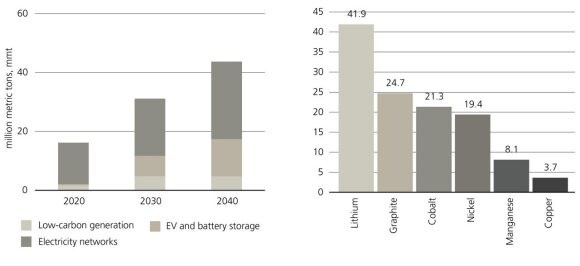

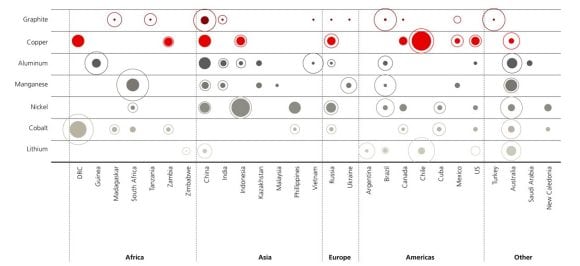

Critical materials for the energy transition

The global energy transition currently underway is a physical one that will need to be built. But what are the building blocks, and where do these critical materials for the energy transition come from?