Digital transformation: think beyond the tech mega caps

2020 has seen the world’s largest tech companies get bigger and the global digital transformation grow wider, but what does the future have in store?

Uwe Rohrig, Senior Equity Specialist, and Alexis Freyeisen, CFA, Equity Specialist, led a detailed webinar looking to at digital transformations and their investing strategy. Here is the full webinar write-up, including an extensive Q&A section.

Key takeaways

Key takeaways

- Digital transformation is here to stay;

- Companies operating in the space have some very interesting growth opportunities but investors must remain selective;

- Many interesting opportunities exist beyond the well-known mega-cap companies operating in the US.

Think beyond the technology sector

Uwe Rohrig, Senior Equity Specialist

Digitization is rapidly changing our daily lives.

Take music for example. I grew up collecting records, then the Walkman came, then I was very proud to have an iPod, and now music is all about streaming.

But digitization is not just about streaming films or music, it is much broader than that.

Think about remote working, home schooling, online shopping, online banking and, increasingly telemedicine. Digitization is a huge topic, and we believe that means investors need to think beyond the technology sector and look at the many different areas being impacted by it.

Speed and reach of user acceptance is massively accelerating

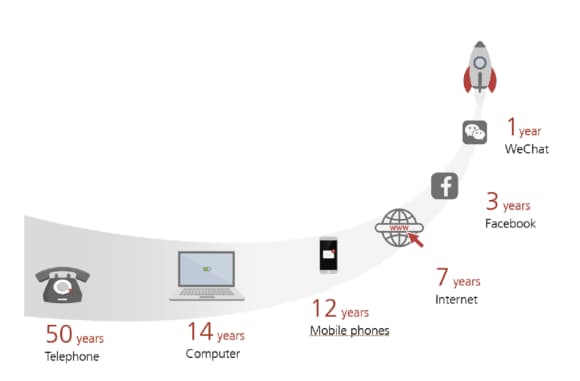

It took 50 years for the number of telephone users to reach 50 million, but it took only one year for Wechat, a social media app run by Tencent, to reach the same number of users.

How long to reach 50 million users?

How long to reach 50 million users?

As we look across the world, the Covid-19 pandemic has accelerated the take-up of digital technology and this is creating an explosion in the amount of digital data being produced.

Increased data volume opens the door to interesting areas. For example, massive data volumes require storage capacity, which is driving the growth of cloud computing.

Furthermore, huge data volumes require computing power, thus driving demand for more powerful computer chips and also creating space for artificial intelligence and big data to deliver applications to thoughtfully process and analyse the data volume.

Digital transformation is not equally distributed across industries

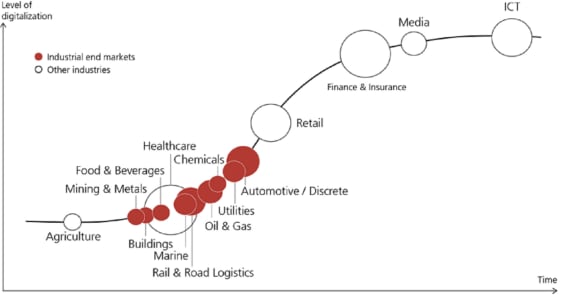

In sectors like technology, media, finance and (increasingly) retail, digitization is already widely used.

However, sectors like industrials and health care are relatively underdeveloped from a digital standpoint, we expect more digital applications to emerge in these spaces in the coming years.

Digitization across industries

Digitization across industries

Six compelling digital transformation investment themes

But what do we do with all of these observations? We go multi-thematic, and we are focused on six themes which we think offer the most compelling opportunities right now:

- Digital data

- Enabling technologies

- E-commerce

- Security and safety

- Healthtech

- Fintech

Looking more specifically, we think three areas will be especially important for investors in 2021.

#1 5G+

Following the 2020 launch of Apple’s first 5G phone, the iPhone 12, we expect a wave of interest in 5G technology and its potential applications, a trend likely to persist for at least the next decade.

#2 Fintech

The pandemic has triggered a dramatic shift toward contactless and mobile payments, and e-commerce. Improvements in customer acquisition are allowing fintech firms to cross-sell across different products and services.

