Digital transformation: robots in the theatre

The health care sector is seeing a digital transformation, and robotic-assisted surgery is a key growth area.

- We believe robotic-assisted surgery is the next area of surgical innovation and digital transformation;

- Robotic surgery offers massive benefits, like enhanced operation precision, yet the sector is vastly under-penetrated;

- But it is growing from a low base, with major increases in usage in the United States;

- We see good investment opportunities within the sector.

Dr Pier Cristoforo Giulianotti is a professor of surgery at the University of Illinois College of Medicine.

In a recent profile by The New Yorker, Professor Giulianotti remembers that he attended a conference in Germany in 1999, sponsored by Johnson & Johnson, where the company demonstrated a prototype of a robotic arm for use in performing surgery.

Johnson & Johnson shelved the project, but Professor Giulianotti says “I knew” – and he was galvanized by the concept.

Fast forward 20 years… Professor Giulianotti now runs a program in robotic-assisted surgery at the University of Illinois College of Medicine.

At the age of sixty-six, he has now performed roughly three thousand procedures with the aid of a robot, and has helped train nearly two thousand surgeons in the art.

Robotic-assisted surgery is the next area of surgical innovation

Robotic-assisted surgery is the next area of surgical innovation

Robotic-assisted minimally invasive surgery offers new approaches that could meaningfully affect patient outcomes.

The digital transformation of surgical procedures from humans to robotics has the potential to lead to huge advancements in addressing various pathogens including lung cancer diagnostics/treatment through extending the reach of minimally invasive biopsies.

According to a leading company in this space, 70% of nodules in the lungs are generally far out in the peripheral lungs.

Massive benefits yet vastly under-penetrated

Massive benefits yet vastly under-penetrated

What convinced Pr Giulianotti twenty years ago is gradually convincing the rest of the profession:

- The ability to cut and suture in deep, tight locations in the body.

Robots have thin rods instead of bulky hands, and—in contrast to conventional or laparoscopic surgery—the rods never tremble.

- Robotic instruments are more flexible than a human wrist.

Robotic instruments can rotate three hundred and sixty degrees. In comparison, laparoscopic tools, which are hand-held and enter the body via small cuts, have a limited range of motion and can be awkward to use. For example, when the tip of a laparoscopic tool is deep inside a patient’s body, it can be hard to exert leverage precisely, and the tiniest movement of the surgeon’s hand can lead to a major mistake.

- Robotic cameras give a full three-dimensional picture of the body

Whereas most laparoscopic probes show a two-dimensional image, the surgeon looks at the footage through a stereoscopic viewer that is attached to the console and sees a full three-dimensional picture of the body.

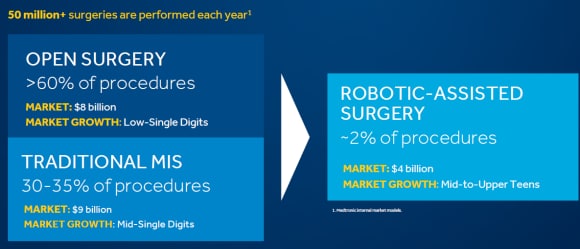

According to a leading company in the industry, the market for robotic-assisted-surgery is underpenetrated owing to significant upfront cost and utilization barriers (set up time, system size…).

But robotic-assisted-surgery may lead to fewer complications, faster recovery with shorter hospital stays, and cheaper surgery costs.

These factors, combined with increasing training and partnerships with hospitals, should accelerate their adoption in the future.

Digitally-enabled tools allow a surgeon to plan, visualize and execute surgical plans with greater precision and lower patient disruption than with conventional surgery.

Leading technology in the space is driving growth in rapid robotic assisted procedures, with general surgery procedures leading the charge.

We believe that leading companies in the space may benefit from long term installed-base growth, procedure volume recovery in developed markets, and expansion of the total addressable market, driven by major product cycles that enable new surgical procedures (radical tonsillectomy and pulmonary biopsies).

The battle of the 'bots is starting…

The battle of the 'bots is starting…

And robotic-assisted surgery may be going mainstream.

An analysis by the Journal of the American Medical Association (JAMA) 1 published in early 2020 suggested that as many as 15% of general surgeries were performed with the help of a robot, rising from roughly 2% over the course of six years.

"The rising investment in the sector will continue to boost both awareness of the technology and the numbers of surgeons trained on robotic surgery platforms," EY said in a recent industry report.

And in the meantime, "intensifying competition will bring down the costs associated with robotic surgery", paving the way for wider adoption.

So this is another area of digital transformation where we see major potential for growth in the future. Contact us to learn more about digital transformation trends and investment strategies.