Ready to deal?

In O'Connor's latest Global Merger Arbitrage outlook, we discuss potential implications of the COVID-19 pandemic on M&A and where we see opportunities in the coming months.

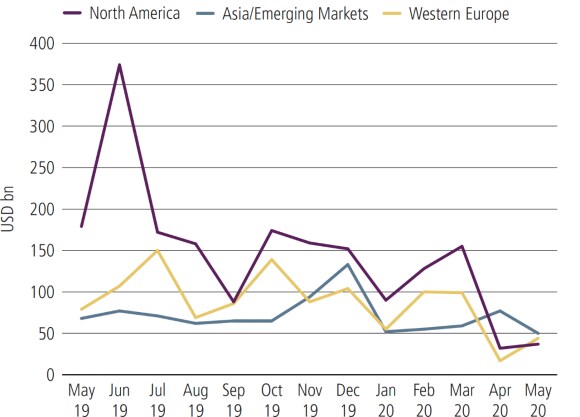

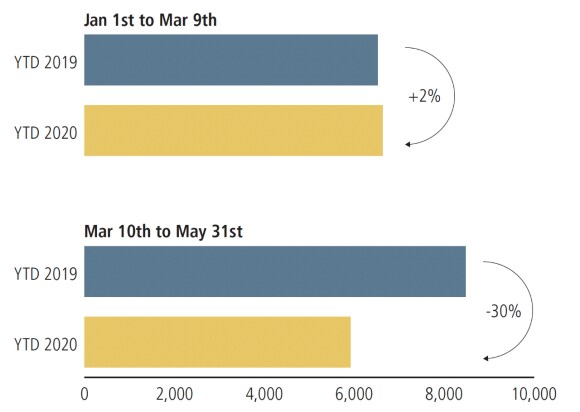

The COVID-19 pandemic caused a massive wave of de-risking across asset classes in March, including the merger arbitrage space, where spreads widened dramatically and activity slowed to a near-standstill.

The COVID-19 pandemic caused a massive wave of de-risking across asset classes in March, including the merger arbitrage space, where spreads widened dramatically and activity slowed to a near-standstill.

The economic effects of the pandemic appear to be slowly resolving, but new deal activity remains muted. We anticipate that we may see activity and announcements increase soon as stressed companies seek relief, ample private equity capital gets put to work at more attractive valuations and strategic buyers pursue both friendly and hostile acquisitions. We continue to explore the major themes reverberating through the merger arbitrage opportunity set with weigh-in from industry experts.