As traditional 60/40 portfolios struggle in an era of persistent inflation and market volatility, institutional and private investors are turning to alternative assets as an additional source of returns and diversification. Jerry Pascucci and Johannes Roth examine the drivers and implications of this structural shift.

For decades, alternative investments have been skewed towards institutional investors with nine-figure minimums and substantial in-house due-diligence capabilities. That world has gone.

Today, as traditional investment strategies buckle under pressure from persistent inflation, elevated interest rates, and geopolitical uncertainty, a significant shift is reshaping investing. Portfolio construction conventions are also being challenged with the 60/40 split between stocks and bonds coming under scrutiny. Investors want uncorrelated returns, as well as shelter from unpredictable financial markets.

Many sophisticated private investors increasingly want to allocate capital the same way as pension funds. The transformation began quietly in the aftermath of the 2008 financial crisis. As central banks flooded markets with liquidity and drove interest rates to historic lows, institutional investors found themselves forced to venture beyond traditional asset classes in search of yield. Private markets began attracting unprecedented capital flows.

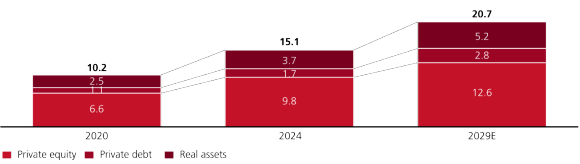

The numbers don’t lie. Private market assets under management have grown substantially over the past decade and a half, reaching approximately USD 15.1 trillion at the end of 2024.1 Just as important, the composition of that capital has shifted dramatically. Whereas pension funds and sovereign wealth funds once dominated, high-net-worth individuals and family offices now represent the fastest-growing segment.

Figure 1: With 15.1 USD trillion in AuM, global private markets are hard to ignore

Figure 1: With 15.1 USD trillion in AuM, global private markets are hard to ignore

Global private markets assets under management, in USD trillion

As public markets have become more correlated and volatile, investors have realized the need for exposure to return streams that are less dependent on daily market moves. As the market matures, the focus is shifting from simply offering alternative products to delivering best-in-class solutions. The fiduciary bar is rising, demanding greater transparency, improved governance, and more sophisticated risk management.

The private capital revolution

Take private equity. An influx of capital has allowed companies to stay private longer, shifting much of the value creation from public to private markets.

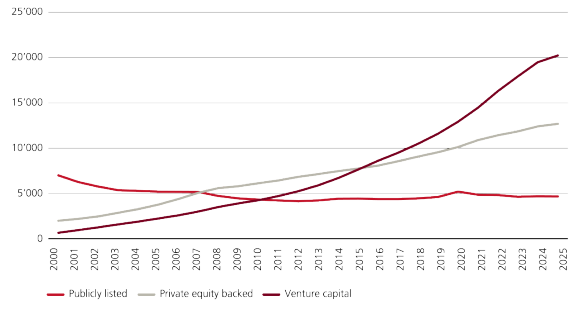

In 1980, there were approximately 4,658 publicly traded companies in the United States. By the end of 2024, despite significant economic growth, there were only 3,804 domestic operating companies listed on major US exchanges – a decline of approximately 18%.2 Many companies that might previously have gone public are choosing to remain private, funded by private equity and venture capital. Companies can now scale to billions in revenue while remaining private.

Figure 2: The target universe is expanding, as more companies choose to stay private for longer

Figure 2: The target universe is expanding, as more companies choose to stay private for longer

Number of US private equity-backed companies versus domestic listed firms on NYSE and Nasdaq

But this success has created new challenges. The slowdown in mergers and acquisitions and initial public offerings has extended holding periods, making liquidity management a critical issue for managers and investors. The traditional private equity model of buying, improving, and selling companies within five years is being tested.

The industry is responding. Secondary markets have grown significantly in size and sophistication. Continuation funds – vehicles that allow general partners to hold onto their best assets longer while providing liquidity to existing investors – have become a core part of the toolkit. Indeed, secondaries are now a core strategy.

The overall evolution is also driving greater specialization. Rather than pursuing broad buyout strategies, many firms are focusing on specific sectors or strategies where they can develop deep expertise and sustainable competitive advantages. Healthcare, technology, and infrastructure have emerged as particular areas of focus.

