Fourth quarter 2022 O’Connor Global Multi-Strategy Alpha Quarterly Letter

It is clear this is a difficult backdrop to be making long-term investment projections with a high degree of confidence, and there will likely be plenty of twists and turns in the coming months.

The 2022 FIFA World Cup will take place in the coming weeks and is set to be a historic and unusual event as the first World Cup ever to be held outside of May, June or July.

‘Historic’ and ‘unusual’ are terms investors seem to be using quite frequently this year in financial markets. At the time of writing, the S&P 500 is having its 5th worst performance YTD since 1928 and losses in global government bonds are the worst since 1949. Navigating this backdrop has required diversification, prudent management of net exposure, and an overall sharp focus on risk.

Yet, while macro volatility has persisted in Q3, and rates have climbed back up to their highs and further, we have observed that rates are no longer the sole driving factor in dispersion between securities, as often seemed the case in the first half of the year.

Companies within the same industry have very different balance sheet structures, working capital requirements, capital expenditure commitments, hedging policies around energy, lags between higher costs and higher pricing, mechanisms they have used to pass through freight and energy cost increases, FX exposure, and so on.

The prospect of a slowing economic backdrop has brought many of these issues to the forefront, giving our investment teams what we believe are relative value opportunities to proactively engage in.

Risk factors are numerous

Risk factors are numerous

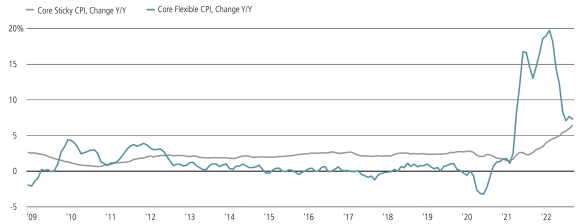

There are plenty of reasons to remain cautious on risk assets, with the most topical point being high and sticky inflation which will likely keep central banks and particularly the Fed in tightening mode.

Figure 1: ‘Sticky’ inflation will likely keep the Fed hawkish…

Meanwhile, goods pricing is coming off, but services inflation is rising

Atlanta Fed ‘Sticky’ vs. ‘Flexible’ Core CPI Baskets (% YoY)

Tightening financial conditions will weigh on valuation multiples, but we have also begun to see earnings downgrades finally come through and are expecting further material downgrades to forward estimates. A simple but useful proxy for 12-month forward EPS changes has been ISM New Orders – Inventories (3 months ahead), which confirms the downward risk for earnings forecasts.

Figure 2: ISM New Orders – Inventories (3 months ahead) acts as a proxy for 12-month forward EPS

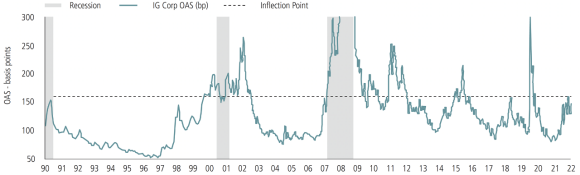

Credit spreads are still not anywhere close to levels we would more normally see during a recession, and thus the implied probability of recession seems too low. Over the past twenty years during non-recessionary periods, we have seen average spreads for US Investment Grade debt around 135bps which gets closer to 220bps during recessions. This compares to the ~150bps we observe presently.

Figure 3: US IG spread history doesn’t suggest a recession yet

Yet positioning is already very cautious across many asset classes. For example, CFTC net non-commercial futures positions on the S&P 500 are near multi-year lows.

Figure 4: CFTC S&P 500 net non-commercial futures positions suggest caution

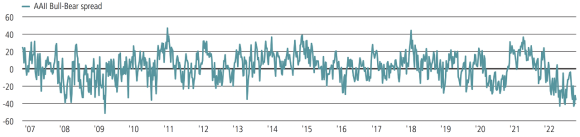

Meanwhile, net bullish investor sentiment (AAII US Investor Sentiment Bullish readings minus AAII US Investor Sentiment Bearish readings) is at the lowest levels seen since March 2009.

