High-quality income in Switzerland’s zero interest rate environment

Why Swiss dividend stocks are so compelling right now.

![]()

header.search.error

Why Swiss dividend stocks are so compelling right now.

Income with dividends and option premiums

Global financial markets are currently navigating a period of heightened uncertainty, with growing geopolitical risks, persistent concerns over economic growth and recent instability caused by tariff disputes all creating major upheaval for investors. At the same time, Swiss investors in particular are once again facing a zero interest rate environment, making the search for reliable sources of income increasingly challenging. Focusing on Swiss dividend stocks can help you to get the most out of this challenging environment. UBS Asset Management offers two attractive, proven investment opportunities in this area.

Rising demand for ‘safe haven’ investment opportunities

With geopolitical tensions complicating pricing in global equity markets, the latest tariffs announced by the USA prompted investors to fundamentally reassess how they diversify risk. The search for investments in global growth opportunities from ‘safe havens’ then came to the fore in the second quarter.

Assets listed in Swiss francs undoubtedly offer just such an opportunity. In addition to concerns over global economic growth, however, the SNB’s latest interest rate decisions are making the hunt for reliable income streams increasingly complicated, especially for Swiss investors. Experts even discussed the prospect of a return to negative interest rates during the first half of 2025.

Swiss dividend stocks: reduced volatility, reliable returns*

In the current environment, investors have increasingly focused on finding dependable sources of income. Swiss investors in particular, who traditionally exhibit a strong preference for regular income streams, are increasingly searching for alternatives to traditional fixed income investments. Swiss equities, especially high-dividend stocks, are becoming ever more important in this environment.

Investors historically reap the rewards of focusing on these companies, with around half of contributions to total returns coming from dividends in the past 25 years. With their regular income streams, dividend stocks can also help investors to cushion losses in a bear market while typically providing portfolios with a certain degree of stability, as they tend to exhibit less volatility in trading.

‘Swissness’ offers advantageous market conditions

Switzerland is renowned for its economic and political stability. The Swiss franc has built a global reputation as one of the most robust currencies, offering investors additional protection in uncertain times – a quality that recently became apparent in the wake of the USA’s tariff announcements. This, combined with the high quality and profitability of many Swiss companies, creates an attractive environment for investing in dividend stocks.

Zero interest rates in Switzerland as a catalyst

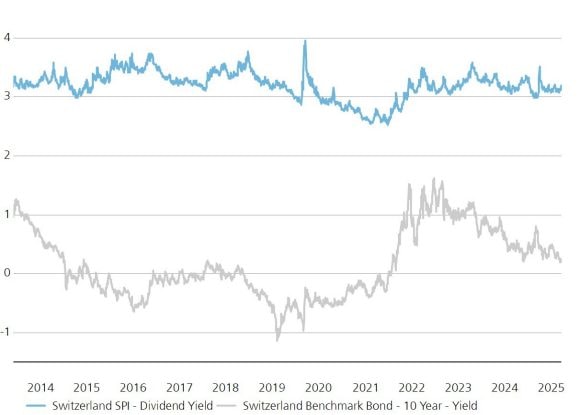

One of the main arguments supporting the increasing appeal of Swiss dividend stocks is the growing discrepancy between dividend yields and 10-year Swiss government bonds in recent months, a gulf that reached 2.94% as of the end of September 2025. This yield gap provides a particularly compelling incentive in periods of persistently low interest rates.

Source: UBS Asset Management, FactSet data as of 30 September 2025.

For illustrative purposes only. Past performance is no guarantee of future performance. This does not constitute a guarantee on the part of UBS AG, Asset Management.

The outlook for these stocks is similarly positive. Current market estimates expect Swiss dividends to grow by around 5.0%* by the end of 2026. In the short term, a few isolated companies could experience stagnant growth due to the aforementioned array of uncertainty factors. With this in mind, we recommend adopting an active management approach that uses clearly-defined quality criteria to determine which companies to invest in, thus minimizing the impact of potential dividend cuts.*

Dividend strategies as robust core investments

High-quality dividend strategies can act as a cornerstone for investors seeking a firm foundation for their portfolio. With this in mind, we would like to spotlight two potential approaches for different types of ‘income investors’.

Focus on full price participation with UBS (CH) Equity Fund – Swiss High Dividend

The Swiss High Dividend strategy offers easy access to a diversified portfolio of Swiss companies with above-average dividend yields and high quality. The strategy focuses on stocks with industry-leading business models, healthy balance sheets and stable earnings. By concentrating on proven companies with high dividends, the strategy generates above-average returns while still offering participation in the Swiss equity market.

Quality is an integral feature of the Swiss High Dividend strategy. As well as selecting companies based on their current dividend levels, the strategy also assesses their ability to maintain or increase dividend payouts in the long term, reducing the likelihood of dividend cuts or omissions as much as possible and ensuring consistent returns for investors.* At the same time, the strategy includes an attractive mix of current dividend champions and the leading Swiss dividend stocks of tomorrow.

Focus on income generation with UBS (CH) Equity Fund – Swiss Income

The Swiss Income strategy offers an attractive alternative for investors with more stringent income requirements who see full price participation as a secondary consideration. This strategy should be understood as an extension of the Swiss High Dividend strategy and is based on the same equity strategy.

As well as generating attractive dividend income from the stock portfolio, however, this strategy also opens up a second compelling income component for investors primarily focused on income distribution. By writing covered call options (a covered call overlay that limits upside participation) on individual stocks within the portfolio, the portfolio generates additional income streams in the form of option premiums, which are exempt from tax for Swiss investors. As a result, the indicative income yield was 8.41% as of the end of September 2025 (3.29% dividend yield “ 5.12% option premium)*.

Equity Specialist / Analyst

Florian Töpfl fulfils a hybrid role as Equity Specialist and Equity Analyst in which he closely collaborates with our global equity investment teams within UBS Asset Management.

Based in Zurich, he is mainly responsible for investment communication of the Swiss active equity strategies and additionally contributes to the Swiss Equities team as an equity analyst. Additionally, he represents the Global Equity Long Short (GELS) capability.

Florian started in the Investment specialist team at UBS Asset Management in June 2019, after he successfully graduated from his MSc dual degree in (International) Banking and Finance.

Florian is a member of the Swiss Investment Committee in Zurich.