Fourth Quarter 2020

O'Connor CIO Letter

With the books closed on 2020, O’Connor is focused on building on the momentum of our market-leading performance relative to our multi-strategy peer group in the year ahead.

With the books closed on 2020, O’Connor is focused on building on the momentum of our market-leading performance relative to our multi-strategy peer group1 in the year ahead.

In many respects, we are more excited about the prospects for the new year as we believe that our multi-strategy arrangement is well positioned to benefit from structural alpha opportunities emanating from powerful trends in the financial markets, global economy, and changing investor capital allocations. And after more than a decade of a singular market cycle characterized by low economic growth and correspondingly low interest rates, pending fiscal stimulus coupled with the complexities of the global economy transitioning from COVID-19 may create a wider array of potential outcomes within the global interest rate, credit, and equity markets. This combination of strong capital allocations and a market environment likely to be characterized by elevated but not extreme volatility, with returns being driven more by relative value disciplines and rotations than beta, has us decidedly upbeat about 2021.

Although we operate a multi-strategy, relative value approach to investing, we are always mindful of the macroeconomic landscape and pay close attention to broader capital markets and investor trends in our capital allocation process and strategy development. This broader lens for our investment process is not to make first order, directional risk allocations to different asset classes, but rather to assess what areas of the market are most likely to experience a high level of dispersion of securities' performance, which at its most fundamental level is the core driver of our returns.

While we are confident in our investment teams and their differentiated approaches' ability to drive alpha, we believe that some of these broader economic and capital markets trends can give our investors an extra return boost if we are able to correctly align our capital with the secular alpha tailwinds present in the market. Additionally, investors know well that a market environment characterized by elevated but not extreme volatility, where returns are driven by idiosyncratic, thematic, sector, and factor risk rather than beta, is the most conducive environment to our strategies delivering strong risk-adjusted returns.

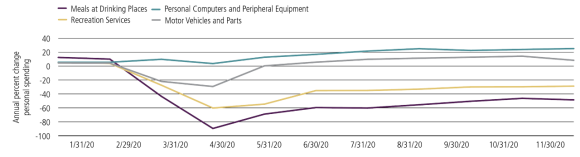

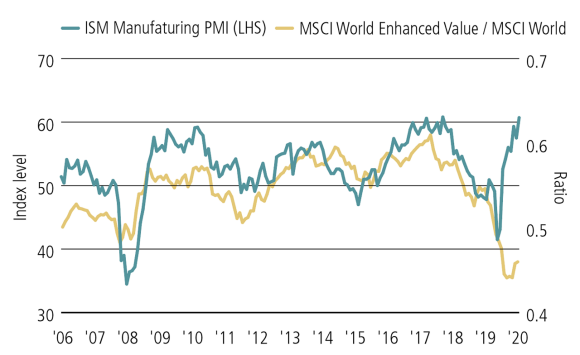

When we think about the macroeconomic outlook for 2021, we see a fairly broad range of potential outcomes as the markets grapple with the interplay between accommodative monetary policy, ongoing fiscal expansion, and the challenge of the global economy accelerating out of the COVID-19 contraction. There are some virtual certainties now as consumer spending will inevitably shift toward services and experiences and away from technology and durable goods while accelerating economic activity favors reflationary trades like value outperforming other factors and interest rate curves steepening.

Figure 1: Spending strength to shift from goods to services in 2021

Figure 1: Spending strength to shift from goods to services in 2021

Figure 2: Ample room for value stocks to catch up to rebound in manufacturing activity

Figure 2: Ample room for value stocks to catch up to rebound in manufacturing activity

Figure 2a: Value stocks trade at discount to growth not seen since dot-com bubble

Figure 2a: Value stocks trade at discount to growth not seen since dot-com bubble

However, we believe that financial markets often discount economic changes before they actually occur, so we see a lot of the early cycle economic activity already discounted by the market. Also, while the conventional wisdom is that growth companies will underperform this rotation toward value in an expected reflationary environment, the secular trends that have underpinned the growth of many of these companies ranging from green technology, to ecommerce, and biotechnology are only accelerating, leaving scope for ongoing outperformance from many of these secular winners.

