Macro Quarterly

The yield curve: more noise than signal

The spread between two and 10-year Treasury bond yields is not a very effective tool for near-term economic forecasting or tactical asset allocation decisions.

Highlights

Highlights

- We believe that the spread between two- and 10-year Treasury bond yields is not a very effective tool for near-term economic forecasting or tactical asset allocation decisions..

- Though growth is decelerating, economic fundamentals remain robust, and recession risk is low, in our view.

- Wehaveclosedourshort positionongovernmentbondsfollowingthesharprisein yields linked to aggressive tightening from the Federal Reserve.

- On global equities, we are neutral at the index level and favor cyclicals that are overly discounting recession risk or have structural upside, as well as higher-quality and defensive pockets of the market where profit growth should remain resilient.

We believe the inversion of short- and long-term Treasury yields tells us nothing new about the economic outlook and is only of modest utility for tactical investment decisions.

Should the two-year Treasury yield stay above its 10-year counterpart in the coming weeks, as forward rates imply, this does not indicate anything to us beyond what the Federal Reserve has already communicated to markets: The policy rate is poised to be taken swiftly to a neutral setting, and a bit beyond that, over the coming two years. If the policy rate is in restrictive territory, it’s very reasonable to expect interest rates to come down over the medium term. But that medium term can be far longer than the 3 to 12 month time horizon for more tactical asset allocation opportunities.

And while rate cuts are often associated with an economic downturn, this is not always the case. As recently as 2019 – and before in 1995, 1984, as well as in the 1960s – a Federal Reserve pivot from increasing to lowering rates helped prevent an economic deceleration from becoming an outright downturn. Furthermore, yield curve inversions have not served as good “sell signals” for stocks and credit in the past. The previous expansion ended due to the exogenous COVID-19 shock – not any economic malaise foretold by the yield curve. Historically, the better time to reduce risk has been when the Federal Reserve is poised to reduce interest rates but, unlike the 2019 episode, is unable to pull off a soft landing.

We often remark that investors must be forward-looking. But when it comes to divining any signals sent by the yield curve, we must also be careful not to be too forward- looking. One day, the US expansion will end. But right now, economic fundamentals – chiefly the labor market, new orders received by manufacturers, and earnings growth – remain robust. This resilience even in the face of headwinds like energy market turbulence in the wake of war and China’s COVID-19 flare-up suggest the inflationary boom in the US is not ending any time soon.

Exhibit 1: Forward returns for global equities after five most recent Treasury 2s/10s inversions

(Dates indicate first inversion during a Fed tightening cycle.)

Date | Date | Three-month forward returns | Three-month forward returns | 12-month forward returns | 12-month forward returns |

|---|---|---|---|---|---|

Date | 8/22/2019 | Three-month forward returns | 7.32153 | 12-month forward returns | 10.84082 |

Date | 12/27/2005 | Three-month forward returns | 5.921687 | 12-month forward returns | 17.97081 |

Date | 2/3/2000 | Three-month forward returns | -0.65821 | 12-month forward returns | -11.7456 |

Date | 3/24/1998 | Three-month forward returns | -1.8186 | 12-month forward returns | 8.714622 |

Date | 12/14/1988 | Three-month forward returns | 2.424192 | 12-month forward returns | 13.16228 |

Date | Median | Three-month forward returns | 2.424192 | 12-month forward returns | 10.84082 |

Date | Average | Three-month forward returns | 2.638119 | 12-month forward returns | 7.788583 |

In our view, the current backdrop warrants a more balanced approach to asset allocation and a focus on relative value within asset classes rather than large tilts on bonds vs. stocks. The surge in long-term global bond yields, driven by changing expectations around US monetary policy, has provided an attractive tactical window to close our short bet against government bonds and neutralize our positioning in duration relative to equities. In risk assets, we are focused on diversifying exposures between what we see as inexpensive pockets of the market with structural upside, cyclicals which embed too much pessimism on the growth outlook, and higher-quality as well as defensive sectors that should benefit if perceived recession risk rises.

Long end, low signal

Long end, low signal

There are many reasons to believe that longer-term bonds, on a standalone basis, don’t provide much information about the short-term environment. Liability-driven, price-insensitive buyers can dilute any economic signal coming from this part of the bond market. Even if inflation continues to surprise to the upside, which is not our base case, we do not anticipate that market participants will price in a sustained stagflationary environment that includes much higher longer-term yields. It is more likely that traders instead price in even more front- loaded monetary tightening that would weigh on price pressures and economic activity, effectively capping the downside in long-term debt.

In our view, after the year-to-date sell-off, government bonds are now in a position to benefit if the market’s assessment of near-term Federal Reserve tightening goes up or down. If fewer hikes are priced should inflation begin to decelerate, there is scope for lower yields across the curve. But if traders expect even more front-loaded Fed action to bring the policy rate above neutral, they will also likely ascribe higher odds to an easing of monetary policy and a potential economic downturn thereafter. This is because such a large magnitude of tightening in a short period of time would be expected to weigh on inflation and activity, with a lag.

It is possible for neutral rate expectations and long-term yields to durably rise from here. But for that, investors will likely need to see evidence that activity is holding up well following aggressive Fed tightening and also, perhaps, that the European Central Bank is able to exit negative interest rates even in the face of material risks to growth linked to Russia’s invasion of Ukraine.

