yields | Rise in yields |

|---|---|---|---|---|---|---|---|

Market | US | Starting yield | 2.0 | In 5 yrs | 3.1 | Rise in yields | 1.1 |

Market | Australia | Starting yield | 1.3 | In 5 yrs | 2.5 | Rise in yields | 1.2 |

Market | Canada | Starting yield | 1.5 | In 5 yrs | 2.9 | Rise in yields | 1.4 |

Market | Germany | Starting yield | -0.3 | In 5 yrs | 0.9 | Rise in yields | 1.2 |

Market | France | Starting yield | 0.0 | In 5 yrs | 1.2 | Rise in yields | 1.2 |

Market | Italy | Starting yield | 2.1 | In 5 yrs | 2.2 | Rise in yields | 0.1 |

Market | Spain | Starting yield | 0.4 | In 5 yrs | 1.6 | Rise in yields | 1.2 |

Market | Japan | Starting yield | -0.2 | In 5 yrs | 0.4 | Rise in yields | 0.6 |

Market | Switzerland | Starting yield | -0.6 | In 5 yrs | 0.9 | Rise in yields | 1.4 |

Market | UK | Starting yield | 0.8 | In 5 yrs | 2.5 | Rise in yields | 1.7 |

Market | China | Starting yield | 3.2 | In 5 yrs | 3.5 | Rise in yields | 0.3 |

April 2020 baseline

Market | Market | Starting yield | Starting yield | In 5 yrs | In 5 yrs | Rise in yields | Rise in yields |

|---|---|---|---|---|---|---|---|

Market | US | Starting yield | 0.6 | In 5 yrs | 2.0 | Rise in yields | 1.4 |

Market | Australia | Starting yield | 0.9 | In 5 yrs | 1.8 | Rise in yields | 0.9 |

Market | Canada | Starting yield | 0.5 | In 5 yrs | 2.0 | Rise in yields | 1.5 |

Market | Germany | Starting yield | -0.5 | In 5 yrs | 0.5 | Rise in yields | 1.0 |

Market | France | Starting yield | -0.1 | In 5 yrs | 0.8 | Rise in yields | 0.9 |

Market | Italy | Starting yield | 1.8 | In 5 yrs | 2.1 | Rise in yields | 0.3 |

Market | Spain | Starting yield | 0.7 | In 5 yrs | 1.5 | Rise in yields | 0.8 |

Market | Japan | Starting yield | 0.0 | In 5 yrs | 0.4 | Rise in yields | 0.4 |

Market | Switzerland | Starting yield | -0.5 | In 5 yrs | 0.4 | Rise in yields | 0.9 |

Market | UK | Starting yield | 0.2 | In 5 yrs | 1.5 | Rise in yields | 1.3 |

Market | China | Starting yield | 2.5 | In 5 yrs | 3.0 | Rise in yields | 0.5 |

For the US, our expected returns on holding a government bond index for 5-years have fallen the most from 1.0% to -0.7%. Other countries – Switzerland, for example, have expected returns in CHF terms rise from -3.1% to -2.4%.5 Credit spreads narrowed sharply going into the New Year, then widened to recession levels in a period of weeks and now have fallen back. On net, the expected return to investment grade credit has declined, but looks attractive relative to sovereigns.

In the credit markets, both investments grade and high yield credits rallied significantly in April and May, with IG option- adjusted spreads narrowing from 255 to 165 bps and high yield OAS narrowing from 880 to 634 bps. This has produced two month returns of 6.3% for IG bonds and 9.1% for high yield. Consequently, we have updated our estimates of credit returns to reflect the end of May.

Selected bond market returns 5-yr baseline

Selected bond market returns 5-yr baseline

June 2019 Baseline

Government Bonds | Government Bonds | 5yr Local | 5yr Local | 5yr Hdg USD | 5yr Hdg USD |