Put together, we see a market that will require vigilance and dynamism in managing factor and thematic risk as the monolithic low interest rate - low economic growth - underweight value - overweight growth era seems largely like a relic of the past.

Aligning O'Connor's strategy with six mega trends

Aligning O'Connor's strategy with six mega trends

While we are confident that this broader economic environment will prove favorable for our strategies, we believe our multi-strategy arrangement is positioned to benefit from six mega trends within the financial markets which should continue to drive baseline returns higher as we capitalize on these secular alpha opportunities. As these will all be familiar trends that we have addressed in prior letters, we will not go into great detail and instead just highlight why we think these trends will persist and create a structural alpha tailwind across a number of our strategies.

The first mega trend is the asymmetry in the size of the US credit markets relative to the amount of dynamic capital deployed by banks and hedge funds. While investors know that US corporate credit issuance in 2020 increased by 56%, 42%, and 91% in investment grade, high yield, and convertibles respectively relative to 2019 {Source Bloomberg LEAG function}, fewer are aware that there has not been a commensurate increase in dynamic risk capital in credit from banks and hedge funds, creating ample relative value opportunities. The broader economic backdrop makes these opportunities even more compelling. The severity of economic conditions during COVID-19, coupled with the vaccine outlook and potential economic acceleration out of the crisis, is causing companies to actively manage their businesses and capital structures, which often is the catalyst for convergence in relative value positions. The actions emanating from this active management ranging from issuance, to optimization, and to liability management are rooted in fundamental corporate financial discipline and securities valuations which are the core tenets of our credit relative value approach.

The second mega trend is the growth and drive toward efficiency in the Chinese equity markets. While everyone understands the size, growth, and dynamism of the Chinese economy, far fewer appreciate the magnitude of global investors' underweight exposure to China and the dramatic steps that regulators are making to attract international capital. Specifically, the recent QFII and RQFII will enable direct trading with local broker/dealers and create an onshore stock borrow market in A-shares. We believe this will spark a golden age of sorts in relative value equity investing in China over the next several years as managers like us will be able to implement the full complement of equity strategies, deriving alpha on both the long and short side and dynamically managing beta, sector, factor, thematic, and idiosyncratic risk.

The third mega trend is environmentally focused investing. Climate change has taken center stage in public policy debates globally, and environmental issues have become top of mind for many investors. Changing consumer preferences, rapidly evolving regulatory policy, and required shifts and increases in capex will drive sustained dispersion in performance of companies involved in the energy transition economy. Our view is that investors are underestimating the complexity of this transition and are overlooking many of the materials, processes, and technologies that will enable this transition. We believe that investors who focus on this theme, and employ deep industry experience, policy, technological expertise, in coordination with a robust corporate finance framework can look forward to a sustained alpha opportunity for the next decade.

The fourth mega trend is the rampant growth of Special Purpose Acquisition Companies (SPACs). While it has become fashionable to critique SPACs as a capital markets distortion and dismiss them as a passing fad, we believe SPACs will continue to play a significant role in the capital markets. In 2020, 237 SPACs priced, raising almost USD 80 bn in capital and surpassing traditional IPOs at USD 67 bn2. And, while almost every investor can and usually does try to invest in IPOs, only a fraction of global investors have the capacity or willingness to invest in a SPAC or in the Private Investment in Public Equity (PIPE) offering that often accompanies a SPAC merger announcement. Investors like ourselves, who have the ability to invest up and down the SPAC ecosystem ranging from SPACs, warrants, deSPAC'd equities, PIPEs, and sponsor equity, while performing strong investment diligence and managing liquidity, may capitalize on sustained inefficiencies in the SPAC market. For investors who think the market will inevitably move past the SPAC phenomenon, we would caution that both companies and investors are seeing substantial advantages in the SPAC market relative to the traditional IPO process.