We do not anticipate that the Federal Reserve’s quantitative tightening campaign will be a meaningful catalyst for fixed income. The net impact on duration in the market is likely to be limited as the Treasury is poised to issue bills, rather than longer-term debt, to replace maturing securities owned by the central bank. Asset sales from the Federal Reserve could cause more market turbulence, but this is not our base case.

Thinking short term

Thinking short term

There are three different scenarios that follow from an inverted yield curve:

- The central bank overtightens and is slow to pivot; recession ensues (positive for government bonds, negative for equities/credit).

- Monetary policymakers remove stimulus before reversing course in order to avoid an economic downturn (positive for equities and duration).

- The economy proves it can handle meaningfully higher interest rates without much deterioration in activity; neutral rates are higher (positive for equities, negative for duration).

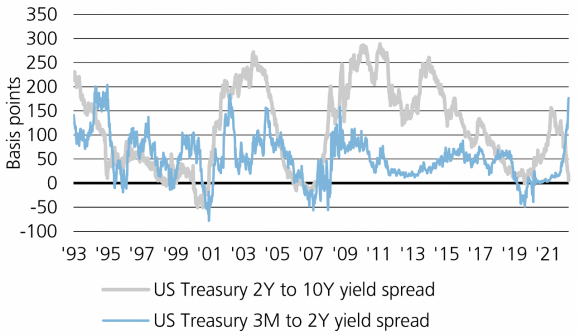

Rather than the 2s/10s curve, we believe that looking at short- term yield spreads (such as the three-month Treasury bill vs. the two-year note) is the most appropriate way to determine whether or not the US economy is in imminent need of monetary support. If this is inverted, investors can make a judgement as to whether central banks will successfully adjust course and keep the expansion on track or not, and position accordingly.

The three-month, two-year Treasury spread is historically elevated at present, implying the US central bank will be able to carry out many rate increases. And yet, this hiking cycle is also expected to be short-lived: the two-year portion of the curve also includes a period in which market participants expect the Fed to be reversing some of this tightening.

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Exhibit 2: A tale of two curves

Three-month vs. two-year curve is a more reliable signal for the economy than 2s/10s

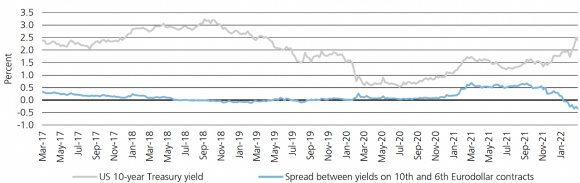

Exhibit 3: Outlook for long-term yields more balanced

Fed rate cuts also priced in after mid-2023 based on Eurodollars, a proxy for US policy rate expectations

Beyond tactically adding back some duration, we believe that it is not prudent to adjust positioning too much today based on the potential for interest rate cuts starting in mid-2023. Those cuts might be sufficient to stabilize economic activity – or they may not even be needed if growth remains near-trend despite the monetary tightening delivered by that time.

Asset allocation

Asset allocation

The expansion remains intact, but growth is slowing, while inflation remains uncomfortably high – and not slowing as fast as central bankers anticipated. As investors balance the prospect of increased Fed tightening now to bring price pressures down with a higher probability of easing later as risks to activity rise, this creates a more symmetric risk-reward profile for government bonds in our view.

We have a neutral stance on global equities at the index level, and view stocks as closer to the upper end of their range based on expected earnings and bond yields. The equity risk premium is near the floor of this cycle. So long as the repercussions of Russia’s invasion could imperil the European expansion and inflation is a threat to the US expansion, it would be imprudent to expect higher valuations to drive equity appreciation.

The economic and market backdrop is far too complex to rely on a one-size-fits-all indicator like the spread between two- and 10-year yields as a guide to investment decisions. But an environment in which perceived recession risks are no longer trivial does prompt us to keep our risk exposures well- diversified and better focus on our procyclical positions. Energy and commodities remain an attractively valued segment of the market buoyed by themes, like changing supply discipline from oil producers and the green transition, that will have staying power, in our view. We believe European banks are overly discounting the extent to which activity will slow. And companies with a high loading to the quality factor or more defensive characteristics should continue to post strong operating results relative to the broader market if the deceleration in economic activity is more abrupt than we anticipate.

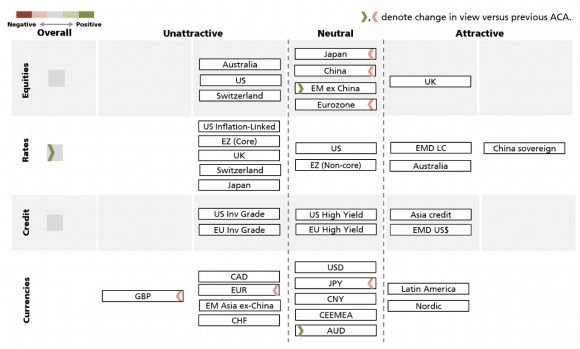

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of March 30, 2022.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities (ex-China) | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall signal | Light green Light green | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 173.9 billion (as of 31 December 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.