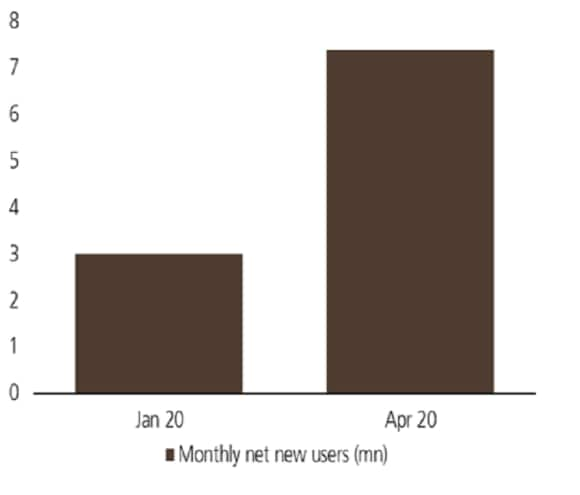

User data for a leading US payment company (Millions), Jan 2020 vs Apr 2020

User data for a leading US payment company (Millions), Jan 2020 vs Apr 2020

#3 Healthtech

We have seen increased patient focus on health outcomes and reduced people’s ability to access care and governments’ capacity to pay for that care. We think healthtech will play a critical role in improving the efficiency and quality of healthcare.

Think beyond mega caps

Much press attention gets focused on the big names in the tech space, but we believe investors need to look across the whole spectrum of companies in the market.

In nearly all sectors like tech hardware, software and e-commerce there are two or three leading companies, but there are very interesting names in the second and third row and in small and mid cap spaces.

In closing, we believe investors need to remember that digital transformation is here to stay, and that companies operating in the space have some very interesting growth opportunities but investors must remain selective, and that many of those opportunities exist beyond the mega cap companies operating in the US.

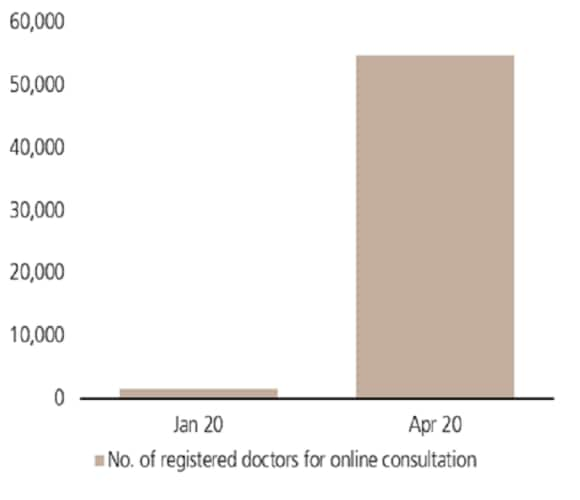

Registered doctors on a leading telemedicine platform in China, Jan 2020 vs Apr 2020

Registered doctors on a leading telemedicine platform in China, Jan 2020 vs Apr 2020

Capturing digital transformation opportunities

Alexis Freyeisen, CFA, Equity Specialist

Capturing opportunities arising from the global digital transformation requires a presence in the US and China - the two main global innovation hotspots.

The key team members within the Digital Transformation strategy have long experience and boots on the ground in these locations, plus access to specialist teams across the globe - like the Emerging Markets Equities team - to drive idea generation.

The strategy looks to invest across stages of development and digitization, essentially seeking multiple sources of growth to make the portfolio more balanced than say a pure tech or pure healthtech fund.

Three kinds of companies are in scope:

1. Early stage companies

We classify early stage or ‘elite’ companies as those that have high growth potential. They don’t necessarily have to be early stage either.

For instance, some of the well-known tech and tutoring firms in China would come into this category as they continue to deliver high revenue growth and still have a large addressable market to tap in to.

An example of an early-stage company would be a digital advertising disruptor that offers a tech platform for companies and agencies to bid for digital advertising space outside of Facebook and Google.

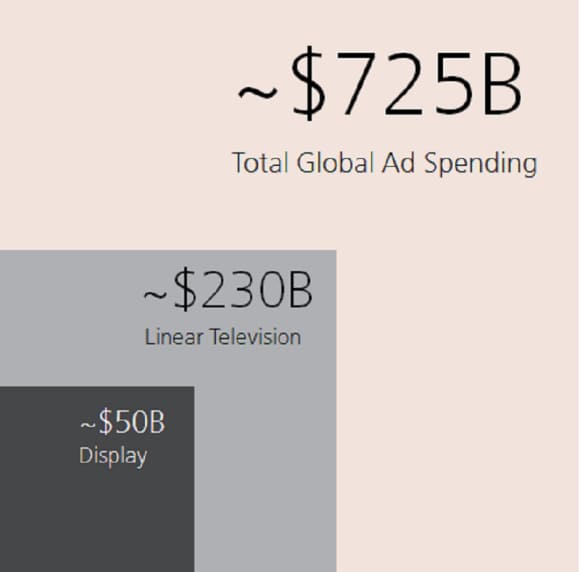

The company’s strength is in the delivery of an algorithmic trading exchange offering users auctions for digital ad space. This capability offers the company a route into a global ad market estimated at USD 725 billion.

