Five reasons for a standalone allocation to China

China is too large and the opportunities too compelling for it to be treated merely as a partial allocation in a generic Emerging Markets strategy. Here are five reasons why:

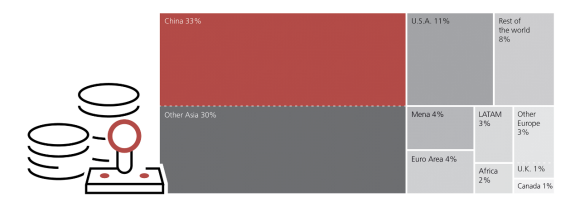

1. China is driving the global economy.

1. China is driving the global economy.

Despite a minor slowdown in 2019, China is where the growth is, contributing 33% of total global GDP in 20191

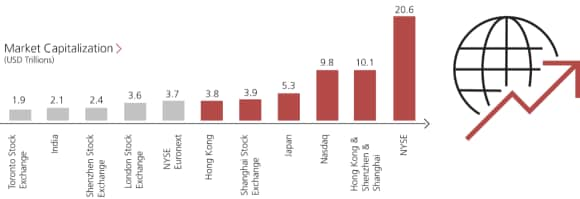

2. China’s markets are some of the largest on earth

2. China’s markets are some of the largest on earth

China’s markets are so large that they deserve a standalone allocation, in the same way investors do to the UK, Japan, and Germany2

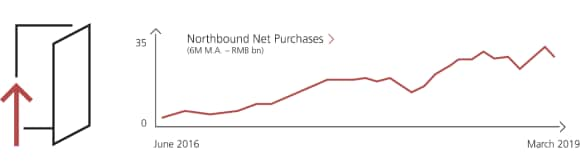

3. And China’s markets are becoming more accessible

3. And China’s markets are becoming more accessible

Stock and Bond Connect programs have opened up onshore markets. Overseas equity investors put RMB 125,4bn to work in China’s equity markets in Q1 20193

4. Offering benefits for investors

4. Offering benefits for investors

Three attractors stand out

5. And strategic positioning for the future

5. And strategic positioning for the future

As new growth drivers from technology and consumer sectors propel China’s economy