Macro Quarterly Preparing for another round of pent-up demand

Macroeconomic themes and tactical asset allocation opportunities

Evan Brown

Head of Multi-Asset Strategy Investment Solutions

Ryan Primmer

Head of Investment Solutions

Luke Kawa

Director Investment Solutions

Highlights

Highlights

- In our view, global activity is poised to re-accelerate in Q4 from Q3, and remain well above trend in 2022.

- Supply chain issues that are contributing to slowing growth and higher inflation will get better, not worse, as vaccinations improve public health outcomes.

- Regions such as Europe and Japan continue to have superior earnings trends and are also relative beneficiaries of rising bond yields as global central banks pare back stimulus.

- However, risks to the procyclical trade, chiefly from more persistently elevated inflation as well as China’s real estate sector, have risen in prominence.

With the final quarter of 2021 underway, it’s important to refocus on the primary determinant of economic activity and financial market performance over the course of the past two years: the pandemic.

Many factors contributed to the downshift in growth during 2021. There has been a natural deceleration as unprecedented stimulus ebbs. The initial phase of pent-up demand has come and gone. And ongoing public health concerns have exacerbated supply shortages while preventing a durable, comprehensive economic reopening.

We believe that this final headwind should shift in a persistently positive direction, with material implications for growth and asset market performance. More progress on vaccinations is getting us closer to a broad normalization of activity. This is the future that forward-looking markets should be pricing in, in our view. Our outlook for strong growth is inconsistent with the prevailing narrative that stagflation is on the horizon.

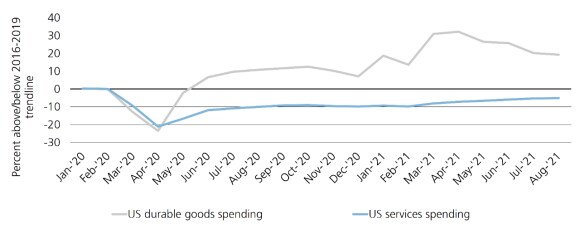

The Delta variant has impeded production and shipping activity, particularly for Asian economies, while also weighing on the service-sector recovery in the developed world. Reduced opportunities for services consumption, in turn, translates to above-trend demand for durable goods, further exacerbating supply constraints. Now, case counts are declining and global vaccinations are moving higher. This allows for the reverse to occur: more production, more labor supply, and more services consumption rather than goods – all of which should prevent supply conditions from worsening.

In our view, these improving public health outcomes mean that the global economy is poised to enjoy a second round of pent-up demand being realized. We expect a re-acceleration of activity in Q4 from Q3, with relative performance across financial markets increasingly reflecting the likelihood that 2022 will be another year of above-trend economic activity.

Exhibit 1: Pandemic-induced shift in spending patterns beginning to normalize

Exhibit 1: Pandemic-induced shift in spending patterns beginning to normalize

Procyclical positions still preferred

Procyclical positions still preferred

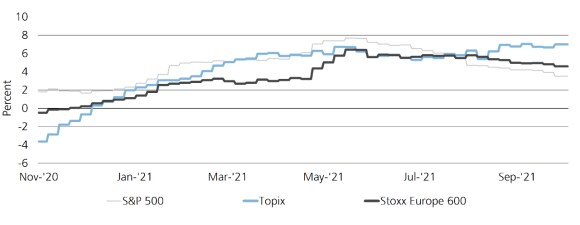

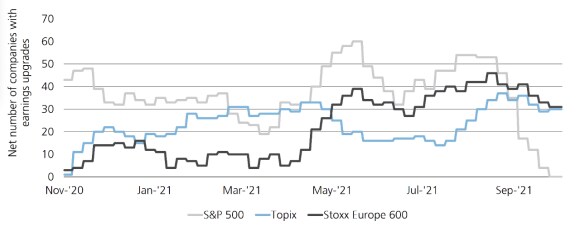

Our positive outlook for global activity informs our preference for procyclical relative value positions –regions like Europe and Japan and sectors like financials and energy. The fundamentals are intact and improving. On a geographic basis, aggregate earnings revisions are stronger in Europe and Japan compared to the US, as is the breadth in profit upgrades downgrades. Valuations, on a relative basis, are also quite compelling to us.

Cyclical assets have performed well since early September even as central banks have grown more hawkish and the outlook for Chinese activity has become more uncertain. When assets, in this case the likes of financials and US equal weight, fail to react as might be expected to what appears to be bad news, this is often a signal that too much negativity had been priced in.

Exhibit 2: Three-month earnings revisions favor Japan, Europe over US

Exhibit 2: Three-month earnings revisions favor Japan, Europe over US

Two of the top three risks for global equities – higher real rates and tax increases in the US – are particular headwinds for US equities. The other risk – continued disappointments on global growth amid uncomfortably high inflation – is why we hedge our favored expressions of non-US developed market equities with a positive view on the US dollar, particularly cyclical Asian currencies.

Some procyclical relative value positions lagged from March to September despite outperforming on earnings. In our view, this is largely attributable to the retracement lower in global bond yields. Therefore the renewed march higher in rates should allow for a catch-up in which more of this superior growth in earnings is reflected by better relative performance.

