Global Real Estate Investing

Quality real estate can help you through volatile markets and act as an inflation hedge

The way we use real estate is changing. Ten years ago, some property types would never have existed

APAC co-head of Multi-Managers,

Real Estate and Private Markets

We bring >9,000 institutional-quality properties in one portfolio

Our flagship global multi-manager property strategy invests in institutional-quality properties across sectors and is available to you in an easy-to-access fund format. The strategy is

1

High quality

Our ‘core’ investment approach means focusing on high-quality, tier-one properties in prime locations.

Our strategy receives multiple, consistent income streams, and supports the portfolio’s stable returns over time.

2

Diversified

Health science, offices, multi-family, logistics, industrials, senior housing, student accommodation, retail sectors – we’ve got it covered.

Our properties are located across US, Europe and Asia.

3

Defensive

Our properties have strong rental demand and we are tilted towards sectors less correlated to the economic cycle:

- Life science

- Senior and student housing

- Industrials

Invest alongside one of the world’s largest real estate manager

- 0 bn

assets under management (EUR) for strategy

- 0

properties or more in strategy

- 0

tenants

- 0

years long track record

- 0

markets

UBS Asset Management is one of the largest real estate managers globally with AUM of over $95 billion. We run a multi-manager real estate platform, and also offer single country, regional and global strategies.

We invest in real estate differently. Our flagship strategy

- is unlisted

- puts money to work directly in properties

- invests through multi specialized managers.

In the last 14 years, this approach has proven to be less volatile than traditional REITS and with lower volatility than that for global bonds.

As challenges around global economy mount, it is important for investors to focus on defensive real estate sectors which are not as correlated to the economic cycle. These sectors include industrials, life sciences and residential.

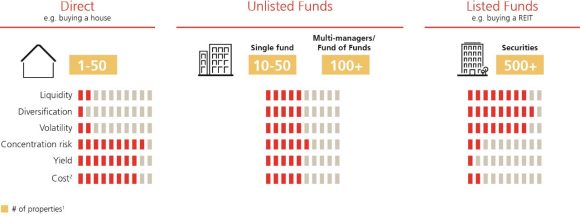

Ways of investing in real estate

You can invest directly, through unlisted or listed vehicles like REITs

Get the best of real estate investing through an unlisted, multi-manager portfolio.

This approach offers you:

- Higher diversification vs buying properties directly

- Lower volatility vs buying REITS

- Lower capital outlay vs buying properties directly

Access our global property portfolio today

Contact our distribution partners to learn more

- Endowus

- MayBank

- Julius Baer

- UBS Wealth Management

- UOB

Disclaimer:

For marketing and information purposes by UBS.

This document and its contents have not been reviewed by, delivered to or registered with any regulatory or other relevant authority in any jurisdiction. This document is for informational purposes and should not be construed as an offer or invitation to the public, direct or indirect, to buy or sell securities. This document is intended for limited distribution and only to the extent permitted under applicable laws in any jurisdiction. No representations are made with respect to the eligibility of any recipients of this document to acquire interests in securities under the laws of any jurisdiction.

Using, copying, redistributing or republishing any part of this document without prior written permission from UBS Asset Management (Singapore) Ltd. is prohibited. Any statements made regarding investment performance objectives, risk and/or return targets shall not constitute a representation or warranty that such objectives or expectations will be achieved or risks are fully disclosed. The information and opinions contained in this document is based upon information obtained from sources believed to be reliable and in good faith but no responsibility is accepted for any misrepresentation, errors or omissions. All such information and opinions are subject to change without notice. A number of comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results may prove to be different from expectations and any unforeseen risk or event may arise in the future. The opinions expressed are a reflection of UBS Asset Management (Singapore) Ltd's judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed.

You are advised to exercise caution in relation to this document. The information in this document does not constitute advice and does not take into consideration your investment objectives, legal, financial or tax situation or particular needs in any other respect. Investors should be aware that past performance of investment is not necessarily indicative of future performance. Potential for profit is accompanied by possibility of loss. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Source for all data and charts (if not indicated otherwise): UBS Asset Management (Singapore) Ltd. (UEN 199308367C )

© UBS 2023. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.