Figure 5: AAII US Investor Sentiment Bullish Index/AAII US Investor Sentiment Bearish Index spread

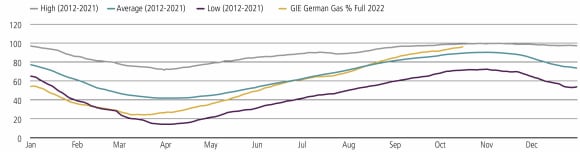

There has been plenty of concern around the implosion of the European economy this winter due to a lack of gas, yet this tail risk seems to be removed with European gas storage levels now having reached better than average levels (German gas storage nearly at 95%, well above the seasonal average and towards the higher end of the historical range) with governments also unleashing fiscal stimulus measures to support consumers and cap utility bills.

Figure 6: Europe’s natural gas shortage is easing

German Gas % Full Index

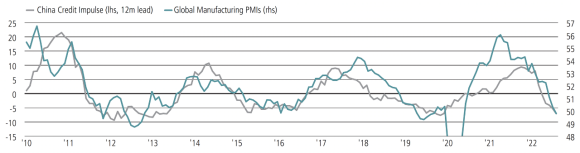

Into and exiting the National Congress of the Chinese Communist Party, we could see a relaxing of measures around movement and new 5-year plans which stimulate demand in certain parts of the economy. Whatever the outcome, improvements in the China credit impulse that have already been taking place bode well for a potential trough in global manufacturing PMIs.

Figure 7: China Credit Impulse (12m lead) vs. Global Manufacturing PMIs

Investors should take a nimble approach

Investors should take a nimble approach

It is clear this is a difficult backdrop to be making long-term investment projections with a high degree of confidence, and there will likely be plenty of twists and turns in the coming months. We believe this is likely to remain a fast-paced market requiring timely and assertive decision making as opportunities arise.

In football (known as soccer in the US) ultimately it is not possible to win just by defending your goal the entire game. The team needs to know when to take risks and push up the field, collectively identifying the best avenues of attack, while being mindful of what could go wrong and remaining balanced in its approach.

Currently, the team has a number of opportunities it is excited about. Within equities we are seeing greater differentiation at a country level in terms of monetary and fiscal policy, as well as inflation and employment data which is leading to a change in correlations between sector peers. The market has also begun to transition towards focusing more on the path of EPS revisions than headline valuations; specifically differentiating at a more granular level between financial leverage, the need and cost of re-financing in 2023, committed capital expenditures, flexibility of the cost base and operating leverage – all of which we believe will be helpful for our bottom up sector focused approach

We believe that our Event Driven strategies have provided capital protection throughout the year, despite consistent spread widening driven by risk-off markets and rate rises. We believe that the challenging macro backdrop is likely to persist in the near term, which may spur a relatively higher degree of volatility in the strategy, but also presents opportunities to initiate or add to situations which we considered less attractive at tighter levels.

As we enter Q4, the event-driven strategies have a significant number of transactions with catalysts that we anticipate unfolding before year end, trading at what we consider to be attractive spreads. New deal announcements have accelerated after the doldrums of the summer months, and the strong dollar may also present opportunities as corporates could take advantage of volatility to pursue strategic cross-border targets, and financial sponsors can take advantage of lower valuations to deploy their record levels of capital.

Within credit, we have consciously kept leverage low as the market reoriented and a myriad of macro risks became more socialized. While we think spreads have more room to widen to reflect a higher probability of recession, historically low non-recessionary average prices on credit are providing compelling protection on the downside and convexity on the upside via liability management exercises, premium change of control structures, and rate moves.

We see compelling relative value opportunities within capital structures and across industries as we expect sector differentiation and dispersion to increase. Credit and fixed income yields broadly are also presenting a compelling alternative to cash and equities for the first time in about fifteen years, which should provide a tailwind for the asset class.

Finally, we are grateful to Kevin Russell for all that he has brought to O’Connor over the past seven years and are sad to see him leave, but we are excited about the franchise we have in place and the opportunity set ahead of us. We remain well positioned in areas where we see structural alpha tailwinds for regulatory, policy, geopolitical and thematic reasons. We continue to capitalize on our dynamic and opportunistic approach to shifting around exposures which allows us to take advantage of dislocations.

Above all, we believe we have a unique collaborative culture where there is full transparency and plenty of channels of communication between teams - in an investing environment where news velocity has been high and many assets are interlinked, we have seen this year how that has been invaluable.

As always, we thank you for your continued support.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.