|---|---|---|---|---|---|

Government Bonds | US Treasuries | 5yr Local | 1.0 | 5yr Hdg USD | 1.0 |

Government Bonds | Australia Gov | 5yr Local | 0.1 | 5yr Hdg USD | 0.8 |

Government Bonds | Canada Gov | 5yr Local | 0.2 | 5yr Hdg USD | 0.5 |

Government Bonds | Eurozone Gov | 5yr Local | -0.8 | 5yr Hdg USD | 1.6 |

Government Bonds | Japan Gov | 5yr Local | -1.0 | 5yr Hdg USD | 1.3 |

Government Bonds | Switzerland Gov | 5yr Local | -3.1 | 5yr Hdg USD | -0.3 |

Government Bonds | United Kingdom Gov | 5yr Local | -2.1 | 5yr Hdg USD | -0.7 |

Government Bonds | Global Government | 5yr Local | -0.2 | 5yr Hdg USD | 1.2 |

Government Bonds | Other Markets | 5yr Local | - | 5yr Hdg USD | - |

Government Bonds | US Corporates | 5yr Local | 1.4 | 5yr Hdg USD | 1.4 |

Government Bonds | US High Yield | 5yr Local | 3.7 | 5yr Hdg USD | 3.7 |

Government Bonds | US TIPS | 5yr Local | 1.5 | 5yr Hdg USD | 1.5 |

Government Bonds | EMD Hard Currency | 5yr Local | 4.5 | 5yr Hdg USD | 4.5 |

April 2020 Baseline

Government Bonds | Government Bonds | 5yr Local | 5yr Local | 5yr Hdg USD | 5yr Hdg USD |

|---|---|---|---|---|---|

Government Bonds | US Treasuries | 5yr Local | -0.7 | 5yr Hdg USD | -0.7 |

Government Bonds | Australia Gov | 5yr Local | 0.0 | 5yr Hdg USD | 0.1 |

Government Bonds | Canada Gov | 5yr Local | -0.8 | 5yr Hdg USD | -1.0 |

Government Bonds | Eurozone Gov | 5yr Local | -0.6 | 5yr Hdg USD | 0.2 |

Government Bonds | Japan Gov | 5yr Local | -0.5 | 5yr Hdg USD | 0.0 |

Government Bonds | Switzerland Gov | 5yr Local | -2.4 | 5yr Hdg USD | -1.4 |

Government Bonds | United Kingdom Gov | 5yr Local | -2.4 | 5yr Hdg USD | -2.5 |

Government Bonds | Global Government | 5yr Local | -0.5 | 5yr Hdg USD | -0.1 |

Government Bonds | Other Markets | 5yr Local | - | 5yr Hdg USD | - |

Government Bonds | US Corporates | 5yr Local | 1.0 | 5yr Hdg USD | 1.01 |

Government Bonds | US High Yield | 5yr Local | 4.2 | 5yr Hdg USD | 4.21 |

Government Bonds | US TIPS | 5yr Local | 0.2 | 5yr Hdg USD | 0.2 |

Government Bonds | EMD Hard Currency | 5yr Local | 7.3 | 5yr Hdg USD | 7.3 |

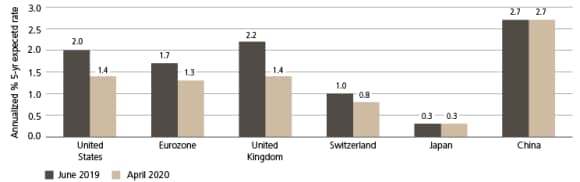

Cash markets

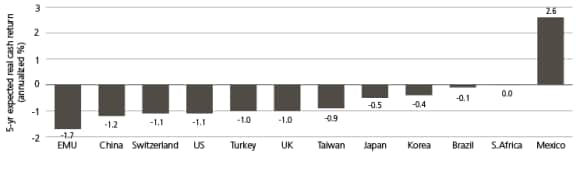

In general, cash rates6 have fallen sharply across the globe in both real and nominal terms in the last ten months, with the biggest drop coming at the end of the period. Countries with some room for them to drop (the US and many emerging markets) saw large declines in 1-month to 3-month yields.

The US 1-month Bill rate dropped from 2.32% to 0.05%--a significant move in this market. The exceptions are Europe and Japan; European bill rates actually rose slightly and Japan's rates dropped only 6 basis points (a relatively large move for Japan).

The emerging markets mirrored the developed and there were sharp declines in markets with already high rates (Brazil, Mexico, South Africa) and more modest declines in markets with limited room for decreases (Korea, Taiwan). Türkiye and Argentina, in particular, had large declines, recovering some from their dismal experiences in 2019.

