Q1 2024 equity market outlook

Five charts on the key indicators we are watching as we head into 2024

![]()

header.search.error

Five charts on the key indicators we are watching as we head into 2024

Global Concentrated Alpha outlook summary

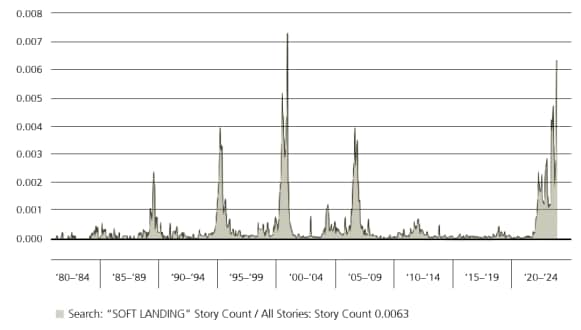

Figure 1: “Soft landing” story count not a good indicator of final outcome

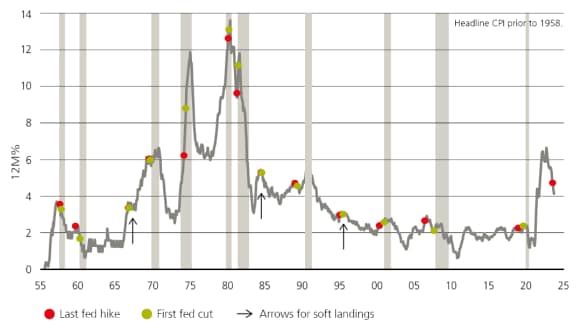

Figure 2: The first Fed that kept hiking post inflation peak

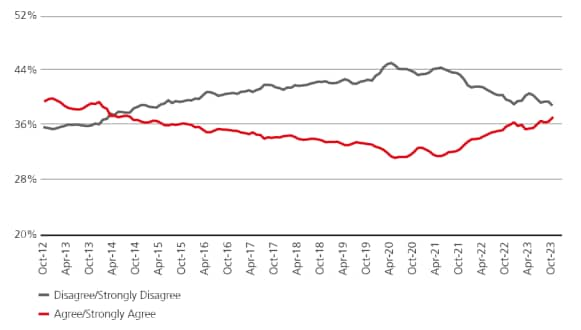

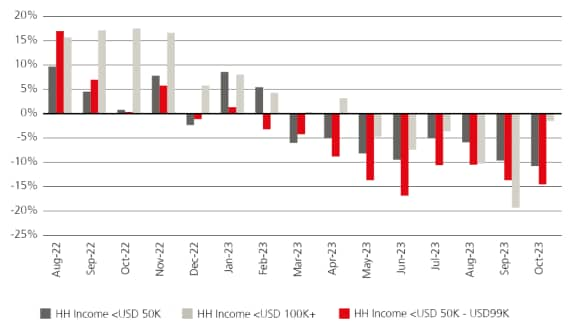

Figure 3: Households seeing more need to save

Figure 4: Spending intentions are slowing

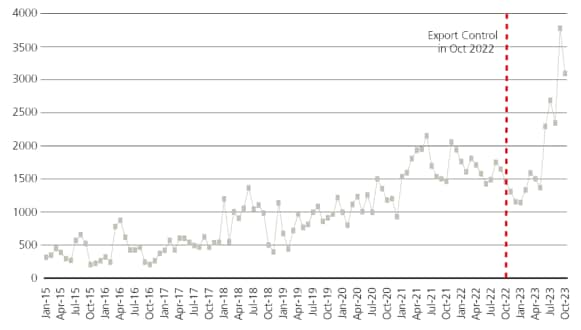

Figure 5: Unsustainable semiconductor equipment demand?