China multi asset investing strategy Q&A (December 2020)

China multi asset expert Gian Plebani sat down for a lengthy Q&A covering recent China market updates, strategy changes and the investing outlook for 2021.

China multi asset strategy Q&A – in 60 seconds

China multi asset strategy Q&A – in 60 seconds

- Joe Biden was declared the winner of the US presidential race, his approach towards China is poised to be more predictable, but still confrontational. However, we believe a Biden administration would be supportive to Chinese risk assets in the shorter term.

- China A shares have rallied, opening up a premium vs. China H shares. We believe there is potential for China H shares to rise in the coming months and then close the premium gap.

- Our strategy had a slight risk on mode going into November; in general we prefer credits and equity over government bonds.

1. China has suffered from the pandemic, as well as ongoing tensions with the US, why have markets gone up so strongly?

1. China has suffered from the pandemic, as well as ongoing tensions with the US, why have markets gone up so strongly?

China’s superior fiscal and monetary capacity to respond to shocks along with its first-in, first-out status on the global pandemic have allowed its domestic equities to hold up better in 2020 compared to emerging market equities as a whole.

We believe this relative resilience will be sustained, with Beijing indicating a commitment to prioritize employment and relax the deleveraging campaign.

2. Biden won the election, what does this mean for the US/China relationship?

2. Biden won the election, what does this mean for the US/China relationship?

Joe Biden was declared the winner of the US presidential race, and is likely to take office with a Republican Senate. For its implication to US-China relationship, in our view, Biden’s approach towards China is poised to be more predictable, but still confrontational.

There will be less emphasis on the balance of trade and a gradual move away from tariffs, but technology will serve as a focal point in the continuing deterioration of US-China relations.

Unlike President Trump, Biden may choose to build multilateral coalitions with American allies to address China on matters pertaining to trade, technology, human rights, and the environment.

All in all, we take a view that, while the geopolitical risk will likely linger in the background, a Biden administration would be supportive to Chinese risk assets in the shorter term.

Biden’s approach towards China is poised to be more predictable, but still confrontational.

3. Where are your cash levels now and why?

3. Where are your cash levels now and why?

We are long risk now and have an overweight in equities, so our cash levels are quite low currently, particularly compared to Q2 2020.

We have also kept a meaningful position in onshore fixed income, that’s because we see it as a risk off asset that currently offers good carry.

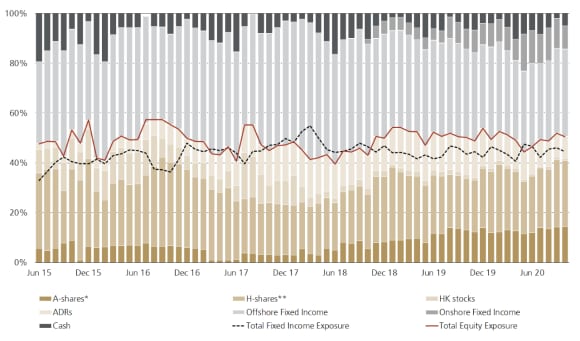

China multi-asset allocation over time, Jun 2015-Oct 2020

China multi-asset allocation over time, Jun 2015-Oct 2020

4. So you have increased your allocation to onshore fixed income, how are liquidity levels in China’s onshore fixed income markets?

4. So you have increased your allocation to onshore fixed income, how are liquidity levels in China’s onshore fixed income markets?

Our onshore China fixed income position is in central government bonds (CGBs) and policy bank bonds (PBBs) so we are quite cautious with the position that we take since these are some of the most liquid parts of the onshore China bond market.

5. FTSE Russell just announced that they would put China bonds into their indices, how significant is this move?

5. FTSE Russell just announced that they would put China bonds into their indices, how significant is this move?

FTSE Russell is the third major index provider to include onshore China bonds in their indices.

It is not such a significant step on its own, but it continues the trend of index inclusion and attracts flow from international investors, which we expect to see play out in the coming years.

6. What’s your view on the RMB and are you/how are you hedging it?

6. What’s your view on the RMB and are you/how are you hedging it?

We hold a constructive view on RMB appreciation. Hence, we no longer hedge our positions and we are comfortable with the RMB positions gained through our onshore exposures.

