Macro Quarterly Embracing a socially-distant early cycle

The pandemic-induced global recession is over. While we don't yet know the shape of the eventual recovery, the early cycle is rich in opportunities.

Highlights

Highlights

- The pandemic-induced global recession is over. US labor market data confirmed the nadir has passed, an expectation already embedded in risk assets. The nascent recovery is likely to look V-shaped at first, but that pace of improvement is unlikely to be sustained. The differing character of economic expansions across the world will be a function of the strength and persistence of the evolving policy responses, but ultimately captive to progress on public health outcomes, most importantly accelerating the development and deployment of a vaccine for COVID-19.

- The magnitude of the rebound in risk assets in response to wide-ranging government and central bank support leaves us neutral on global equities, with a preference for relative value trades over large directional exposure. Six major macroeconomic themes guide our recommended asset allocation going forward.

- This early cycle is rich in opportunities, and we intend to stay nimble to capitalize on options as they appear. In an uncertain macroeconomic backdrop, we embrace inexpensive expressions of the pro-cyclical trades that we believe have the most room to run in an enduring economic recovery. We are also maintaining defensive positions to protect against left-tail outcomes.

- The journey back will not be without road bumps or detours. Possible catalysts for a return of volatility include a cessation of incremental improvements in activity, a second wave of COVID-19 outbreaks, an escalation in US-China tensions, and political risk linked to potential policy changes as the US election nears.

- We are cautious on US equities. In addition to the intensification of acutely American political risk in the second half of 2020, US stocks are expensively priced with a sector tilt that may fall out of favor in an early-cycle environment. In our view, more value can be found in non-US equities.

The journey back

The journey back

Along with a positive inflection in global economic activity comes a shifting opportunity set for investors. Equity and bond markets no longer look to be in obvious disagreement, as was the case for most of April and May, with any differences on the outlook now more a matter of degree than direction. The US dollar is briskly retreating relative to most other currencies, another signal that the peak in economic and financial stress is in the rear-view mirror.

Amid this backdrop, we seek to embrace cyclical, undervalued positions in risk assets that we believe disproportionately benefit from the emergence of economic green shoots that mark an early-cycle environment. Our concerns about the likely lack of vigor in the economic rebound and potential for its derailment inform our desire to limit overall beta and retain flexibility to adjust positioning to evolving policy and public health conditions. The incremental progress in activity key to the resilience of risk assets will inevitably be challenged in the weeks ahead.

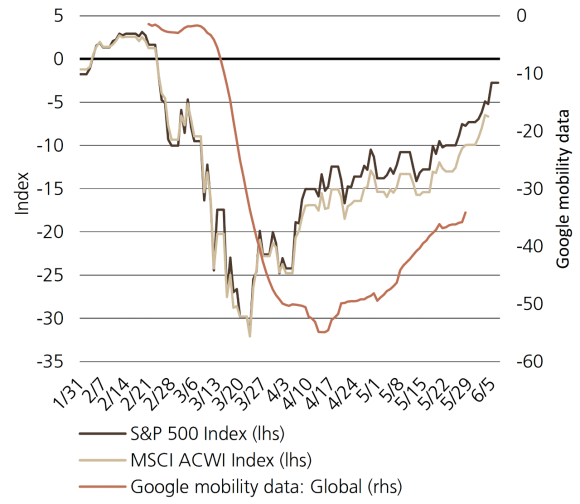

Exhibit 1: Stocks pricing in continued economic recovery

Exhibit 1: Stocks pricing in continued economic recovery

Percent change in global, US stocks (left axis) and deviation of Google global mobility data (right axis) from Feb.1 baseline

We were surprised by the magnitude of the initial gains the US labor market exhibited in the May non-farm payrolls report, but not unprepared for a market environment that reflects this return to expansion after the COVID-19induced global recession. However, we advise against extrapolating this pace of improvement to the following months.

Given the size of the run-up in global equities and highly uncertain trajectory of the economic recovery, we have a much higher conviction on relative value positions compared to directional exposure. We hold a cautious stance on US stocks on a relative basis, a testament to rich valuations and a technology overweight that may turn from a tailwind to a headwind as investors seek areas and geographies of the equity market with more leverage to global growth that’s improving, albeit from a very low base.

Six themes for the second half

Our cross-asset positioning is guided by six macroeconomic themes we see shaping the financial market landscape over the coming quarters and providing opportunities for attractive risk-adjusted returns.

1. Out of the deep recession into an uncertain recovery

Though the rebound in economic activity is underway, the post-lockdown thawing will likely be uneven across geographies and financial markets. A lack of visibility into the outlook for demand could translate into lower consumption and business spending, and a protracted journey back to full economic health.

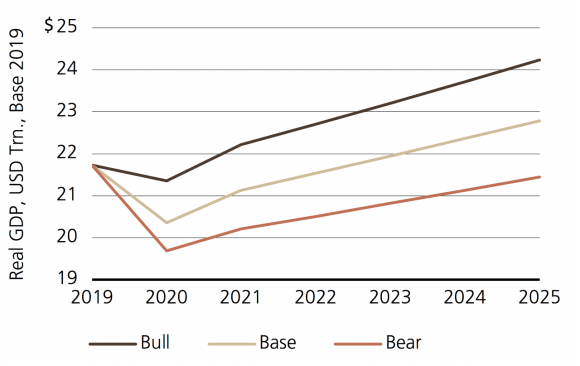

Initial spurts of growth as shelter-in-place restrictions are lifted will inevitably look V-shaped given the depths to which activity plunged. The question is what shape the recoveries take after this point.

We believe these nascent V-shapes will prove to be false dawns that mark the start of a long return to pre-crisis levels of output rather than a brisk return to trend. Many layoffs that appeared temporary at first are turning into permanent separations. This will continue to the extent that businesses find operating at lower levels of capacity to be unfeasible, especially in the event that governments fail to follow through with continued support and fiscal stimulus for reopened economies.

How quickly economies make up lost ground is highly dependent on the virus. Absent a vaccine or effective treatment, a complete return to pre-COVID-19 patterns and levels of activity is not within the tactical investment horizon. Of course, there are much more pessimistic health outcomes – with associated adverse implications for growth and risk assets – within the range of possible scenarios, too.

Even our bull case for US economic activity includes a contraction in 2020. In our base case, the level of real GDP at the end of 2019 will not be eclipsed until 2023. Our most bearish scenario sees the American economy continuing to operate at lower levels of output through 2025.

As such, while our equity positions have a pro-cyclical tilt, we take a neutral stance on the asset class. The foreign exchange market offers a myriad of ways we seek to remain protected amid detours on the path to economic normality. Our preferred positions include being long the Japanese yen relative to the Australian dollar and US dollar.

Exhibit 2: It will take time to get back to where we were

Exhibit 2: It will take time to get back to where we were

Different scenarios for US GDP through 2025

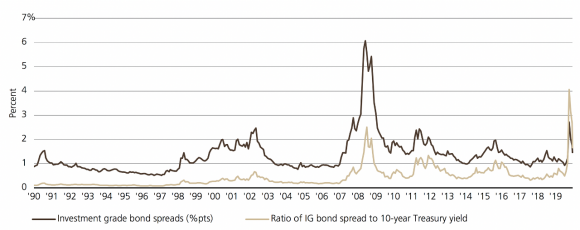

Exhibit 3: Investment grade bonds are still attractive compared to Treasuries

Exhibit 3: Investment grade bonds are still attractive compared to Treasuries

Historically average spreads offer extreme yield enhancement

2.Policy bridge to normalization

The panoply of monetary and fiscal support deployed to prevent the most abrupt economic downturn in history from becoming a prolonged depression is working. Forward-looking markets increasingly reflect an expectation of continued progress, which has largely been validated by the data flow.

We have sought to capitalize via a mixture of positions that benefit from the healing of markets as the left tail of depression-era outcomes was curtailed, as well as selective aggression with exposure to cyclical upside as risk appetite broadens and green shoots of economic activity emerge.

US investment grade bond spreads have tightened substantially to historically normal levels thanks to the Federal Reserve’s foray into the asset class. Corporate debt continues to remain attractive in a world in which worst-case economic outcomes have been avoided yet reliable carry remains scarce. The ratio of incremental yield provided by high-grade US debt vs. the risk-free rate remains at rarely-seen extremes. The ebbing of pessimism towards emerging market assets makes hard-currency debt another way to play growing risk-on sentiment that offers higher coupons and greater scope for spread tightening without taking currency risk.

