China economy 2020 in five charts

China's economy generates a lot of noise, so we thought we'd cut through it by selecting five China charts that will matter for investors in 2020.

China economy 2020 – 5 takeaways

China economy 2020 – 5 takeaways

- China's economy will slow to 5.8% growth in 2020, according to the OECD;

- China's central bank will grow credit in the economy, but in a different way to the past;

- Pork prices will put upward pressure on consumer price inflation, the price of pork grew 101.3% y-o-y in November 2019, according to China's National Bureau of Statistics;

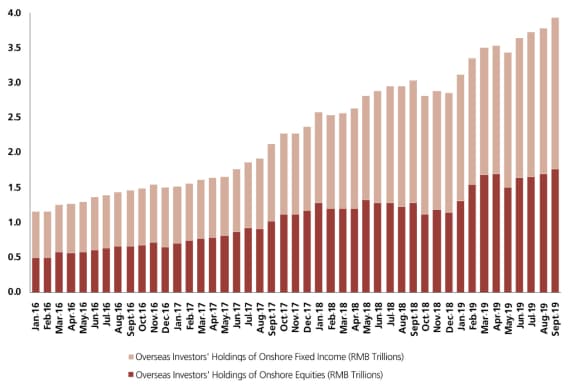

- Offshore investors will become more influential in China's money markets, they owned about RMB 4 trillion of onshore equities and bonds in September 2019, according to the People's Bank of China;

- With an election coming in 2020, China will probably feature heavily in President Donald Trump's Twitter activity, which will add to volatility and policy uncertainty.

#1 China's economy: L-shaped recovery

#1 China's economy: L-shaped recovery

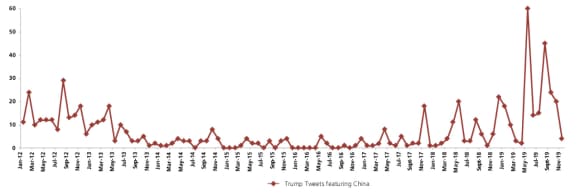

China's economy will grow 5.8% in 2020, slower than 6.1% in 2019, according to estimates by the Organization for Economic Co-operation and Development (OECD)1.

That's consistent with the 'L-shaped recovery' we have been expecting for some time. That's because China's government has supported the economy with tax and interest rate cuts during the past year.

Looking at government statements, China's authorities appear comfortable with the predicted growth rate, and we don't expect a ramp up in stimulus to boost growth above this level.

While growth has come down, we think that's fine because it is a more sustainable pace and, crucially, driven by consumption and services, where growth remains robust, despite worries of dampened growth from the trade war.

China: Real Economic Growth YoY (%), 2007-2024 (f)

#2 China credit impulse – a lead indicator of Chinese and global economic growth

#2 China credit impulse – a lead indicator of Chinese and global economic growth

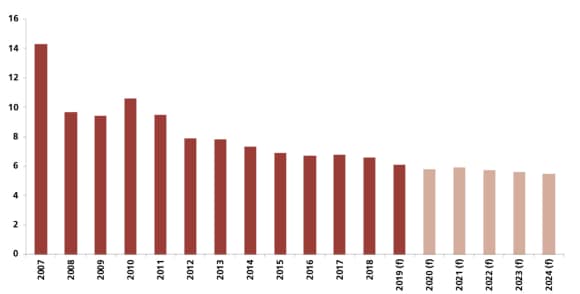

China's credit impulse - the measure of growth in total credit in the economy as a % of GDP - can give investors an early read of future growth prospects for both the Chinese and world economy.

Growth in the credit impulse drove the post-GFC boom in 2009 & 2010, supported a pick-up in global growth in 2013, and also contributed to faster global growth in 2017.

Additionally, the drop in growth in the credit impulse from mid-2017 through 2018 also dragged on domestic and global growth.

We're now seeing what looks like a return to growth in the credit impulse. That said, China remains on a deleveraging drive, so we doubt the impulse will grow that much in 2020.

We believe that rather than boost credit, the People's Bank of China will move to reduce interest rates in H1 2020 but keep a close hold on loan creation.