Switching the lens from equity to debt, post-financial crisis regulation has driven a curtailing of risk appetite. Combined with regional bank challenges, traditional banks have retreated from corporate lending and created space for alternative lenders.

For decades, banks were the primary source of credit for mid-market companies. Regulatory changes following the 2008 crisis, including capital requirements that made lending to smaller, sub-investment grade companies less attractive, created an opportunity for private lenders.

Indeed, private credit expanded to approximately USD 1.7 trillion at the end of 2024, up from approximately USD 1 trillion in 2020.3 The asset class has grown roughly ten times larger than it was in 2009 and is estimated to reach USD 2.8 trillion by 2029.4 Private credit now accounts for more than 40% of global new issuance, up from less than 10% just a decade ago.

Rapid growth has brought challenges. As more capital has entered the market, lending standards have come under scrutiny. Higher interest rates are testing borrowers’ ability to service debt, while regulators are paying increasing attention to a sector that largely operates outside traditional oversight.4

Direct lenders are moving up-market, competing with banks for larger deals, while others are moving down-market, providing capital to smaller businesses traditionally served by regional banks. Specialized lenders are emerging in niche areas like asset-backed credit, as well as intellectual property and litigation finance.

The megatrend opportunity: AI, energy transition and infrastructure upgrades

The convergence of global megatrends is creating compelling investment opportunities. Private capital is not just providing diversification for investment portfolios; it is increasingly becoming essential funding for the economy of tomorrow.

The AI infrastructure supercycle

Nowhere is this more evident than in the artificial intelligence (AI) boom currently sweeping through entire industries.

Training a single large language model can require the computing power of thousands of specialized chips running continuously for months. The electricity demands are enormous, with some estimates suggesting AI could account for a significant portion of incremental electricity demand growth in the coming years. This has triggered what many describe as an “infrastructure supercycle.”

In this sense, real assets play a crucial role in the AI technology rollout. The AI revolution is really an infrastructure story. Every query, calculation or AI-powered recommendation requires massive computing power. This means data centers, and all the requisite “picks and shovels” I would allude to electrification, cooling etc. and the role of real assets in enabling the technology to reach potential.

The result is a blurring of traditional asset class boundaries. What once might have been considered real estate investments – data centers and server farms – now function more like critical infrastructure, generating stable, long-term returns with limited correlation to traditional markets.

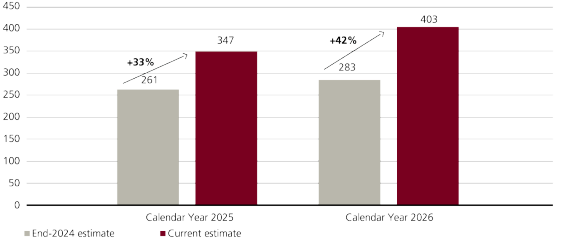

Investment will have to keep pace. McKinsey estimates that capital expenditure required to support AI-related data center capacity demand could range from USD 3 tln to USD 8 tln.5 Unlike traditional real estate, these facilities often come with built-in tenants – tech giants like Microsoft, Amazon, and Alphabet – locked into long-term leases that provide predictable cash flows.

Figure 3: Big 4 Capex has been revised up c.30-40% in YTD-25

Figure 3: Big 4 Capex has been revised up c.30-40% in YTD-25

Consensus forecast: Big 4 Calendar Year 2025 and 2026 Capital Expenditure firms on NYSE and Nasdaq

The energy transition imperative

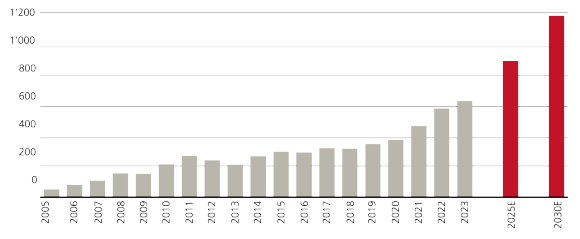

Meanwhile, the shift away from fossil fuels toward renewable energy sources is creating significant investment opportunities. The International Energy Agency estimates that achieving net-zero emissions by 2050 will require USD 4 trillion in annual investment through 2030.6 This is roughly double the current level. Governments and public markets alone cannot provide this capital, meaning private investment will be essential.