In our view, the EU policy response, meanwhile, provides a foundation for attractively valued European banks and Italian equities to flourish. The European Central Bank has established programs that offer negative funding rates to subsidize financial institutions’ lending to the real economy and facilitate the narrowing of sovereign periphery spreads. This much-needed carrot will help offset the stick of negative policy rates, which has long been an overhang on the group. The potential for fiscal integration should also allow for a more vigorous recovery, a boon for cyclical, undervalued segments of the market in particular.

Gold, an asset historically prized for its defensive qualities, now seems to offer a more nuanced way to play an economic recovery that requires historically low interest rates and the expansions of central bank and government balance sheets at an unprecedented pace. Financial repression resulting in miniscule yields on even longer-term government debt means to us that bullion has more capacity to provide portfolio protection, especially should left-tail events come to pass.

3. Different responses, different outcomes

Just as the scale of the cumulative policy response by different countries to the pandemic provides investment opportunities, so too does the variance among them.

Having the health infrastructure that allows for success in testing, tracing, or containment likely bodes well for a country’s ability to smoothly transition to reopening activity and to control any future outbreaks. In addition, the strength and directness of the policy responses should help determine how quick and enduring the recoveries can be.

Germany and Japan stand out as having better public health outcomes coupled with robust fiscal responses. In our view, these factors bolster the appeal of these nations’ equity markets relative to emerging markets, some of which have less fiscal capacity and many of which have made less headway containing the virus.

This also leads us to prefer large-cap Japanese equities relative to their French peers. Though this position would likely benefit from upside surprises in the cyclical turn, any lack thereof should be somewhat offset by Japan Inc.’s superior balance sheets, based on interest coverage ratios.

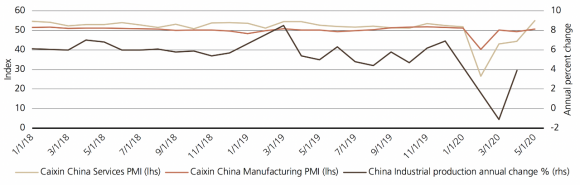

Exhibit 4: Hard and soft data show China's economy has stabilized

Exhibit 4: Hard and soft data show China's economy has stabilized

Industrial production back to growth, with PMIs in expansionary territory

4. Chinese growth stabilizes

The timing of outbreaks across different countries also matters for financial markets. The first to suffer from the pandemic are also among the first to see a meaningful recovery in economic activity, correspondingly buttressing domestic assets. We believe that Chinese and Korean equities are well-positioned vs. developing-market counterparts in this regard. The nations’ markets offer a mix of offense and defense, with the former more leveraged to domestic consumer-driven, relatively acyclical technology holdings and the latter geared more towards the cyclical semiconductor space.

Other elements also bolster the fundamental case for this position. Beijing’s successful attainment of stabilizing rather than supercharging growth should provide smaller positive spillovers for the rest of the emerging markets universe than has historically been the case during prior episodes in which the fiscal impulse turned positive. China also enjoys more fiscal and monetary flexibility than the rest of that group, including the ability to more expediently marshal resources to boost production.

5. Tail risks and volatility up – and it’s not just COVID-19

Top of mind is a resurgence of the pandemic that brought global activity to a standstill. The recovery in financial assets and shift to concerns over a second wave of COVID-19 infections bely the more somber reality: globally, the first wave is yet to crest. But it’s far from the only risk that investors need to be mindful of at this juncture.

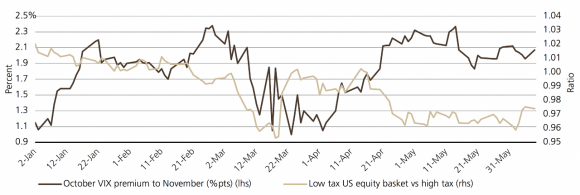

In the US, recent protests reflecting long-standing racial inequities run the risk of contributing to an uptick in new cases. This social unrest increases the risk of unexpected outcomes for the November US election, outcomes already more difficult to discern in light of the evolving perception of authorities’ handling of the public health crisis. At present, we do not believe markets are adequately pricing in the potential for market-unfriendly tax and regulatory shifts in the event that Joe Biden ascends to the presidency and the Democratic party controls both houses of Congress. Bipartisan concern over the power wielded by technology giants remains an acutely US-centric equity risk due to the composition of major indexes.