China Credit Impulse (LHS) & G20 GDP Growth (RHS) (%/YoY Change), Q2 2008-Q3 2019

#3 Pork prices

#3 Pork prices

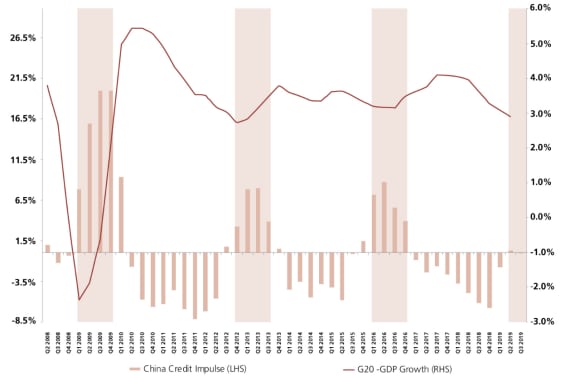

Pork prices account for an estimated 2.5% of China's consumer price index (CPI), according to Bloomberg who also estimate that food prices account for 19.9% of the basket2.

China's stock of pigs has been severely affected by an outbreak of African swine fever, with an estimated 25% of China's pork production being taken out of the market.

That's caused an increase in pork prices – growing 101.3% y-o-y in November 2019, which fed a y-o-y increase of 3.1% in China's consumer price index (CPI), its headline rate of inflation, according to China's National Bureau of Statistics.

China has taken measures to deal with the shortages by releasing supplies from pork reserves and supporting farmers. While we expect inflation pressure to ease in the next six months, but these conditions will make China's authorities reluctant to significantly increase credit in the economy in the near term.

China : Pork Prices (%/YoY Change)

#4 Offshore investors onshore in China

#4 Offshore investors onshore in China

Stock & Bond Connect and quota removals have opened up China's financial markets and international investors have responded, raising their combined onshore fixed income and equity holdings to RMB 4 trillion as of September 2019.

We expect this trend to continue as China's bond and fixed income markets continue to go into global index benchmarks. MSCI has raised the representation by A-shares in its indices and Bloomberg Barclays and JP Morgan are bringing China onshore bonds to their benchmarks.

These are important developments for sure, but they are particularly important for the development of the economy long-term. China needs foreign capital to not only feed the economy but to create a more differentiated source of finance for the private sector.

Additionally, we expect China's capital account balance to move into deficit in the coming years, so that makes an influx of overseas capital essential to maintain financing to the economy.

Overseas Investors' Onshore Holdings (RMB Trillions), Jan 2016-Sep 2019

#5 China. Trump and 140 characters

#5 China. Trump and 140 characters

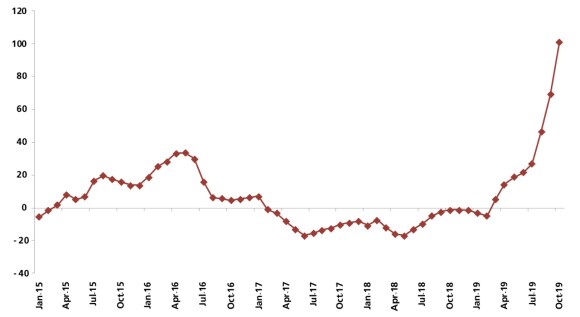

Donald Trump likes to tweet about China and has been doing it more frequently recently, particularly with trade negotiations ongoing and an election coming in 2020.

The unpredictable nature of Donald Trump's tweets make for uncertainty about the outlook for US government policy and the prospects for the US/China trade relationship.

This kind of unpredictability can impact investor sentiment.

Indeed, we believe that concerns about the future trade relationship between two of the world's largest economies have been impacting markets, particularly in China.

Given the factors described above, and our belief that that the US/China rivalry will run for a longer period of time, we continue to expect Trump's Twitter views on China will be at the forefront of both the newscycle and investors' minds in the future and will add to ongoing uncertainty in the markets.

Tweets by Trump featuring China, Jan 2012-Nov 30, 2019