How will politics shape markets in 2026?

Trade policy will stay in the spotlight

The US Supreme Court is set to rule on the administration’s use of IEEPA for tariffs, potentially affecting around 70% of tariff revenue. If current tariffs are overturned, new, more targeted tariffs are likely, increasing policy uncertainty and volatility, especially if trading partners retaliate. However, a divided US Congress—probable after the midterms—could limit major shifts in trade policy.

Leadership changes are also in focus

The Fed will get a new chair in 2026, with challenges ahead given high inflation and debt, but we expect monetary policy to remain broadly supportive for markets. The US midterm elections in November will add to headline risk, with all House seats and one-third of Senate seats up for grabs. While political rhetoric may intensify, history suggests markets typically look past election cycles. Current odds suggest a divided Congress, which would likely result in legislative gridlock and limit the scope for major policy changes on trade, fiscal stimulus, or financial regulation.

Globally, political risks persist

In Europe, attention will center on political stability in France and the UK, while the Russia-Ukraine war and tensions in the Middle East are likely to persist. In Latin America, elections in Chile, Colombia, Peru, and Brazil could reinforce the region’s shift toward right-leaning governments. Asia’s political calendar is quieter, but Japan’s fiscal policy decisions and China’s new Five Year Plan—emphasizing growth, security, and technology—will be closely watched.

Key risks

An AI disappointment

We believe current investor enthusiasm for AI is justified by strong capital spending, innovation, and adoption. But valuations are high, markets have rallied strongly, and no investment boom has ever seen capital spending perfectly match future demand. The AI rally may face periods in 2026 when investors fear excess investment, bottlenecks, or obsolescence. Broader risks could emerge if refinancing dries up, triggering defaults or threatening financial stability.

A return of inflation

The inflation impact of US tariffs has matched expectations, though tariff evasion may be higher than anticipated. A risk for 2026 is that second-round effects—US companies raising prices or profit-driven inflation—could make inflation more persistent and harder for the Fed to ignore, limiting its ability to respond to risks and potentially keeping long-term yields elevated.

US-China conflict

The US-China rivalry intensified in 2025. Ongoing competition suggests further brinkmanship will remain a risk through 2026, especially around tariffs, rare earth exports, and AI chip sales. So far, escalations have ended in negotiated agreements, reflecting incentives to avoid prolonged disruption.

Debt concerns

In 2025, global bond investors repeatedly flagged rising government debt, with episodes of higher yields in the US, France, Japan, and the UK. If governments fail to reassure markets on borrowing and inflation risks, or pressure central banks to cut rates, yields or currency volatility could rise. Rapid yield increases would pose risks to equity markets. Investors should also monitor both public and private credit markets, where tight spreads and looser lending standards may have created vulnerabilities.

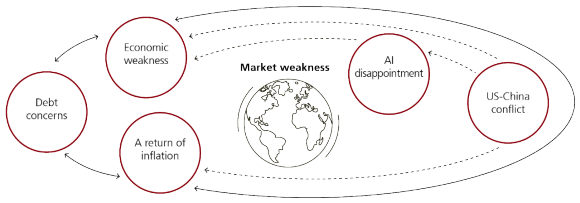

Several factors could lead to market weakness

Illustration of potential key market risks for 2026, with dotted lines depicting indirect influence

Scenarios

Key factors and targets (December 2026) | Key factors and targets (December 2026) | Bull scenario (Tech boom) | Bull scenario (Tech boom) | Base case (Solid growth) | Base case (Solid growth) | Bear scenario (Disruption) | Bear scenario (Disruption) |

|---|---|---|---|---|---|---|---|

Key factors and targets (December 2026) | AI | Bull scenario (Tech boom) | Robust, broad-based AI spending and rapid adoption. Monetization exceeds expectations, driving productivity and corporate profits. “Agentic” and physical AI applications accelerate, fueling optimism and further investment. | Base case (Solid growth) | Solid AI investment continues, with steady adoption and gradual monetization. Productivity gains are incremental, supporting business sentiment but not transforming macro growth. | Bear scenario (Disruption) | AI investment stalls or contracts due to disappointing monetization, technical setbacks, or obsolescence. Corporate caution leads to reduced capex and slower adoption. |