7. Which do you favor right now, China A shares or China H shares?

7. Which do you favor right now, China A shares or China H shares?

We have a large position in the China A share space, but we see that the China H space looks attractive too. China A shares have rallied quite a lot, opening up quite a premium vs. the China H share market. We believe there is potential for China H shares to rise in the coming months and then close the premium gap.

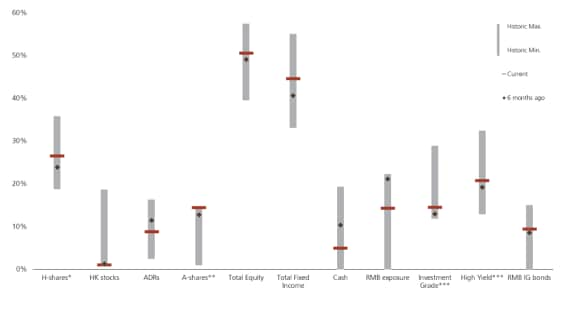

China multi-asset allocations: snapshot, November 2020

China multi-asset allocations: snapshot, November 2020

8. What’s your preference right now, HY, IG or CNY bonds?

8. What’s your preference right now, HY, IG or CNY bonds?

Generally, we have a preference for credits over CNY bonds, and we prefer high yield over investment grade because we still like the fundamentals in the space and the market has priced in a higher implied default risk, and particularly in the property space where we hold companies that have stronger balance sheet and solid cash flows.

9. Are you concerned at all by rising bond defaults onshore in China, how are you reacting to it?

9. Are you concerned at all by rising bond defaults onshore in China, how are you reacting to it?

Default cycles are part of the maturing China onshore bond market and are in a longer term perspective a healthy development for pricing and stability.

In a historical perspective, default cycles are nothing new. The defaults seen recently have been in the local state-owned enterprise space, where we have seen defaults in local SOEs since 2014 and an uptick in the cycle throughout 2015-2017, indicating a gradual shift towards a more reflective market pricing.

Most importantly, within the onshore bond space for CAO, we only hold rates bonds - CGBs and PBBs - which are government-backed and seen as safe assets.

We only hold rates bonds - CGBs and PBBs - which are government-backed and seen as safe assets.

10. What’s your current strategy?

10. What’s your current strategy?

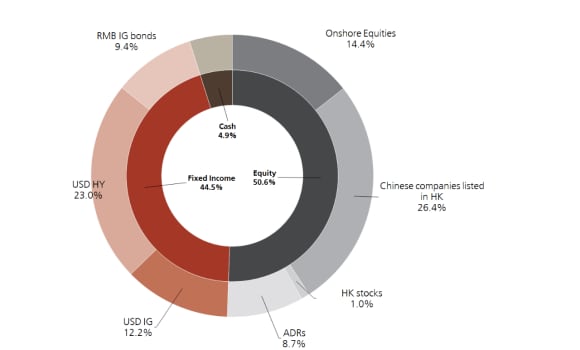

China is clearly on a strong V-shaped recovery track and we expect the economy to return to on-trend growth in the next six-to-12 months. We have a slight risk on mode going into November to position for a potential Biden win in the US presidential election.

In general, we prefer credits and equity over government bonds. We are holding more onshore equities compared to historical average given the easing stance of monetary policy and growing international demand due to index inclusion.

We have increased our credits exposure by funding out from our onshore government bonds while we still hold a meaningful amount to balance risk.

China multi-asset allocation, November 2020

China multi-asset allocation, November 2020

We have a preference on HY over IG considering the attractive yield and implied default risk. We hold a constructive view on RMB appreciation and we are comfortable with the RMB positions gained through our onshore exposures.

Unlike President Trump, Biden may choose to build multilateral coalitions with American allies to address China on matters pertaining to trade, technology, human rights, and the environment.

All in all, we take a view that, while the geopolitical risk will likely linger in the background, a Biden administration would be supportive to Chinese risk assets in the shorter term.

In addition to active bets between equity and bonds, we emphasis the importance of allocating capital between the onshore and offshore assets to benefit from different catalysts and investor behavior.