China Translated – March 2020

China Translated explains what's happening in China both on the ground and in the markets.

As coronavirus becomes a global challenge, investors are looking for a policy response. Looking at what's happening on-the-ground in China, we can see the Chinese government has been a first-mover, and that has major implications for both the Chinese economy and high-yield fixed income investors.

Key takeaways:

Key takeaways:

- China's government has been a first mover and unleashed a wave of policy support measures in February and March;

- Funding channels have been opened so credit gets into the economy, and quickly;

- Default risks have subsided in China, just as they have risen elsewhere around the world;

- China and Asian high yield bonds offer an attractive option to investors in a world starved of yield.

China rapidly loosened policy in February

China rapidly loosened policy in February

The People's Bank of China, China's central bank, put RMB 1.2trn (USD120bn) into money markets on February 3rd – the biggest daily move on record – and added another RMB 400bn (USD 57.5bn) on February 4th. On top of this, China's central bank also cut rates for commercial banks, companies, and households through February.

Further support followed in March

Further support followed in March

Moving into March, China's government also opened funding channels so credit

gets into the economy, and quickly.

China's government also opened funding channels so credit gets into the economy, and quickly.

Here are four measures:

- Supporting local government financing vehicles (LGFVs): local governments manage LGFVS, which invest in local-level projects, like infrastructure and property development. LGFVs faced big repayments in 2020 and 2021, so the government has allowed them to extend repayments and issue new debt before the end of March.

- Allowing shadow banking channels to open: China's regulators have allowed shadow banking channels, like trust financing companies, back into operation to boost lending.

- Easing controls on property developers: by removing caps and relaxing the 1-year minimum tenors on bond issues, particularly for Chinese developers domiciled in Hong Kong.

- Assisting small businesses: small- and medium-sized businesses can now delay loan payments until July and have can use RMB 500bn (USD 71.9bn) of new financing facilities.

As global risks have gone up, default risk in China has subsided

As global risks have gone up, default risk in China has subsided

China's economy still faces many challenges and we expect weak official statistics for 1Q20.

However, we believe the government moves described above indicate a big reduction in default risks in China, and potentially for the next twelve months.

That's different to the rest of the world right now, where the initial economic effects of the coronavirus outbreak are starting to be felt and where default risks appear to be rising.

Where to find yield & income in a world of negative yields?

Where to find yield & income in a world of negative yields?

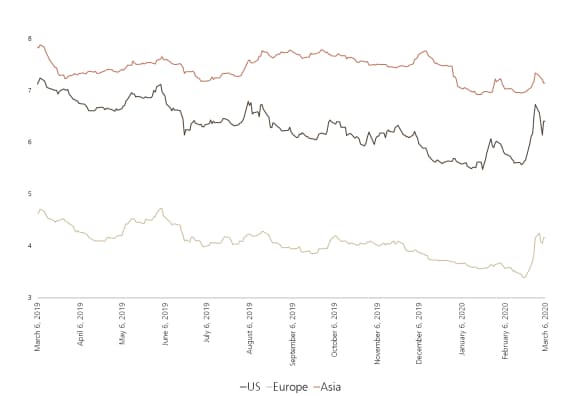

So for investors struggling in a world of not just low yields but also a huge USD 14trn of negative yielding debt, we feel that the Asian high yield market currently looks attractive.

We believe the strong relative value on offer compared to US and European high yield, make for an attractive solution for yield-and-income hungry investors right now.

For investors struggling in a world of not just low yields but also a huge USD 14trn of negative yielding debt, we feel that the Asian high yield market currently looks attractive.

High Yield Markets Compared (YTW): Asia, US and Europe, Mar 6, 2019-Mar 6, 2020

High Yield Markets Compared (YTW): Asia, US and Europe, Mar 6, 2019-Mar 6, 2020

Key investor takeaways:

Key investor takeaways:

- China's government has been a first mover and unleashed a wave of policy support measures in February and March;

- Funding channels have been opened so credit gets into the economy, and quickly;

- Default risks have subsided in China, just as they have risen elsewhere around the world;

- China and Asian high yield bonds offer an attractive option to investors in a world starved of yield.