Want China but don't like risk?

We have a solution

China multi-asset investing – in 30 seconds

China multi-asset investing – in 30 seconds

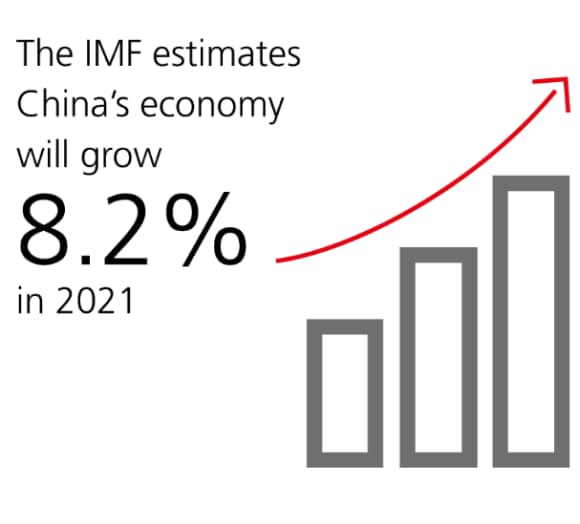

- China's economy is forecast to grow 8.2% y-o-y in 2021 by the International Monetary Fund;

- Capturing China's growth, however, can be challenging: markets can be volatile and it can be hard for investors to choose between the wide range of Chinese asset classes;

- Given the volatile nature and complexity of the China investment universe, we believe a 'risk-aware' approach to China multi-asset investing can be more effective;

- China multi-asset investing strategies combine opportunities across the China investment universe in a one-stop portfolio and allocate actively as opportunities emerge.

China is where the growth is

China is where the growth is

Rebounding an estimated 8.2%, the IMF estimates that China's economy will grow faster than forecast global economic growth of 5.4% in 2021.

But investing in China can be complex (and volatile)

But investing in China can be complex (and volatile)

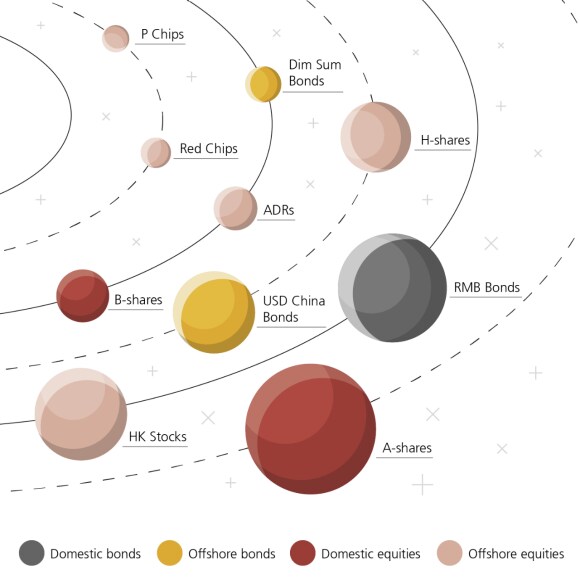

For investors looking to capture China's growth story, it can be hard to choose between the wide range of assets in the Chinese investment universe.

Investors would need to understand the different risk-return profiles and performance drivers of each class, as well as taking an active currency decision for assets denominated in RMB.

The China investing universe is complex

The China investing universe is complex

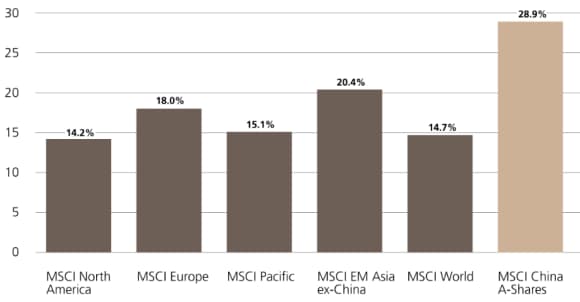

Also Chinese assets, and particularly equities, can be volatile.

In these conditions, a multi-asset investing strategy might be worth considering.

Annualized Returns and Volatility (%) Across China Asset Class Benchmarks, Feb 2002-Dec 2019

Annualized Returns and Volatility (%) Across China Asset Class Benchmarks, Feb 2002-Dec 2019

How do China multi-asset strategies work?

How do China multi-asset strategies work?

Multi-asset strategies typically work by combining a mix of equities, bonds and cash into one allocation.

Given the volatile nature and complexity of the China investment universe, we believe a 'risk-aware' approach to China multi-asset investing can be more effective.

In this sense, 'risk-aware' means taking an active investment approach that flexibly manages five key asset allocation decisions to deliver attractive risk adjusted returns:

- Allocating between onshore and offshore China markets: opportunity sets and market drivers differ between onshore and offshore markets.

- Deciding on cash vs risk allocations: both China equities and bonds are risk assets, and may sometimes be correlated. China multi-asset strategies that allocate up to 30% cash, offer flexibility in risk-off environments.

- Weighing equities vs bonds: Equity allocations can mean exposure to 'new economy' sectors, like healthcare, consumer and IT, while bonds offer exposure to traditional sectors like industrials and real estate.

- Balancing USD vs RMB: actively managing the exposure between the two currencies, allowing allocation to local assets while hedging out the currency risk if deemed appropriate.

- Hedging portfolio risk: using options and futures from time to time to hedge tail risk and protect investor's assets.

Details make the difference

Details make the difference

The dynamics described above are particularly valuable in a market such as China, which is evolving rapidly and presenting a range of attractive opportunities and long-term investible trends.

We believe this active macro top down approach, together with experienced on-the-ground teams in China and rigorous bottom-up security selection creates the opportunity for China multi-asset strategies to deliver risk-controlled growth.

So contact us today to learn more about this multi-asset approach to China investing, and how it may help you meet your investment objectives.