It is also one of the few asset classes where demand is structural and policy aligned. Whether renewable energy generation, battery storage, smart grids or green hydrogen, the investment opportunity is likely to run for some time – albeit evolving in nature.

Figure 4: Renewable energy investment is expected to double by 2030

Figure 4: Renewable energy investment is expected to double by 2030

Global spending on renewable energy infrastructure in USD bn

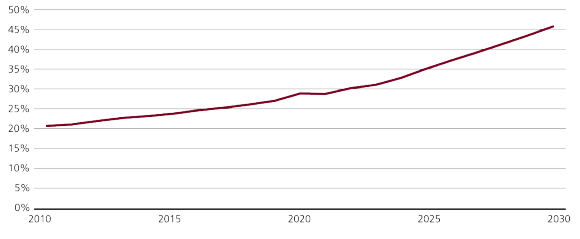

Figure 5: Renewables now make up 35% of the energy mix

Figure 5: Renewables now make up 35% of the energy mix

Renewable energy share in global final energy consumption

The investment landscape is also evolving rapidly beyond traditional wind and solar projects. Advanced battery storage systems that stabilize electrical grids are attracting substantial private capital. Green hydrogen production, still in its early stages, is drawing investment from both infrastructure funds and private equity firms betting on its potential to decarbonize heavy industry.

Second-order opportunities are becoming increasingly relevant. As electric vehicles achieve mass adoption, private investors are funding networks of charging stations, battery recycling facilities and the rare earth mining operations that supply critical materials. The energy transition essentially requires a broad rethinking of how energy is produced, stored and consumed.

Infrastructure in transition

Beyond this, a broader infrastructure renaissance is underway. Across developed markets, aging infrastructure systems – many built in the post-World War II boom – are reaching the end of their useful lives just as population growth and urbanization are placing new demands on these systems.

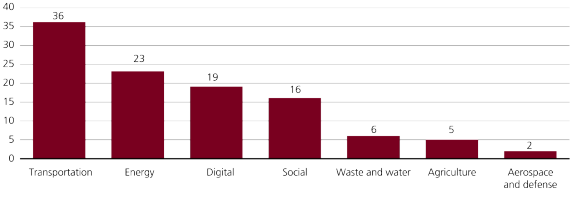

Figure 6: By 2040, cumulative infrastructure investment could reach over USD 100 trillion

Figure 6: By 2040, cumulative infrastructure investment could reach over USD 100 trillion

Total infrastructure investment projected through 2040, by sector (in USD tr)

Cumulative global infrastructure investment could reach over USD 100 trillion by 2040.

Indeed, the American Society of Civil Engineers estimates that the United States alone needs USD 3.6 trillion in infrastructure investment over the next decade. 7 Europe faces similar challenges, with estimates suggesting EUR 500 billion in annual investment needs through 2030. Asia’s infrastructure gap is even more pronounced, with the Asian Development Bank projecting needs of USD 1.7 trillion annually.8

Traditional public funding mechanisms are proving inadequate. Government budgets, constrained by aging populations and rising debt levels, cannot meet these needs alone. Private capital is stepping in to fill some of the gap. This represents a generational shift in how infrastructure is funded and operated. Private capital isn’t merely providing funding; it comes with operational expertise, technological innovation and the long-term mindset that the public sector often struggles to deliver.

The opportunities span traditional infrastructure (i.e., roads, bridges, airports) as well as new digital infrastructure like fiber optic networks and 5G systems. Increasingly, investors are focusing on mid-market opportunities where there is typically less competition and better pricing than with the mega-sized deals. Water treatment facilities, waste management systems and transportation assets are all also attracting significant private investment.

Investment access innovation

As alternative investments have matured and democratized, the vehicles through which investors access these strategies have also evolved. The traditional model – institutional capital committed to closed-end funds with 10-15 year term– is giving way to a more flexible ecosystem tailored to different liquidity, timing and control needs.

Structural innovation has today resulted in increased choice around liquidity, pacing and co-investment. A key innovation is the rise of evergreen, or perpetual, vehicles that allow continuous subscriptions and periodic redemption features often at the discretion of the GP. These funds help reduce vintage-year timing risk, potentially provide periodic partial liquidity options and simplify participation for smaller investors by eliminating capital calls and distributions.

