Macro outlook and investment allocation

Evan Brown, UBS-AM Head of Multi-Asset Strategy and Louis Finney, Co-Head of Strategic Asset Allocation Modeling, outline key global macro trends and discuss alternative investing strategies.

Macro outlook and investment allocation

Macro outlook and investment allocation

- Whether you believe higher inflation is transitory or not, most investors' asset allocations assume a low inflation world.

- Given the risks to inflation are skewed to the upside for the first time in years, some alternatives offer unique properties to diversify portfolios in an inflationary environment.

- Alternatives have delivered a different return and risk profile than public assets.

- Private equity has had had a substantially higher return than public equities and other segments offer premiums over similar public markets.

- Expected returns for public assets are lower than a year ago (government bonds are the exception.) Although we expect a similar drop in expected return for alternatives, the premiums over public markets should remain.

Evan Brown, UBS-AM Head of Multi-Asset Strategy

Evan Brown, UBS-AM Head of Multi-Asset Strategy

This has been an unusual time for economic policy.

We have the lowest real interest rates since the 1950s, which reflects just how determined central banks are to get inflation at or above the long-term target, along with historic fiscal stimulus in response to the COVID-19 recession.

Both have increased inflation expectations, which clearly has implications for markets.

US real rates haven't been this low since the 1950s

US real rates haven't been this low since the 1950s

Increasing the attractiveness of real assets

Increasing the attractiveness of real assets

After the best 12 months return for the S&P 500 since 1936, the equity risk premium is already at the lows of the previous cycle. We've seen credit yields hit record lows.

We believe there is not a lot of risk premium still to extract from public markets on a pure beta level. So this is the backdrop that we all have to acknowledge as asset allocators.

The big question we are hearing now is whether the inflation we have started seeing here in the US is transitory, as the US Fed is arguing, or more sustainable and thus concerning.

Markets are starting to price in higher inflation

Markets are starting to price in higher inflation

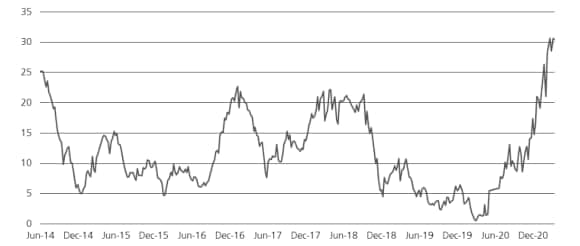

Implied odds of a material pickup in price pressures rose sharply on stimulus measures.

Market-based probability of inflation rise

Market-based probability of inflation rise

June 26 2014-Apr 7, 2021

The market is implying about a one in three chance of 3% average inflation over the next five years.

The probability of inflation being an issue is higher than it's been in a very long time and we need to make sure that our portfolios are diversified against this outcome.

In public markets, commodities, inflation linked securities and value stocks provide some diversification.

But another factor to keep in mind is that for years the market has rewarded long duration assets in public markets whether it's long bonds or secular growth stocks.

And for years we’ve seen a negative correlation between stocks and bonds. If there is a surge in inflation, that correlation may become positive as bonds and equities begin to sell off at the same time.

Alternative assets, like real estate, infrastructure and hedge funds, are less closely historically correlated to stocks and bonds, and offer unique properties that can perform well in an inflationary world.

Expected Returns | Expected Returns | Global 60/40 | Global 60/40 | 50% equities, 25% bonds, 25% alts | 50% equities, 25% bonds, 25% alts |

|---|---|---|---|---|---|

Expected Returns | 5-year Geometric Return | Global 60/40 | 4.5% | 50% equities, 25% bonds, 25% alts | 5.2% |

Expected Returns | 5-year Sharpe Ratio | Global 60/40 | 0.46 | 50% equities, 25% bonds, 25% alts | 0.51 |

Expected Returns | 10-year Geometric Return | Global 60/40 | 5.1% | 50% equities, 25% bonds, 25% alts | 5.8% |

Expected Returns | 10-year Sharpe Ratio | Global 60/40 | 0.48 | 50% equities, 25% bonds, 25% alts | 0.53 |

According to UBS-AM’s capital market returns projections, over the next 10 years the standard 60/40 stock/bond portfolio will earn about 4.5%, and have a 0.46 Sharpe ratio.

But for a portfolio split 50% equities and 25% each in bonds and alternatives, we project about 5.2% returns with a higher Sharpe ratio. We believe these are fairly conservative estimates, taken from index benchmarks.

Bottom line, we believe beta is limited in public markets and whether we have sustained inflation or not, we need to adjust our portfolios to account for the risk of higher inflation. We believe diversifying portfolios by adding alternatives will improve risk/return profiles.

