Asia equities: FAQS, facts and figures

Asian equities are a growing and diverse space for investors, with a full range of small, medium and large cap stocks. In this detailed Q&A, we answer some common investor questions about the asset class, Asian markets, and Asia investing.

The five best-performing Asian equity market indexes in 2020 were:

- Shenzhen Stock Exchange Component Index (SZI): +38.7%

- Taiwan Taiex:+22.8%

- Japan Nikkei 225: +16.0%

- India BSE Sensex: +15.8%

- India Nifty 50: +14.9%

Source: CNBC, December 31, 2020¹

Sinopec is the largest listed Asian company by revenue, with revenues of USD 407 billion in 2020, according to the Fortune Global 500. The Fortune Global 500 for 2020 ranked companies by total revenues for their respective fiscal years ended on or before March 31, 2020².

As of March 16, 2021, Tencent was the largest Asian company by market capitalization, according to Bloomberg data.

22, according to data produced by the World Federation of Exchanges, as of February 2021³.

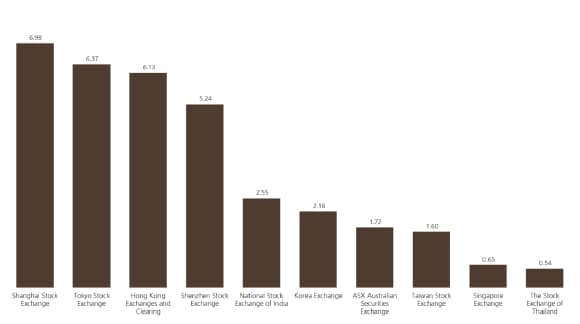

The ten largest stock exchanges in Asia, according to the World Federation of Exchanges and measured by market capitalization in USD as of December 31, 2020 are:

- Shanghai Stock Exchange (USD 6.98 trillion)

- Tokyo Stock Exchange (USD 6.37 trillion)

- Hong Kong Exchange (USD 6.13 trillion)

- Shenzhen Stock Exchange (USD 5.24 trillion)

- National Stock Exchange of India (USD 2.55 trillion)

- Korea Exchange (USD 2.17 trillion)

- ASX Australia Securities Exchange (USD 1.72 trillion)

- Taiwan Stock Exchange (USD 1.60 trillion)

- Singapore Exchange (USD 0.65 trillion)

- Thailand Stock Exchange (USD 0.54 trillion)

Asia’s ten largest stock exchanges by market capitalization (USD trillions), December 31, 2020

Asia’s ten largest stock exchanges by market capitalization (USD trillions), December 31, 2020

The Shanghai Stock Exchange, with a market capitalization of USD 6.98 trillion at the end of December 2020, is the largest stock exchange in Asia, according to the World Federation of Exchanges.

The Shanghai Stock Exchange is the biggest stock market in China, measured by market capitalization. The Shanghai Stock Exchange had a market capitalization of USD 6.98 trillion as of December 31, 2020, according to data from the World Federation of Exchanges.

China A-shares are RMB-denominated equity shares of China-based companies and trade on either the Shanghai Stock Exchange (SSE) or Shenzhen Stock Exchange (SZSE). H-shares are HKD-denominated equity shares of mainland China companies listed on the Hong Kong Stock Exchange.

4,214 companies are listed on A-share markets as of the end of February 2021, according to data from the World Federation of Exchanges. A-shares include companies listed on both Shanghai and Shenzhen Stock Exchanges. As of the end of February 2021, 1,829 A-share companies were listed in Shanghai, and 2,385 A-share companies were listed in Shenzhen.

Hang Seng is the name of an index that represents and tracks the largest listed companies on the Hong Kong stock market, it is the main indicator of the performance of the overall Hong Kong market.

52, as of February 2021, according to the Hang Seng Indexes Company⁴.

Australia, Hong Kong, New Zealand, Singapore, China, India, Indonesia, Korea, Malaysia, Pakistan, the Philippines, Taiwan and Thailand are classified by MSCI as countries within the Asia ex-Japan group.

IT, Materials and Energy are the key overweight sectors for our Asia All Cap HALO strategy against benchmark as of February 28, 2021.

Valuations for Asia equities are relatively inexpensive and generally still below the US, according to price-earnings data at the end of February 2021.

12M Forward Price-to-Earnings Ratio (P/E)/10 Years History: Markets Compared

12M Forward Price-to-Earnings Ratio (P/E)/10 Years History: Markets Compared

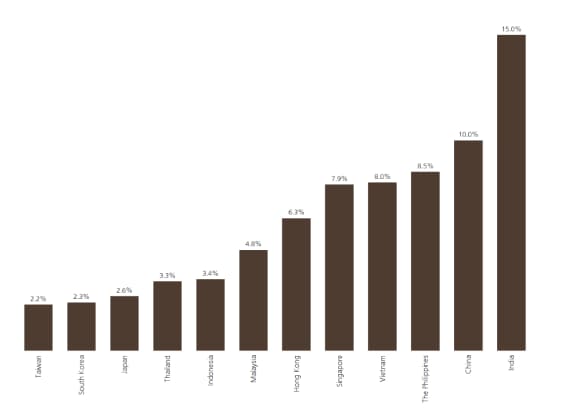

India is forecast to see 15.0% y-o-y growth in consumption in 2021, followed by 6.5% y-o-y growth in 2022, according to UBS estimates as of February 26, 2021

Asia: Forecast growth in consumption, 2021 (f)

Asia: Forecast growth in consumption, 2021 (f)

The MSCI Asia ex-Japan Small & Mid Caps benchmark index.

