China multi-asset investing - why?

What are the benefits of a China multi-asset strategy and how does it help investors? Gian Plebani, Portfolio Manager, Investment Solutions, explains in a one-minute video.

China's complex universe

China's complex universe

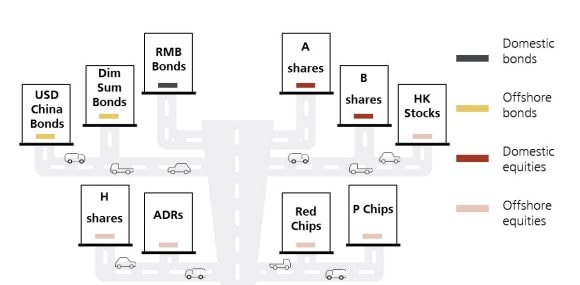

China has a complex and diversified investment universe.

On the equity side, there are onshore stocks like A and B shares, and all sorts of offshore stocks like H shares and ADRs.

On the bond side there is similar complexity between onshore and offshore markets and currency denominations.

Learn all about China equities and the different types in China A-shares: FAQS, facts and figures here:

A one-stop China multi-asset investing approach

A one-stop China multi-asset investing approach

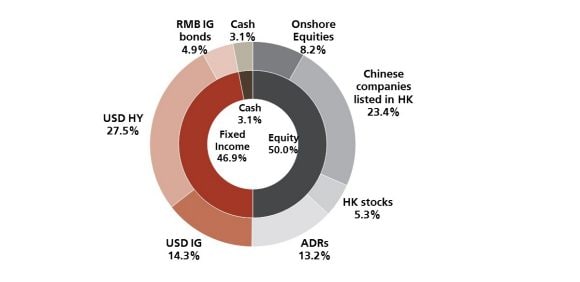

Therefore we have built a one-stop multi-asset solution for China investors where you get access to China's growth potential through equity investments and get income through investments in bonds.

Our unique multi-asset approach maintains a good balance between equities, bonds, cash, as well as between onshore and offshore investments.

In a neutral environment, we allocate 50% to equities and 50% to bonds, while 10% of each of those equity and bond allocations will be to onshore assets.

Get the most recent strategy update from the China multi-asset team here:

China multi asset, but with an active allocation style

China multi asset, but with an active allocation style

We apply, however, an active allocation style.

We can move approximately 35% and 65% in equities and bonds, we can also divest up to 30% into cash in a negative market environment.

The maximum allocation to RMB is 50% of the portfolio while the base currency is in US dollars.

What does a China multi-asset strategy look like?

What does a China multi-asset strategy look like?

Here is our asset allocation before a very successful year in 2019.

Who manages the China multi-asset strategy?

Who manages the China multi-asset strategy?

China Allocation Opportunity, our China multi-asset investing strategy, is managed by Gian Plebani, Portfolio Manager, Investment Solutions, and supported by a team including Rob Worthington, Global Head of Investment Specialists, and Kenly Wong, Investment Specialist.