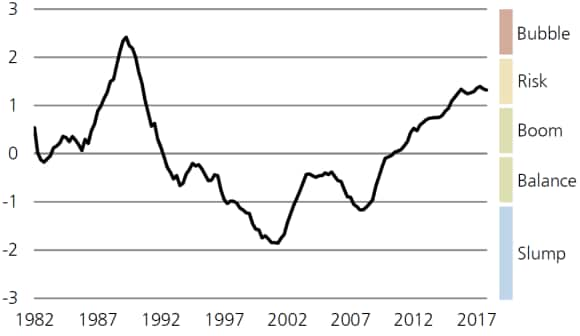

Zurich, 7 February 2018 – At 1.32 points, the UBS Swiss Real Estate Bubble Index was in the risk zone in 4Q 2017. The disparities on the homeowner market declined for the second time in succession. The key factor was the persistently low growth in the mortgage debt of households with the banks, with simultaneously strong income growth in the last quarter. In 4Q, Switzerland recorded its strongest nominal economic growth in almost three years, up 0.6% quarter on quarter.

Mortgage debt growth underestimated

Household mortgage debt rose by 2.6% last year, considerably below the average for the last 10 years of 3.8%. Even so, the actual volume of outstanding mortgages might have grown more than the data suggest, because insurers and pension funds have started to award more mortgages in recent years. Insurers only hold a market share of around 5%, but the growth rate of their mortgages over the last three years was twice as high as those of the banks. The pension funds' mortgage books also picked up again significantly from 2016, following several years of declining trends. The Real Estate Bubble Index could well be slightly underestimating the actual risks at the moment.

Increased disparities in the risk regions

Home price inflation was slightly up again in 4Q 2017, compared with the two previous quarters. This stopped a stronger decline in the Real Estate Bubble Index. On the one hand, general inflation persisted at the level of the previous quarter. On the other, asking rents fell by 0.4%. The price-to-rent ratio is thus lurching from one high to the next; it now takes over 30 years' rent to buy your own home. The highest price-to-rent ratios are to be found in the risk regions of German-speaking Switzerland and the tourist regions, where a home of your own actually costs considerably more than 35 years' rent.

UBS Swiss Real Estate Bubble Index – 4Q/2017

Selecting exposed regions

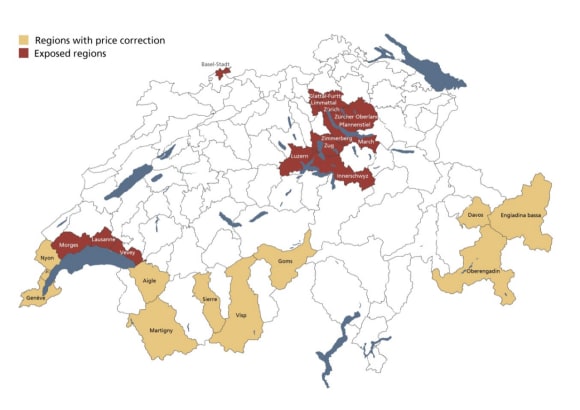

The regional risk map shows those regions posing the greatest macroeconomic risks in the event of a Swiss-wide correction. The analysis is based on the population size, the price level and the price behavior for owner-occupied homes. The selection of risk regions is linked to the UBS Swiss Real Estate Bubble Index. Vacancy or liquidity risks are not taken into account.

Regional risk map – 4Q/2017

Risk regions for the Swiss residential property market and regions with a price correction of more than 5 percent since 2014

The UBS Swiss Real Estate Bubble Index report is available on the Internet via this link: www.ubs.com/swissrealestatebubbleindex-en.

The index is published on a quarterly basis. The next date of publication for the UBS Swiss Real Estate Bubble Index is 8 May 2018.

UBS Switzerland AG

Contacts

Claudio Saputelli, Head Swiss & Global Real Estate, Chief Investment Office WM

Phone +41-79-513 50 45

Dr. Matthias Holzhey, Head Swiss Real Estate Investments, Chief Investment Office WM Phone +41-44-234 71 25