Evergreen funds now span private equity, private credit, real estate, and infrastructure, including co-mingled secondaries and co-investment, offering diversified exposure. Yet managing liquidity features comes with trade-offs, funds must hold liquid reserves that may suppress absolute returns and can impose restrictions, proration or queues during stressed periods – underscoring the limits of offering liquidity in private markets.

Investors seeking diversification across managers and strategies are turning to more sophisticated multi-manager platforms. These go beyond traditional fund-of-funds by providing access to closed managers, negotiating better terms through scale and enabling more dynamic asset allocation. Some also incorporate co-investment and secondary opportunities, which can be especially valuable when targeting emerging managers or niche strategies.

Separately managed accounts (SMAs) deliver maximum customization while retaining professional management. Investors can set mandates, exclude sectors and maintain full transparency into holdings, making SMAs popular for ESG-focused portfolios and for managing concentration risk. To broaden access, “club” SMAs are emerging, allowing multiple investors with similar objectives to pool capital to reach the scale required for tailored portfolios.

For larger investors seeking control and potentially higher returns, co-investment platforms enable direct participation alongside general partners in specific deals, typically with lower fees. Investors can target preferred sectors, geographies or capital structures while retaining influence over deal selection.

Many limited partners now allocate a meaningful share of their private-market exposure to equity and debt co-investments, often relying on dedicated teams or specialized platforms to source, underwrite and monitor opportunities.

The role of artificial intelligence in investing

Artificial intelligence (AI) is only beginning to reshape private markets investing, but its direction is clear. By extracting insight from data at greater scale and speed, AI is changing how investors source deals, conduct due diligence and monitor portfolios, while automating many routine tasks. The potential can be seen in specific generative AI interventions like research analysis and production, through to more agentic forms where certain tasks and processes are automated. Deal sourcing in private markets has traditionally been relationship-driven. AI broadens this funnel by scanning large datasets to identify potential targets. Algorithms can assess thousands of companies at once, combining financial metrics, growth patterns, management changes, sentiment indicators and hiring trends to flag opportunities earlier.

In private credit and real estate, similar tools analyze cash-flow data, supplier relationships, demographics and development activity, as well as imagery and sensor data, to refine underwriting and market views.

Natural-language processing (NLP) is especially powerful in reviewing large document sets. In M&A due diligence, AI can analyze customer contracts to detect concentration risks or pricing trends, while in private credit it can flag covenant breaches or unusual terms. AI can review thousands of legal, contractual and regulatory documents in hours rather than weeks, uncovering red flags much faster than manual reviews. Language models can also support financial modelling, evaluate cash flows and bring more consistency to assessments of management quality by analyzing track records and communication patterns.

Once investments are made, AI is reshaping how portfolios are monitored and valued. Rather than relying solely on periodic reports, investors can use operational and alternative data to generate more real-time insights. AI-based valuation models integrate broader datasets and link company characteristics to historical transaction outcomes, providing more dynamic interim assessments. For risk management, AI can detect hidden correlations and systemic vulnerabilities across portfolios, highlighting concentration risks and interconnected patterns that may affect performance.

Although still at an early stage, AI’s impact on private markets is likely to be significant. The competitive edge will sit with firms that integrate these tools thoughtfully while preserving the human judgment and relationships that remain essential to successful investing.

Alternative realities

For investors, the message should be clear. Adoption is expanding to a much broader swath of investors beyond those previously able to access private markets. In this new reality, alternatives are becoming central to portfolio construction, essential for meeting the return and risk objectives that traditional assets alone cannot provide.

The democratization of access opened the door; megatrends are creating the opportunities; and AI is providing new tools. What remains is the discipline to navigate this landscape successfully, preserving the value of the risk and illiquidity premia that define these asset classes while adapting to an increasingly competitive and scrutinized environment.

As the industry matures, the abundance of capital has impacted valuations and intensified competition for the best opportunities. But maturation also brings opportunities. The real value of alternatives is not simply diversification by asset class; it lies in the differentiated return profile they provide.

With the great portfolio reset well underway, the key question for investors is no longer whether to participate, but how to do so thoughtfully, strategically, and with the long-term perspective that alternatives require.

The Red Thread

Alternative alpha

Alternative alpha