The MSCI Asia ex-Japan Small & Mid Caps benchmark index recorded gross returns of 50.09% over a one-year period as of February 26, 2021, and gross (annualized) returns of 5.98% and 11.68% over three and five years, respectively, according to official data from MSCI⁵.

1,992 companies, as of December 2020, according to the MSCI All Country Asia ex-Japan Small & Mid-Caps Index.

There are more than 3,000 small and mid cap stocks in Asia ex-Japan, and the large universe, with some stocks having low trading volume and thus limited liquidity, has led to them being under-researched.

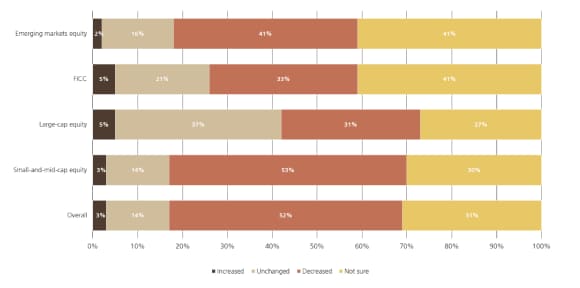

In addition, the implementation of MiFID II has exacerbated the situation. MiFID II required brokers to charge separate fees for trade execution and for research, one of the outcomes being a reduction in overall commissions/fees paid to brokers.

This appears to have led to research providers focusing on large-cap stocks which are more heavily-traded, thereby negatively impacting research in small and mid cap equity sectors.

In a Europe-wide survey by CFA Institute on the outcomes of MiFID II conducted in 2019, one year after the launch of MiFID II, the investment professionals surveyed cited decreases in the number of analyst jobs and a scaling back of research coverage, with the small- and mid-cap equity sectors affected most.

Survey: Since the introduction of MIFID II, for the following asset classes, has research coverage increased, remained unchanged, decreased, or not sure? (Sell-side responses)

Survey: Since the introduction of MIFID II, for the following asset classes, has research coverage increased, remained unchanged, decreased, or not sure? (Sell-side responses)

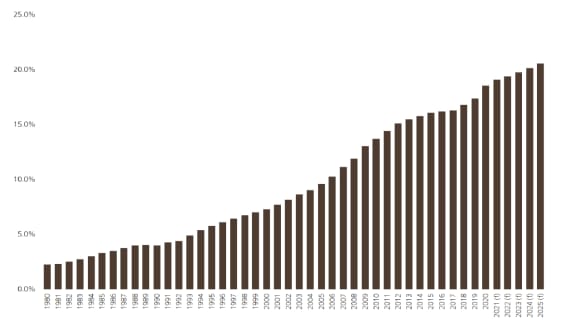

Asian countries contributed 43.97% to global gross domestic product (GDP) in 2020, according to calculations by the International Monetary Fund (IMF). Asia’s contribution to global gross domestic product is forecast to grow from 43.97% in 2020 to 47.07% in 2025, according to IMF estimates as of October 2020.

China contributed 18.56% of total global gross domestic product in 2020, according to estimates by the International Monetary Fund (IMF) as of October 2020. The IMF forecasts that China’s contribution to total global gross domestic product (GDP) will grow to 20.57% in 2025.

China’s contribution to global GDP (%), 1980-2025 (f)

China’s contribution to global GDP (%), 1980-2025 (f)

China, India, Japan, Indonesia, Korea are the five largest economies in Asia, according to estimates for 2020 by the International Monetary Fund (IMF) that rank economies by GDP in current prices in USD.

The five largest economies in Asia, 2020 (GDP in current prices, USD)

The five largest economies in Asia, 2020 (GDP in current prices, USD)

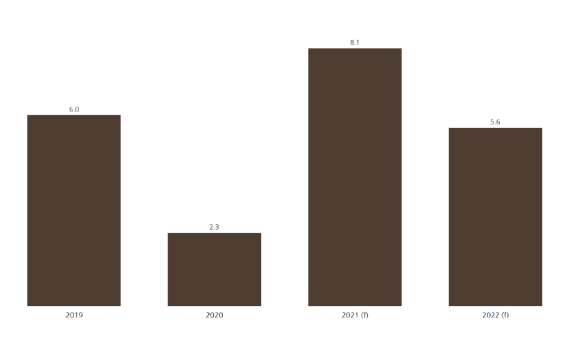

China‘s economy - the second largest in the world - will grow by 8.1% y-o-y in 2021 and by 5.6% y-o-y in 2022, according to forecasts made in January 2021 by the International Monetary Fund.

China: GDP Growth (%-YoY), 2019-2022 (f)

China: GDP Growth (%-YoY), 2019-2022 (f)

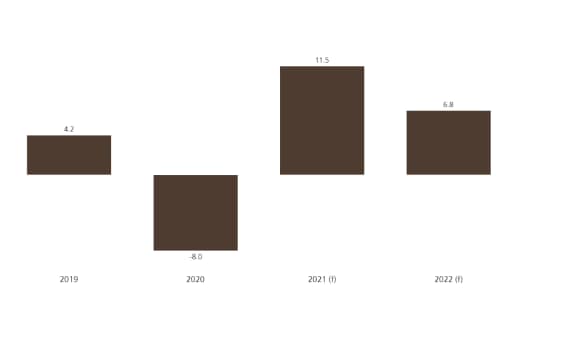

India‘s economy will grow by 11.5% y-o-y in 2021 and by 6.8% y-o-y in 2022, according to forecasts made in January 2021 by the International Monetary Fund.

India: GDP Growth (%-YoY), 2019-2022 (f)

India: GDP Growth (%-YoY), 2019-2022 (f)

Explore more insights

Original articles and videos with expert analysis, views and opinions on a broad range of asset classes and themes.