Exhibit 5: Little election fear in volatility markets or equity market underbelly

Exhibit 5: Little election fear in volatility markets or equity market underbelly

High tax stocks outperforming, VIX curve shows plateau in event risk pricing

And during the US election campaign, bipartisan support for a tougher stance on China will likely increase headline risk, at the very least. Relations between the world’s two biggest economies are probably set to worsen. We believe this deterioration is unlikely to disrupt the phase one trade deal, which remains on a separate track. But concerns over regional security, technology decoupling, obstruction of capital flows, and China’s handling of the pandemic serve as flash points for the two sides in which fissures could quickly escalate into chasms and fuel volatility.

A short position in cyclical Asian currencies like the Thai baht, Korean won, and the Taiwan dollar may provide the most attractive expressions of hedging renewed bouts of financial market turmoil linked to the realization of risks that upend any nascent recovery in global activity.

6. Inflation: Muted now, uncertain later

The first-order deflationary impacts of the COVID-19 shock and lingering economic slack associated with job losses which will not be immediately recouped suggest that a structural turn in the 40-year downwards trend in core inflation is not imminent.

One avenue for a shift to eventually materialize is through a problem of success. If the extraordinary global support brought to bear by central banks and governments to address this crisis proves sufficient – or perhaps excessive – a sustained increase in price pressures could result as the expansion progresses. This could be reinforced by a more persistent muscular fiscal role in achieving macroeconomic goals generally delegated to the central bank. In addition, the long history of subdued price pressures could leave monetary policymakers embracing an upturn in inflation rather than attempting to tamp down on it. Separately, the potential for continued deglobalization and the ensuing reshoring of supply chains could lay the foundation for, or augment, inflationary forces.

An upward spiral in price pressures would undermine the role of sovereign fixed income as a diversifier in balanced portfolios, and therefore this theme warrants close monitoring by asset allocators. As such, we remain vigilant for different economic and political developments that could spur a reversal in this trend, the seeds of which may have already been sown.

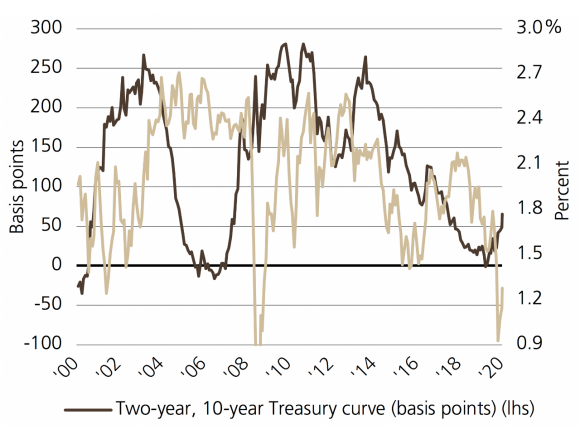

Our call for the two-year, 10-year Treasury yield curve to steepen is informed both by our faith in the Federal Reserve’s commitment to keep policy rates low to encourage an economic recovery as well as the lack of inflation risk premia baked in at the longer end of the curve. That is, 10-year breakeven rates are trading roughly two standard deviations below their 20-year average, providing relatively inexpensive optionality to a breakout in price pressures.

Exhibit 6: Curve flat, breakevens low vs. history

Exhibit 6: Curve flat, breakevens low vs. history

Little inflation premia embedded in longer-term yields could buoy steepening

Conclusion: Relative opportunities

We see the end of the pandemic-induced global recession as a backdrop rich in attractive opportunities to increase exposure to early-cycle themes. Our focus is on relative value positions, as unbridled enthusiasm about the fruits borne of this early cycle environment needs to be curbed in light of the fundamental forces that warrant a more balanced approach to asset allocation.

Science holds the key to the broadest possible return to pre-pandemic patterns of spending. Uncertainty on the nature of the recovery therefore remains elevated, with little visibility into how quickly a complete rebound can be attained. An immense amount of economic damage is yet to be repaired, and may even swell in the event of a policy error or second wave of the virus. And most importantly for financial markets, substantial progress is required to justify the expectations embedded in some risk assets, particularly US equities.

In the current environment, flexibility remains a chief consideration to capture more opportunities as they present themselves. Protective safeguards should also be kept in place to shield investors. Challenges to the burgeoning growth outlook will inevitably appear, fostering short-term volatility and perhaps threatening to undermine this longer-term journey back to full economic health.

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 9 June 2020.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.