Retirement

Retirement planning for women: the challenges

Women still face major challenges regarding their pensions. A UBS study demonstrates potential solutions for financial security.

![]()

header.search.error

Retirement

Women still face major challenges regarding their pensions. A UBS study demonstrates potential solutions for financial security.

In recent years, specific legislation and cultural changes have improved the economic position of women in Switzerland. Despite this, certain differences persist between the sexes, at least according to the statistics. This also has a significant impact on their financial situation when they retire.

Considered objectively, the pension data appears to suggest a bias toward women. These include: a lower retirement age until 2023, lower AHV contributions overall, higher AHV benefits and an identical conversion rate in pillar 2 – despite the fact that women retire earlier than men and tend to live longer.

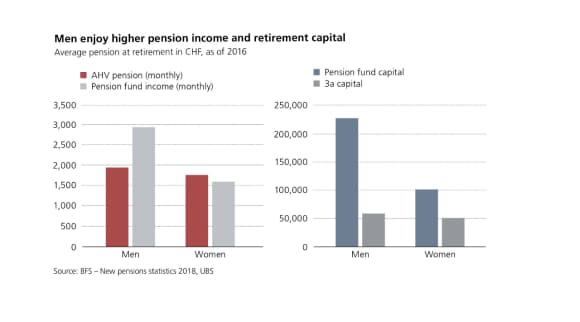

However, these factors do not prevent the systematically lower pensions and comparatively lower standard of living of female pensioners. This problem is due to social structures, individual decisions and destinies outside the pension system. Women still earn less than men, even if they have closed the gap somewhat in recent years. Women are more likely to work part time and to take career breaks more frequently than men. Due to the high costs of third-party childcare, they are often away from the workplace longer than they would like. Their lost earnings usually occur at an age that is significant for their career development. Alongside the lower contributions to pillar 1 and pillar 2, the opportunities to save privately are also reduced, a problem which in turn is magnified by the lack of compound interest over a period of decades. In addition, women tend to invest more conservatively, leading on average to lower returns.

Changes in society in recent decades have opened up many new opportunities for women. But every decision – about training, career, further education, full-time or parttime work, taking parental leave or going freelance – affects your pension situation. And decisions in your private life, where traditional marriage is far from the only habitation or family model nowadays, also have far-reaching consequences. When couples decide whether to get married, they rarely take into proper account the considerable legal and pension-related aspects. For the partner who earns less and therefore pays in less – still usually the woman – the consequences of divorce or the death of the spouse are considerable.

In principle, almost every pension situation can be improved. Almost every decision that affects family life or commitment to work affects our pension. The impact of important financial decisions on your pension situation should, however, be taken into account.

In addition, and at the levels of state and society, there are further factors essential to a generally more stable pension situation, specifically for women. The three-pillar system must be consolidated and the 3rd pillar, in particular, made more attractive. For example, the law could be changed to allow those not working to pay into pillar 3a and allocate the corresponding tax relief either to a spouse – if employed – or toward credits against future tax obligations. Clearer and more flexible childcare and working models could prevent women, in particular, from being left behind.

Because a personal conversation is worth a lot

What can we do for you? We’re happy to address your concerns directly. You can contact us in the following ways: