Asia drives the world economy. It has been doing so for years and that’s something we will all have to get used to also in the future. Despite recent regulatory change and the related short-term market volatility, China’s influence continues to grow, Asia’s consumer base expands, and Asian companies extend their lead in the world of tech and innovation. And while we believe these trends will drive the future, we also believe that now is the time to bring Asia’s growth story and diversification benefits into your portfolios.

And we have a wide range of attractive strategies to help you capture Asia’s multi-faceted growth story.

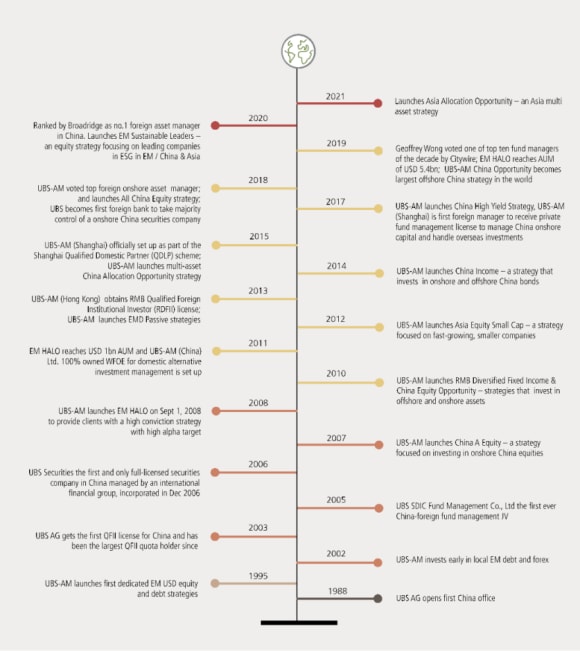

Leading in China

Voted joint no. 1 foreign asset manager in China for 2021 by Broadridge1

Award-winning strategies

Our China & Emerging Markets equity strategies have won many awards over the years2

Highly-rated fund managers

Three of our Asia & China fund managers made L’Agefi Indices list of the world’s 100 best fund managers3