Chapter four: What’s your next move in China investing?

Investing in China lately has come with higher risks and volatility, but the scale and variety of opportunities on offer remain compelling to those looking for returns across asset classes for the long run.

Surprise checkmate by stacked cannons

Alternatives

Alternatives

While Chinese stocks and bonds continue to present compelling investment opportunities, China is no longer just all about traditional asset classes, or even onshore versus offshore investments. In its pursuit to become one of the main global financial hubs, over the last few years China has actively focused on reforming its financial sector, and we believe that this is creating opportunities for relative value trading that weren’t available to investors in the past. China’s markets are becoming a key source of alpha and its transition from beta to alpha is one of the key trends in relative value investing at least over the next 5-10 years. There are at least three market characteristics and developments that are supportive of a more relative value approach to investing in China.

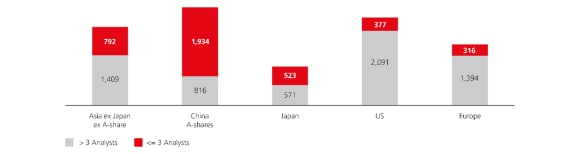

Chart 5: Listed company equity analyst coverage: China's equity universe is under-researched

Chart 5: Listed company equity analyst coverage: China's equity universe is under-researched

And last but not least, the use of short selling as a risk management tool to protect long positions has historically been limited by the availability of short borrowers in China. However, last year’s implementation of the new rules to improve liquidity through opening the Chinese capital market allows active long/short investors to reach out to domestic investors such as domestic mutual funds, life insurance companies and corporate investors. This has doubled the size of the borrowing pool and could mean a five times growth for the relative value market when it matures in the long term according to our estimates. These regulatory reforms will fundamentally change the operating characteristics of the China A-share market by allowing hedge fund investors to short with domestic brokers and secure margin on a range of securities that were not available in the past. Hedge funds will therefore be able to more effectively capture long and short alpha while dynamically managing beta, sector, factor, thematic and idiosyncratic risks.

We believe there is a large investment opportunity in China as liquidity improves on both the long and short side. We are also looking at quantitative strategies in China and are closely studying their credit and fixed income markets. These strategies may bring about much more efficiency and allow us to invest in a much more diverse way across the onshore Chinese equity markets. Investors who are bullish on China yet weary of short-term volatility should consider adding long/short strategies to their allocation.

The Chariot can go far and wide

Conclusion

Conclusion

China is a country of many strengths and potential, and offers plenty of attractive long-term opportunities. While it’s clear that risks to investing in China have risen and recent events have many investors on edge, we firmly believe the long-term investment case for China is intact.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Whether you have a question or a request, we will be happy to get in touch with you.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.