Key factors and targets (December 2026) | Economy | Bull scenario (Tech boom) | US growth outpaces trend, led by strong consumption and business investment. Unemployment remains low, wage growth is healthy. Other major economies benefit from global tech spillovers and easing trade tensions. | Base case (Solid growth) | US grows at its 2% trend rate; labor market softens but unemployment stays below 5%. Consumption is resilient. Growth in Europe and China is supported by targeted fiscal stimulus. | Bear scenario (Disruption) | US growth slows sharply—below trend or even flat—due to lagged tariff impacts, weaker consumption, and spillover effects. Other major economies also weaken; risk of recession rises. |

Key factors and targets (December 2026) | Policy | Bull scenario (Tech boom) | US tariffs fall below 10%, reducing trade friction. Possible Russia-Ukraine ceasefire boosts global sentiment. Central banks maintain or tighten policy only modestly; credit spreads tighten. | Base case (Solid growth) | Fed cuts rates toward 3-3.5% as inflation stabilizes near targets. US tariffs remain in the high teens, but retaliation is limited. Fiscal stimulus in Europe and China supports growth. | Bear scenario (Disruption) | Central banks respond aggressively: Fed cuts 200–300bps. Policy focus shifts to crisis management. Credit spreads widen. Trade tensions and inflation risks persist. |

Key factors and targets (December 2026) | MSCI AC World | Bull scenario (Tech boom) | 1,450 | Base case (Solid growth) | 1,350 | Bear scenario (Disruption) | 830 |

Key factors and targets (December 2026) | S&P 500 | Bull scenario (Tech boom) | 8,400 | Base case (Solid growth) | 7,700 | Bear scenario (Disruption) | 4,500 |

Key factors and targets (December 2026) | EuroStoxx 50 | Bull scenario (Tech boom) | 6,800 | Base case (Solid growth) | 6,200 | Bear scenario (Disruption) | 4,400 |

Key factors and targets (December 2026) | SMI | Bull scenario (Tech boom) | 14,600 | Base case (Solid growth) | 13,600 | Bear scenario (Disruption) | 10,500 |

Key factors and targets (December 2026) | MSCI EM | Bull scenario (Tech boom) | 1,640 | Base case (Solid growth) | 1,560 | Bear scenario (Disruption) | 1,070 |

Key factors and targets (December 2026) | Fed funds rate (upper bound) | Bull scenario (Tech boom) | 4.00 | Base case (Solid growth) | 3.5 | Bear scenario (Disruption) | 1.5 |

Key factors and targets (December 2026) | US 10y Treasury yield (%) | Bull scenario (Tech boom) | 4.75 | Base case (Solid growth) | 3.75 | Bear scenario (Disruption) | 2.50 |

Key factors and targets (December 2026) | EURUSD | Bull scenario (Tech boom) | 1.14 | Base case (Solid growth) | 1.20 | Bear scenario (Disruption) | 1.26 |

Key factors and targets (December 2026) | EURCHF | Bull scenario (Tech boom) | 0.98 | Base case (Solid growth) | 0.95 | Bear scenario (Disruption) | 0.90 |

Key factors and targets (December 2026) | Gold* | Bull scenario (Tech boom) | USD 3,700/oz | Base case (Solid growth) | USD 4,300/oz | Bear scenario (Disruption) | USD 4,900/oz |

Building an effective alternatives allocation

Investors with a long-term horizon and an “endowment” investment style may benefit from allocating up to 20-40% of their portfolios to alternatives such as hedge funds, private markets, and infrastructure. The optimal allocation depends on individual risk tolerance, liquidity needs, and long-term objectives, but a well-structured alternatives allocation can enhance diversification and improve risk-adjusted returns.

Effective diversification across alternative strategies is essential to maximize their benefits, in our view. By investing in a mix of hedge funds, private equity, private credit, and infrastructure, investors can access varied sources of return and reduce potential downside risk. A balanced approach ensures the portfolio remains resilient and adaptable to changing market conditions.

Manager selection is especially important in alternatives. Investors should therefore prioritize high-quality hedge funds with strong track records, private market funds with robust governance and expertise, and infrastructure assets offering stable cash flows. Those making smaller allocations may benefit from fund-of-funds or evergreen solutions, while larger investors may prefer a diversified selection of single managers.

Get in touch

Together, we can help you pursue what’s important

Together, we can help you pursue what’s important

Disclaimers

Disclaimers

Year Ahead 2026 – UBS House View

Chief Investment Office GWM | Investment Research

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd.