China equities: A five-step guide for 2020

Trade tensions and fears of a sharper growth slowdown have dominated the backdrop for Chinese equities in 2019. How should investors approach investing in China in 2020?

Bin Shi, Head of China Equities

Let's look forward to 2020 by first looking back at 2019.

Let's look forward to 2020 by first looking back at 2019.

Volatility has been constant, trade tensions dominant and slowdown fears prevalent. This is important to bear in mind as we move into 2020 as these three factors are still on the horizon. The key for investors is how to handle them.

Embrace volatility

Embrace volatility

Rivalry between the US and China will likely continue. That's because China's increasingly important role in the global economy will continue to be a challenge for the US.

In our view, that means noise from this evolving relationship and market volatility will continue.

But volatility isn't new in China's retail investor-driven markets, and if investors were put off by this in the past, they would have missed many opportunities.

The trick is how to embrace volatility and turn it to an advantage.

We embrace volatility by ignoring noise and investing actively in what we see as quality companies during periods of mispricing.

Accept slower topline growth in China

Accept slower topline growth in China

On a related note, investing in China requires adjusting to realities, particularly around China's economy.

If you google 'China,' 'growth,' 'slowdown,' 'fears,' and 'recession,' you'll discover thousands of doom-laden articles about the outlook for China.

In part, these outlooks are true, but we don't mind. In fact, we welcome a slower growth outlook for China.

That's because China's economy is slowing as it moves to more sustainable growth driven by domestic demand and services.

So we're not scared off by slower growth. In fact, it has been a reality for years, and we have still been able to invest successfully in the past by focusing on what matters.

Focus on what matters

Focus on what matters

What really matters for long-term investors is how to allocate to long-term drivers for China.

For us, the answer is domestic growth, and that's been the key story of the past few years.

For all that trade fears dominate news flow, domestic demand now drives China's economy – and that's been a decisive shift over the past five years.

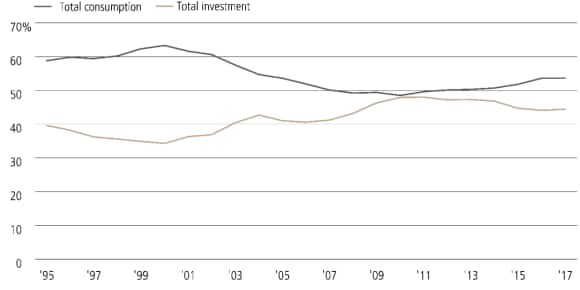

Exhibit 1: China's economy: Consumption and investment as a percent of total GDP, 1995-2017

Consumption accounted for approximately 53.6% of China's total GDP in 2018, and we believe there's still a lot of room for China to catch up with developed economies like the US and Japan, where private consumption accounted for approximately 69.4% and 68.7% of total GDP in 2018, respectively1.

How China gets there will be crucial, and that means looking in depth at the fundamental, long-term drivers that underpin the growth of China's domestic economy

Stick with long-term drivers

Stick with long-term drivers

We see a series of such drivers, all of which remain intact and have the potential to keep growing in the coming years, like:

- China's aging population: an extra 115m people are projected to reach the 65 years+ age bracket in China by 20301. That means lots of things, but for investors it creates opportunities because it implies strong structural demand growth in areas such as senior care, medical products and insurance.

- Automation and robotics: automation is changing China, and not just by boosting manufacturing productivity. Go into China's leading logistics companies and even restaurants and you'll see how automation and robotics are changing the way these companies do business and provide better services to customers.

- Premiumization: we're seeing sustained demand for premium products, driven by rising incomes and desire for social status. Take luxury autos for example. Mercedes Benz's sales grew 12.9% y-o-y in Q3 2019, despite an overall slump in car sales across the whole of China during that period2.

Many companies will benefit from the above trends, but judging which ones will be winners over the long term is a key challenge and that's where company quality becomes a key differentiator.

Focus on quality

Focus on quality

We expect divergence between good and bad companies in China, and that's why it is crucial to focus on the highest quality companies in the market.

We do that by taking a bottom-up approach to research: i.e., visiting companies, interviewing suppliers, talking with employees, surveying customers, and evaluating firms according to strict criteria.

That gives us not only insight into the firms, but also a detailed view on whether these companies may have the products and business models to grow and lead their industries over the long term.

And this approach is going to become a key differentiator in the year ahead.

Many sectors in China remain fragmented. As competition rises, there's potential for top-quality companies to grow market share, particularly in industries like insurance and education services.

Investing in China's equities in 2020 and beyond

Investing in China's equities in 2020 and beyond

So by applying all these factors, and recognizing the many opportunities in China's equity markets while valuations remain reasonable, we're confident we can continue to perform both in 2020 and beyond.

We'd encourage investors to look beyond market noise and focus on what's really happening in China.