Five-year expected return from rolling 1-month Treasury Bills

Five-year expected return from rolling 1-month Treasury Bills

Expected 5-yr T-Bills returns

Market | Market | June 2019 | June 2019 | April 2020 | April 2020 |

|---|---|---|---|---|---|

Market | United States | June 2019 | 2.1 | April 2020 | 0.2 |

Market | Eurozone | June 2019 | -0.2 | April 2020 | -0.4 |

Market | China | June 2019 | 2.6 | April 2020 | 1.5 |

Market | United Kingdom | June 2019 | 0.7 | April 2020 | 0.4 |

Market | Japan | June 2019 | 0.0 | April 2020 | -0.2 |

Market | Switzerland | June 2019 | -0.5 | April 2020 | -0.3 |

Market | South Korea | June 2019 | 1.8 | April 2020 | 1.0 |

Market | Taiwan | June 2019 | 1.0 | April 2020 | 0.3 |

Market | Brazil | June 2019 | 5.5 | April 2020 | 3.1 |

Market | Mexico | June 2019 | 7.1 | April 2020 | 5.3 |

Market | South Africa | June 2019 | 6.4 | April 2020 | 4.1 |

Market | Türkiye | June 2019 | 19.6 | April 2020 | 8.5 |

Expected 5-yr inflation

Market | Market | June 2019 | June 2019 | April 2020 | April 2020 |

|---|---|---|---|---|---|

Market | United States | June 2019 | 2.0 | April 2020 | 1.4 |

Market | Eurozone | June 2019 | 1.7 | April 2020 | 1.3 |

Market | China | June 2019 | 2.8 | April 2020 | 2.7 |

Market | United Kingdom | June 2019 | 2.2 | April 2020 | 1.4 |

Market | Japan | June 2019 | 0.3 | April 2020 | 0.3 |

Market | Switzerland | June 2019 | 1.0 | April 2020 | 0.8 |

Market | South Korea | June 2019 | 2.0 | April 2020 | 1.4 |

Market | Taiwan | June 2019 | 1.9 | April 2020 | 1.2 |

Market | Brazil | June 2019 | 4.2 | April 2020 | 3.2 |

Market | Mexico | June 2019 | 3.3 | April 2020 | 2.7 |

Market | South Africa | June 2019 | 4.5 | April 2020 | 4.1 |

Market | Türkiye | June 2019 | 11.5 | April 2020 | 9.5 |

Expected 5-yr real cash returns

Market | Market | June 2019 | June 2019 | April 2020 | April 2020 |

|---|---|---|---|---|---|

Market | United States | June 2019 | 0.1 | April 2020 | -1.2 |

Market | Eurozone | June 2019 | -1.9 | April 2020 | -1.7 |

Market | China | June 2019 | -0.2 | April 2020 | -1.2 |

Market | United Kingdom | June 2019 | -1.5 | April 2020 | -1.0 |

Market | Japan | June 2019 | -0.3 | April 2020 | -0.5 |

Market | Switzerland | June 2019 | -1.5 | April 2020 | -1.1 |

Market | South Korea | June 2019 | -0.2 | April 2020 | -0.4 |

Market | Taiwan | June 2019 | -0.9 | April 2020 | -0.9 |

Market | Brazil | June 2019 | 1.3 | April 2020 | -0.1 |

Market | Mexico | June 2019 | 3.8 | April 2020 | 2.6 |

Market | South Africa | June 2019 | 1.9 | April 2020 | 0.0 |

Market | Türkiye | June 2019 | 8.1 | April 2020 | -1.0 |

We expect real cash rates to be negative for quite a while. Rates will likely stay low as central banks will be reluctant to tighten prematurely.

Another development in the cash markets was a huge increase in risk premiums on the credit side. Libor rates (and other short rates with credit risks) saw increased spreads over government bill rates, but has subsided into April and May.

Five-year expected real cash returns

Five-year expected real cash returns

Source: UBS Asset Management. Data as of 30 April 2020.

Currencies

Currencies

In the past ten months the US dollar rose against almost all currencies with the DXY gaining 3.0%.

Several emerging market countries had substantial currency declines: for example, Argentina (-36%), Brazil (-29%) and South Africa (-23%). Two developed market economies that had large declines were Norway (-17%) and Australia (-7%). The Japanese yen and the Swiss franc ended up with small changes relative to the US dollar, while the euro dropped about 4.0%.

Overall, we view the US dollar as overvalued on a long run basis against the EUR and EM currencies. As a result we expect the USD to decline slightly in the coming years, partly as a result of the flight-to-quality effect wearing off.

In the following table we compare the changes in currency effects from a USD investor's perspective. These estimates are based on purchasing power parity, the relative paths of inflation, and the degree of reversion to fair value. In June of 2019, a USD investor in Eurozone equities or bonds should have expected an additional return of 0.8% per year due to the euro rising in value relative to the dollar. Interest rate differentials were quite large at that point in time, so hedging would have improved expected returns by 2.4%. Since then the dollar appreciated and interest rate differentials narrowed. Consequently, by April 2020, we expect that this same investor now expects their euro investments to appreciate by 1.9%, but hedging 'income' to drop to 0.8%.

We also apply the same methodology when looking at multi- currency baskets such as global equities or global government bonds. For example, a USD investor investing in developed market equities ex US would have expected 1.1% gains per year from foreign currency appreciation in the June 2019 assumptions and this increased to 1.8% in our April 2020 assumptions.

Another effect of the narrowing of interest rate differentials is that hedged impacts are lower. For example, for a global government bond portfolio, the impact of hedging dropped from 1.4% to 0.4%. As can be seen in the chart below, this impact is across the board for this group of major currencies.