Figure 3: SPACs have some advantages over IPOs

Type of Risk | Type of Risk | Advantage | Advantage | SPAC | SPAC | Advantage | Advantage | IPO | IPO |

|---|---|---|---|---|---|---|---|---|---|

Type of Risk | Timing | Advantage | ✓ | SPAC | End to end process less than six months | Advantage | X | IPO | Often more than a year |

Type of Risk | Proceeds | Advantage | = | SPAC | Historically the primary risk given uncertainty of the trust but significantly mitigated with advent of PIPE | Advantage | = | IPO | Typically considered the key benefit of a traditional IPO |

Type of Risk | Execution | Advantage | ✓ | SPAC | Significant advantage – after the PIPE process you know one way or another if it’s going to work | Advantage | X | IPO | Big issue particularly for early stage growth companies – you could pursue for a year before you know whether it will work |

Type of Risk | Holders | Advantage | = | SPAC | PIPE investors can be hand selected and often include strategic partners. Investors via the trust are often not long term holders | Advantage | = | IPO | Issuing banks and sponsor can shape the book of holders, but it is often more a function of relationships with the banks than partnership with the emerging company |

Type of Risk | Pricing | Advantage | ✓ | SPAC | Once the PIPE is raised you have a very high degree of price certainty. Institutional investor validation of pricing prior to announcement | Advantage | X | IPO | Well known traditional IPO risk – you really don’t know where you’ll land until day of pricing at which point you’re under tremendous pressure to accept the outcome |

Type of Risk | Projections | Advantage | ✓ | SPAC | Given it’s a merger, substantial flexibility on forward looking projections | Advantage | X | IPO | Limited ability to show forecasts |

The fifth mega trend is the disintermediation of banks as hedge funds and asset managers extend credit directly to borrowers. Particularly in the case of riskier and more complex loans, banks are not willing and able lenders in many cases. This offers one of the most attractive, risk-adjusted yield and total return profiles available in the financial markets for private credit investors. With limitations on banks' structured lending emanating from statutory regulation, central bank supervision, and shareholder preferences, we believe this disintermediation will continue, making private credit one of the most compelling capital allocation opportunities for investors who can manage lower liquidity.

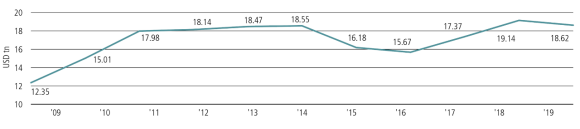

The sixth and final mega trend is the migration of supply chain finance from bank and corporate balance sheets to investors. With estimates of financing needs at USD 7.5 trillion globally and the operational and accounting complexities of investing in trade finance, a persistent supply/demand imbalance makes the risk/reward profile of investing in corporate credit via this asset class compelling. We see better yields, shorter durations, lower default probabilities, and higher recoveries in trade finance when compared to corporate bonds, leading to a compelling relative value opportunity on a sustained basis. While we see this market ultimately developing a comprehensive securitization solution as we have seen in the ABS and MBS market, the time between now and that eventuality provides a compelling window of opportunity for investors.

Figure 4: Global merchandise trade value

Figure 4: Global merchandise trade value

Alpha over beta in 2021

Alpha over beta in 2021

Having just watched the inauguration of President Biden, it seems that a bit more stability is in store for the US political landscape. Additionally, the timeline of vaccine rollouts, while bumpy, seems to set the stage for the beginning of a new economic cycle. However, as is often the case, asset prices have significantly adjusted to reflect these changes before they actually occur, creating a market backdrop where we believe volatility will remain elevated but not extreme and returns will be driven by idiosyncratic, thematic, and sector risk as opposed to beta.

As of now, we are happy to again confirm that none of the O'Connor investment team has tested positive for COVID-19, and we continue to operate effectively both on a remote basis and in several of our offices around the world. We are all excited to return to the office en masse later this year, but we continue to follow the UBS approach of being cautious and prioritizing employee health and safety, particularly in light of the stable technology platform and control environment being delivered by our colleagues across UBS Asset Management.

After our success managing risk and being dynamic with capital in 2020, we find ourselves confident that 2021 will be another strong year for our strategies. Now, more so than any other time in our recent history, we believe that we have our capital allocated to strategies that leverage not just the traditional forms of investment and cyclical alpha, but also structural alpha emanating from the trends discussed above. While both the returns and volatility likely will moderate from the levels experienced in 2020, we believe our absolute return strategy will provide both stability and significant uncorrelated returns for investor portfolios.

We hope you are all well and healthy and imagine that you are as excited about 2021 as we are here at O'Connor.

Thank you for your support and trust in us,

Kevin Russell