The Federal Reserve will continue to command outsized attention among global central banks, and for good reason.

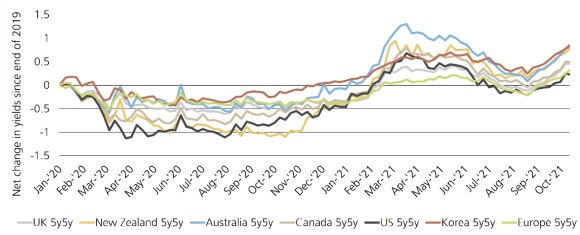

Exhibit 3: Global cyclical outlook better than before the pandemic

Exhibit 3: Global cyclical outlook better than before the pandemic

Exhibit 4: EPS revision breadth also favors Europe, Japan

Exhibit 4: EPS revision breadth also favors Europe, Japan

But what is shaping up to be different about this cycle is that US monetary policymakers are not expected to be going alone in withdrawing stimulus, in stark contrast to the 2017-2018 period.

A couple of developed market central banks, like Norway and New Zealand, are already raising rates. And importantly, the expected five-year yield in five years’ time for many advanced economies is above where it was prior to the onset of the pandemic. We believe that this is an indication that markets are beginning to tentatively acknowledge the cyclical strength in this expansion will be larger in magnitude and longer-lasting.

Growing risks to the outlook

While we have conviction in our procyclical view, we do acknowledge that the risks surrounding it have risen. The biggest threat is that the current state of affairs persists, contrary to our expectations. A sustained combination of inflation surprising to the upside, growth underwhelming, and stressed supply chains preventing end-demand from being realized would be broadly negative for financial assets – both stocks and bonds. In our view, the Q3 earnings season may mark a peak in the impact of these supply chain concerns on operating performance and guidance.

However, the onset of winter and accompanying heightened risk of COVID-19 spread in the Western world could push back the timing of a comprehensive economic reopening and enhance price pressures. Central banks’ patience with inflation could wear thin, with a pivot to more aggressive policy tightening. And even a gradual withdrawal of central bank accommodation would challenge equity valuations, particularly for expensive, growth-oriented segments of the market, and may cap the upside in stocks to the still-strong rate of earnings growth. An appreciation for the wide-ranging ramifications of an extension of this slowing activity, rising inflation backdrop is a key reason why we are running what we believe are judicious levels of risk at the portfolio level and maintain a long US dollar bias.

Exhibit 5: Growth surprises should improve as inflation surprises roll over

Exhibit 5: Growth surprises should improve as inflation surprises roll over

China’s regulatory campaign and prioritization of the quality and nature of economic growth, rather than the quantity, is a known but difficult to quantify source of downside risk. Markets are conditioned to expect meaningful Chinese policy offsets when the domestic outlook worsened. Investors may be overconfident and wrong-footed in case China’s policymakers are willing to endure greater short-term economic pain in the pursuit of long-term goals. A protracted Chinese slowdown, whether linked to a prolonged regulatory crackdown or a severe retrenchment in real estate, would be negative for both domestic risk exposures and have adverse spillovers for global procyclical positions. One mitigating factor to this risk is that China has not been as big of a driver of cyclical upside or commodity demand recently compared to the pre-pandemic early economic expansion, due to a stronger fiscal-led rebound in developed economies.

Conclusion

Threats to the outlook – both from monetary tightening and negative side effects from the organization of Chinese economic policy – are introducing downside risks to growth while capping the upside available. But, more importantly, public health outcomes are offering more cause for conviction in the well-being of this nascent expansion. That progress is key to unlocking a healthier nominal growth environment in which both labor and goods shortages dissipate.

Shifting from a high inflation/slowing growth backdrop to a moderating inflation/robust growth regime should support the outperformance of procyclical positions. We believe that inflation is still likely to remain elevated enough to keep central banks telegraphing the withdrawal of policy accommodation, especially as labor markets continue to heal. This should keep real rates grinding higher while market-based measures of inflation compensation stay relatively lofty, as well. Rising yields, in turn, should prove a boon to cyclical regions like Europe and Japan and sectors like financial and energy. Higher rates may serve as important corroborating evidence as to the likely vigor and duration of the economic expansion – not as a sign of looming stagflation – which should allow the better earnings growth in these areas of the stock market to be more fully reflected in price performance.

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

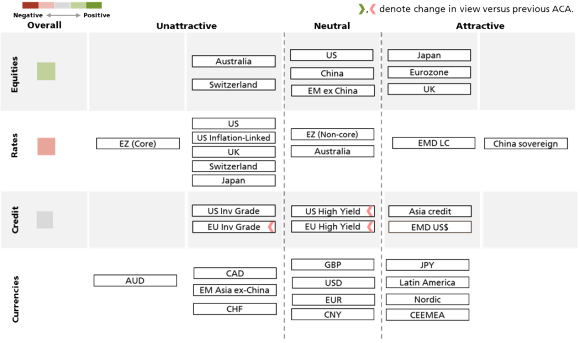

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 1 October 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Neutral / Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 167.9 billion (as of 30 June 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.