UBS-AM Capital Markets Assumptions

UBS-AM Capital Markets Assumptions

Louis Finney, UBS-AM Co-Head of Strategic Asset Allocation

When we formulate our capital market assumptions, we start by ascertaining the size of the markets.

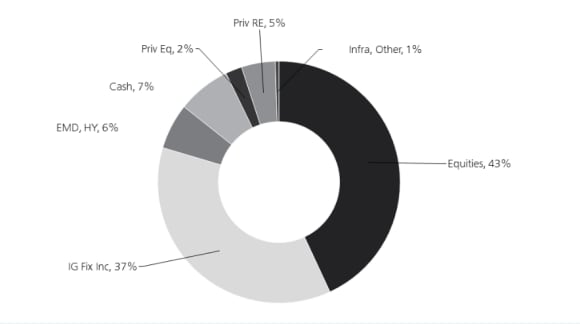

As of December, 2020, we estimate the current capitalization at USD 155 trillion, 43% of that is in equities, about 43% in bonds, 7% cash and 7% in alternatives.

Alternatives here, consist mostly of real estate private equity and a small slice in infrastructure, timberland and farmland of about 1%. Not included are gold, hedge funds, commodities, etc., which can add another 5% to 7% by some estimates.

Global Capital Markets

Global Capital Markets

December 2020

This doesn’t count:

Asset Class | Approximate Size in USD | ||

Gold | 7 trillion | ||

Hedge Funds | 3 trillion | ||

Commodity Funds | 250 trillion | ||

Private Equity |

| ||

Dry Powder | 3 trillion | ||

Crypto-currencies | 3 trillion |

When we are developing the return and risk expectations for the capital markets and alternatives, we do have some formal models that can help us, but we also rely on the relationships that we've seen historically. Over last 25 years, this is the general profile and some observations:

Real estate:

- Return between stocks and bonds

- Appraisal risk close to bonds, but economic risks should be higher

Hedge funds:

- Return and risk between stocks and bonds

Private Equity:

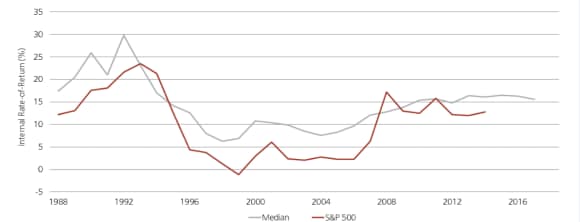

- On average over the past 25 years, the median fund has outperformed the S&P by 420 bps. This is lower in the last decade: 200 bps.

We estimate that the typical private equity fund has about a seven-year cycle, which we’ve compared with 6-year S&P 500 returns.

Median Net IRRs of Private Equity Funds and Subsequent 6-yr S&P 500 Returns

Median Net IRRs of Private Equity Funds and Subsequent 6-yr S&P 500 Returns

1990-2020

Over the last 30 years, the median private equity fund has earned a premium over the public market, as represented by the S&P 500. With some exceptions, most of the time private equity returns are above the returns for the public markets.

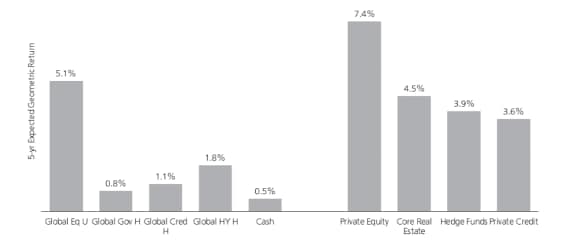

Asset class | Expected 5-yr Return USD terms | ||

Global Equities Unhedged | 5.1% | ||

Global Governments Hedged | 0.8% | ||

Global Credit Hedged | 1.1% | ||

Global High Yield Hedged | 1.8% | ||

3-Month Treasury Bills | 0.5% | ||

Private Equity | 7.4% | ||

Core Real Estate | 4.5% | ||

Hedge Funds | 3.9% | ||

Private Credit | 3.6% |

5 Year Expected Returns

5 Year Expected Returns

March 2021

On our expectations for forward-looking returns, a few observations. We've got high valuations in the US equity market and roughly fair value outside the US.

We estimate global equity returns over the next 5 years to be about 5.1% in unhedged USD terms.

We expect bonds, in hedged terms to be in very low single digits. This is higher than a year ago when our 5-year return expectation for global government bonds was 0%.

Our return expectations for alternatives are affected by the low interest rate environment, but still look good relative to public markets. In private equity, we expect to see a similar premium to what we've seen historically, at 7.4%.

We expect real estate returns to be close to equities at 4.5%, with hedge funds and private credit a little under 4%.