- UBS hits fundraising goal more than a year ahead of schedule for impact investments related to the United Nations Sustainable Development Goals

- Firm also launches white paper on sustainable finance trends for the World Economic Forum’s Davos Agenda

Zurich/Basel, 28 January 2021 – UBS, the world’s leading sustainable investment manager, today launched a white paper on sustainable finance trends in 2021, after the firm exceeded a key target more than a year ahead of schedule.

UBS initially aimed to raise USD 5 billion for impact investments related to the United Nations Sustainable Development Goals (“SDGs”) in the five-year period between 2017 and 2021, and surpassed that milestone during the second half of 2020. Each investment aims to generate a measurable social or environmental impact relating to one or more of the SDGs, as well as a compelling financial return for clients.

During 2020, UBS continued to expand the rest of its sustainable investment offering. Its Asset Management division saw its Climate Aware strategies reach USD 15 billion in size and more than doubled its sustainable investing-focused assets to USD 97 billion. Within its Global Wealth Management division, invested assets in its 100%-sustainable portfolios exceeded USD 18 billion, following over USD 7 billion in inflows and even better performance than traditional equivalents.

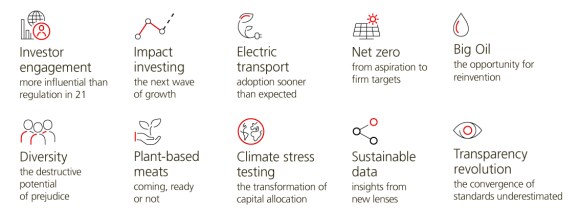

Following these achievements, UBS today published a white paper on ten sustainable finance trends for the World Economic Forum’s Davos Agenda Meetings this week. The paper projects that in 2021:

- Impact investing will fuel a new wave of growth in sustainable finance

- Investor engagement on sustainability issues will be more influential than regulation in 2021

- Sustainability data will continue to evolve faster than expected

- Climate stress testing will go mainstream, reflecting net zero emissions goals and other factors

- Electric transportation, plant-based meat and the reinvention of oil companies should provide attractive investment opportunities

Axel A. Weber, Chairman of the Board of Directors at UBS Group, says: “Sustainability is at the heart of everything we do at UBS. We are proud to have met our key target of USD 5 billion for SDG-related impact investments earlier than expected and believe sustainable finance will make a growing impact in 2021.”

Ralph Hamers, Group Chief Executive Officer of UBS, says: “Sustainability is no longer just a talking point, but also a catalyst for action. Investors and companies should seek to get ahead of this transformation if they wish to navigate 21st-century risks and opportunities effectively.”

Suni Harford, President, UBS Asset Management, says: "As sustainable investing moves into the mainstream, our clients are seeking to better understand and improve the long-term outcomes resulting from their investments. As a leading investor, we are playing an active role in calling for greater transparency and helping to accelerate the pace of progress that will be critical in achieving real-world sustainability outcomes.”

Huw van Steenis, Senior Advisor to the CEO and Chair of the Sustainable Finance Committee at UBS, says: “Sustainability has become a key driver of portfolio performance and resilience – and we are finding an inflection as clients aren't just looking to reduce risk or exclude some securities, but rather scan for investment opportunities leveraged to energy transition and other sustainable themes."

Ten trends shaping sustainable finance in 2021

Ten trends shaping sustainable finance in 2021

UBS Group AG and UBS AG

Contacts

Contacts

Switzerland:

+41-44-234 85 00

UK:

+44-207-567 47 14

Americas:

+1-212-882 58 58

APAC:

+852-297-1 82 00