Global ad spending, 2019

Global ad spending, 2019

2. Mature companies

Mature companies are seeing/or will likely see renewed growth by embracing digital transformation.

For instance, two companies falling into this category would be one of the world’s largest entertainment firms and a major global sports company who have recently switched to more direct to customers models, streaming services and e-commerce, respectively.

In the case of the entertainment firm, we have seen how it has built a direct-to-consumer video streaming service to leverage its huge range of existing content. This digital transformation has been a hit with investors and consumers, driven a huge increase in subscribers during the past year.

3. Enabler companies

Enabler companies either benefit from and/or deliver the technologies for the digital transformation we have seen all around us.

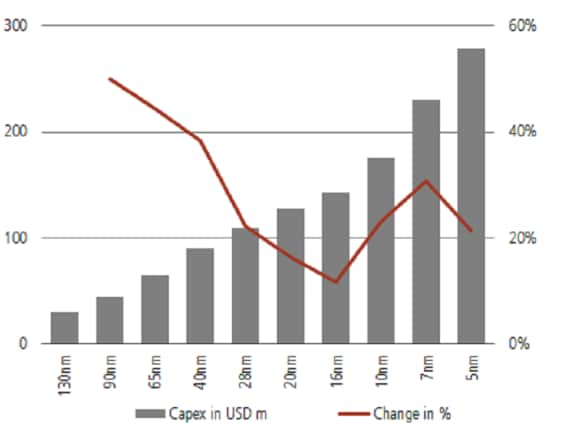

Companies that fit this profile include the major semiconductor chip manufacturers, many of whom will benefit as growth in the IoT, 5G, AI require leading edge chips.

Capex spending required for semiconductor wafer technology

Capex spending required for semiconductor wafer technology

How to buy these companies? We begin by asking ourselves two fundamental questions.

What do we mean by good company? We consider a company to be good when it possesses distinctive competitive resources – technology, strategic position, brand equity, culture – that enable it to earn outsized returns. Importantly, ESG forms an integral part of the investment process and is key to identifying superior companies.

What about good price? We use a Discounted Cash Flow model which we reverse engineer to see what slope and or duration of growth is priced in by the market. We also run scenario analyses (base, bull, bear) and compare that to what the market is pricing.

Bringing it all together, the strategy aims to derive alpha from diversified sources of growth. Specifically, by identifying ‘elite’ growth sources where the market has underestimated the duration or magnitude of the opportunity and offsetting these selections in our barbel with renewed growth and enabler companies.

Looking at the current positioning of the strategy, two key elements stand out: firstly, broad exposure across all six themes described earlier and, secondly, significant exposure to potential future disruptors, who we define as being less than USD 50bn in terms of market capitalization (although this is a loose definition).

The next big thing…….

When we think about the next big thing in the digital transformation space, we think it could potentially be healthtech.

The health care sector has traditionally been slow to adopt new digital technologies.

However, with rising costs, abundance of data, improving data analysis, and expanding connectivity, we are seeing faster adoption and growth a number of areas.

- The delivery of care is being transformed and has much further to go. Telemedicine is seeing rapid adoption, due to ease of use, employee incentives, and insurance coverage.

- Genomic medicine is opening new horizons. Genomic sequencing or editing technology enable the modification of the building blocks of life, promising new drugs for a range of diseases.

For instance, the recently developed vaccine for the Covid-19 virus uses the genome sequence to design a molecule called messenger RNA. This molecule when injected into cells instructs them to make Sars-Cov2 spike protein, which the virus normally uses to invade cells.

This in turn induces an immune response from the body. This is a novel vaccine technology, as opposed to conventional ones that contain an inactivated or weakened version, or yet a piece of the virus - Finally, robotic-assisted surgery is a key area to watch. We believe minimal invasive procedures from robotic surgery, coupled with increased precision, will likely see strong take-up from both patients and health care services companies in the future.

New augmented reality capabilities improve the surgeon’s ability to manage the surgical field in ways that was the stuff of science fiction just a few years ago.

Embrace the digital future

In summary, the Digital Transformation strategy invests in enduring themes that have a long shelf life, rather than just the latest short-term fad.

The strategy aims to be more than a simple tech investing solution focused on the FAANGS and has a broader exposure to non-tech sectors and also to smaller companies that have the potential to be future disrupters.

Given all that we have discussed today, we believe that the digital transformation themes we have explored still have much more room to run and that the biggest changes are yet to come, so we’d encourage investors to embrace the digital future and think seriously about investing in this space now.

UBS Digital Transformation offering is long term in nature, and is an oriented strategy that we believe will increasingly gain importance in overall asset allocation, migrating from satellite to more core, and potentially replacing ETF or US/Global equity allocations.

Q&A

Q&A