Is your cash blowing away?

A well-diversified portfolio, which is in line with an investor’s investment goals and risk appetite, is key to investment success. Too often investors are over-allocated to cash. "Cash is not king", investors should carefully consider the proper allocation to cash to meet long-term goals.

Cash is often mistakenly perceived as providing safety and security in investors' portfolios. It is natural to seek security and holding a certain amount of money in an account can seem a safe option. However, holding too much cash may actually be riskier for investors. It can overexpose investors to unpredictable currency fluctuations, prevent them from achieving their investment goals or drive them to take excessive risks on the rest of the portfolio. But what about cash providing flexibility and a safety net in case of unforeseen circumstances? Investors have other options to stay flexible while enhancing their overall portfolio.

The more cash you keep, the less likely it is that investors will achieve their long-term financial goals

Cash and purchasing power

Purchasing power is the value of a currency expressed in terms of the amount of goods or services that one unit of money can buy. All else equal, inflation has a negative impact on purchasing power. It means that inflation decreases the amount of goods and services that may be purchased. So if it is true that cash rarely performs negatively (except in a negative interest rates environment), the value of cash doesn't remain constant over time. Cash may be considered safe, but actually loses value or purchasing power over the years.

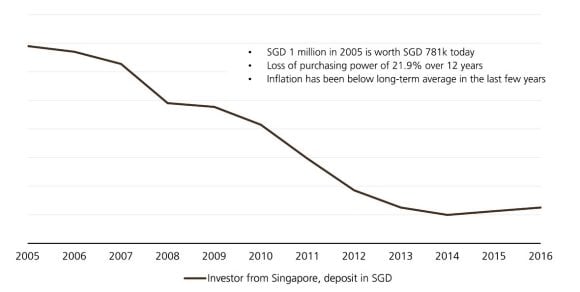

Here we use a Singapore-based investor, who has been invested in cash since 2005, as a case study. Taking into account inflation in the Island City over this period, an investment of SGD 1000 in 2005 would only have a real value of SGD 781 today. This is a loss in purchasing power of -21.9% (illustration 1). If we take into account the money market returns over the holding period, the real value of the initial investment would still be lower, approximately SGD 863, representing a loss of purchasing power of -13.7%. In other words, the deposit interest rate on cash over the last 12 years would not have protected investors against inflation. If the same Singapore-based investor had been invested in USD instead of SGD, his loss in purchasing power would have been even larger as the SGD appreciated strongly against the USD from 2005 to 2012 (i.e. -32.1% without factoring deposit rates and -22.9% interest earn on a deposit).

Illustration 1

Cash and investment risks

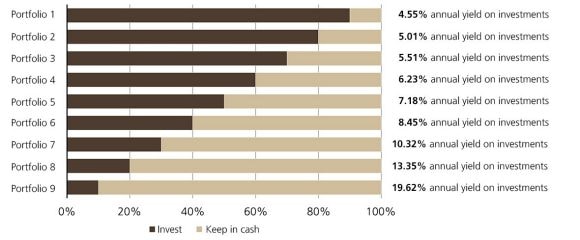

Contrary to common expectations, holding excessive cash in a portfolio can lead to greater investment risks. This is because investors often have a long-term return objective for their portfolios that does not take into consideration the fact that part of the portfolio is invested in cash. Cash dilutes the overall return of an investor's portfolio. In a low yielding environment like the one we are experiencing today, the higher the allocation to cash, the higher the rest of an investor's portfolio has to perform to achieve the overall portfolio expected return. Let's look at what kind of return is necessary to turn 1 million today into 1.5 million in 10 years by comparing 2 investors with different cash allocations. The first investor decides to keep only 10% in cash, while the second investor is more conservative and wants to keep 50% in cash. The first investor only needs to generate 4.6% p.a. on the invested portfolio (90%) to achieve the expected return of 1.5 million in 10 years. In contrast, the more conservative investor needs to achieve 7.2% p.a. in order to meet the same goal. The second, more conservative, investor would need to take on greater risk on the invested portfolio in order to achieve his long-term objectives (illustration 2).

Illustration 2

What is required to turn 1 million

today into 1.5% million in 10 years

Cash is not king and investors should identify cash alternatives based on their individual preferences for risk, time horizon and expected return

The role of cash

For many investors, cash appears to be the ’obvious’ solution for safety and capital preservation. The role of cash should be for liquidity and not safety. Holding too much cash is detrimental to an investor's long term goals. UBS Wealth Management CIO recommends a relatively limited allocation to cash (i.e. 5%) in its Strategic Asset Allocation (SAA). Unfortunately, most investors tend to hold an excessive amount of cash in their portfolio (the average cash holding is about 30%).

In the long run, cash will underperform other financial assets that offer a risk premium. The more cash an investor holds on to, the greater the risk he must assume on the invested portion of his portfolio (while having fewer investment options). An excessive allocation to cash also prevents effective diversification and is likely to put long-term financial objectives in jeopardy.

In summary, cash is not king and investors should identify suitable cash alternatives based on their individual preferences for risk, time horizon and expected return. Please contact your client advisor today to optimize your portfolio allocation.

Other articles you might like

Other articles you might like

We’d like to meet you

We’d like to meet you

Come and see us so we can tell you more about us.