Many investors on the wrong side of the hedging proposition have found the high negative income unattractive (for example, Japanese investors who are considering whether to hedge a US real estate portfolio). Now this consideration has narrowed, making hedging more attractive from their perspective.

June 2019 Currency

|

| Unhedged | Unhedged | Hedged | Hedged |

|---|---|---|---|---|---|

| EUR | Unhedged | 0.8 | Hedged | 2.4 |

| GBP | Unhedged | 1.0 | Hedged | 1.4 |

| JPY | Unhedged | 2.6 | Hedged | 2.3 |

| CHF | Unhedged | 0.0 | Hedged | 2.8 |

| CAD | Unhedged | 0.8 | Hedged | 0.3 |

| AUD | Unhedged | 0.3 | Hedged | 0.7 |

| CNY | Unhedged | -0.2 | Hedged | -0.5 |

| Index Baskets | Unhedged | - | Hedged | - |

| Dev Mkt Eq x US | Unhedged | 1.1 | Hedged | 1.9 |

| Global Equity | Unhedged | 0.4 | Hedged | 0.4 |

| Global Eq x US | Unhedged | 0.9 | Hedged | 0.9 |

| EME | Unhedged | 0.2 | Hedged | -1.9 |

| Global Gov | Unhedged | 0.9 | Hedged | 1.4 |

| Global Gov x US | Unhedged | 1.4 | Hedged | 2.2 |

| Global Credit | Unhedged | 0.2 | Hedged | 0.3 |

| EMD Local | Unhedged | 0.3 | Hedged | -2.1 |

April 2020 Currency

|

| Unhedged | Unhedged | Hedged | Hedged |

|---|---|---|---|---|---|

| EUR | Unhedged | 1.9 | Hedged | 0.8 |

| GBP | Unhedged | 1.9 | Hedged | -0.1 |

| JPY | Unhedged | 2.7 | Hedged | 0.6 |

| CHF | Unhedged | 0.5 | Hedged | 1.0 |

| CAD | Unhedged | 1.5 | Hedged | -0.2 |

| AUD | Unhedged | 0.8 | Hedged | 0.2 |

| CNY | Unhedged | 0.0 | Hedged | -1.3 |

| Index Baskets | Unhedged | - | Hedged | - |

| Dev Mkt Eq x US | Unhedged | 1.8 | Hedged | 0.4 |

| Global Equity | Unhedged | 0.7 | Hedged | -0.1 |

| Global Eq x US | Unhedged | 1.5 | Hedged | -0.2 |

| EME | Unhedged | 0.7 | Hedged | -2.0 |

| Global Gov | Unhedged | 1.4 | Hedged | 0.4 |

| Global Gov x US | Unhedged | 2.1 | Hedged | 0.6 |

| Global Credit | Unhedged | 0.4 | Hedged | 0.0 |

| EMD Local | Unhedged | 1.3 | Hedged | -2.9 |

Alternatives

Alternatives

The prospects for real estate are highly uncertain. Some segments suddenly have a questionable future—is there a permanent hit to malls and central business district office buildings? We expect a lot of turnover and adjustment, but potential for great opportunities exist as well. We projected a relatively low return for real estate in 2019 (4.9%) and see little rationale for returns to be much higher, though we expect the dispersion of returns across funds to be higher.

We have updated our methodology for hedge funds and will use some factor adjustments to the returns. We would expect that with better valuation and an increased opportunity set, the expected hedge fund alpha has increased, though financing constraints may limit the scalability of opportunities. Although these returns appear to be low, they are net-of-fees and provide a fairly high premium over cash interest rates and should beat most bond markets (with the exception of high yield). Even with these low returns, if hedge funds can provide low correlation with other asset classes, they can play important roles in moderate and low risk portfolios.

In private equity, we expect a large discrepancy by vintage year. Vintages in the 2017 to 2019 years should start to see significant write-downs of NAVs over the next three quarters along with lower than expected distributions; however, vintages starting in 2020 are investing in a brighter market environment. Distressed debt investing and buy-out funds suddenly have a plethora of opportunities and could do quite well.

Alternatives: 5-yr expected returns in USD terms

|

| June 2019 | June 2019 | April 2020 | April 2020 |

|---|---|---|---|---|---|

| US Real Estate (unlevered) | June 2019 | 4.9 | April 2020 | 4.8 |

| Hedge Funds (Low Vol) | June 2019 | 3.9 | April 2020 | 3.5 |

| Hedge Funds (High Vol) | June 2019 | 4.5 | April 2020 | 4.0 |

| US Private Equity | June 2019 | 7.7 | April 2020 | 7.5 |

| Global Private Equity (unhedged) | June 2019 | 9.1 | April 2020 | 9.0 |