UBS (Lux) Bond SICAV - Asian High Yield (USD)

The UBS Asian high yield Fund invests predominately in US dollar Asian bonds, rated BB and below. The Fund has provided strong distribution income (distribution share classes only) and consistent returns.

Seek dependable income

Seek dependable income

With UBS Asian high yield fund1

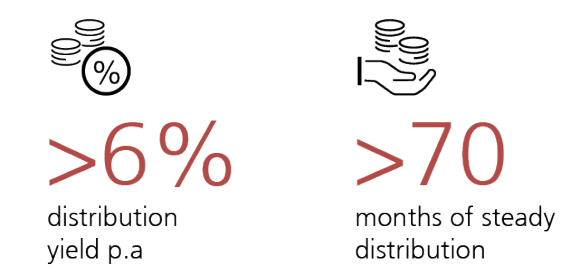

>6% p.a. distribution payout over 5 years

>6% p.a. distribution payout over 5 years

For over 5 years, the P-mdist (USD) share class has provided investors with more than 6% distribution yield per annum (p.a.). The most recent distribution, June 2023, had a distribution per share USD 0.271.

Fund factsheets

Fund factsheets

Share class (Click for factsheets) | Share class (Click for factsheets) | Distribution | Distribution | ISIN | ISIN |

|---|---|---|---|---|---|

Share class (Click for factsheets) | P-mdist SGD | Distribution | Monthly | ISIN | LU0626907124 |

Share class (Click for factsheets) | Distribution | None | ISIN | LU0626906662 | |

Share class (Click for factsheets) | Distribution | Annually | ISIN | LU0725271786 | |

Share class (Click for factsheets) | Distribution | Monthly | ISIN | LU0626906746 | |

Share class (Click for factsheets) | Distribution | None | ISIN | LU0626907470 | |

Share class (Click for factsheets) | Distribution | None | ISIN | LU0626907397 |

More insights on Asian high yield bonds

More insights on Asian high yield bonds

1Source: UBS Asset Management, as of June 2023

NAV refers to the NAV before which the dividend was paid out.

Equivalent yield is derived from simple arithmetic calculation where the dividend is divided by the NAV, and annualised thereafter. Please use this for reference only. Distributions are not guaranteed and will be at the Management Company absolute discretion. Distribution yield does not equal to total return. This share class (mdist) makes monthly and gross-of-fee distributions.

Past payout yields and payments do not represent future payout yields and payment.

This share class which pays distribution may distribute not only investment income, but also realised and unrealised capital gains or capital. Where capital is distributed, this will result in a corresponding reduction in the value of Shares, and a reduction in the potential for long-term capital growth

2Source: UBS Asset Management, Bloomberg based on the JACI HY index

UBS (Lux) Bond SICAV , a Luxembourg open-ended investment company, is the responsible person for the Fund's sub-fund, UBS (Lux) Bond SICAV - Asian High Yield (USD) (the "Sub-Fund") recognised under Section 287 of the Securities and Futures Act of Singapore. UBS Asset Management (Singapore) Ltd (Company Registration No.:199308367C) has been appointed as the Singapore representative ("UBS AM SG").

Investors should read the Singapore prospectus (“Prospectus”) for further details before deciding to subscribe for or purchase units in the Sub-Fund, a copy of which can be downloaded from our website. The Prospectus can also be obtained free of charge from UBS AM SG, or from any of our authorized distributors as listed in our website. The price of the units in the Sub-Fund and the income accruing to those units, if any, may fall as well as rise. The Sub-Fund may use or invest in financial derivative instruments* to the extent permitted under Luxembourg laws. Due to the investment policies and/or portfolio management techniques of the Sub-Fund, it may experience greater volatility in its net asset value*. Investments in the Sub-Fund are not deposits in, obligations of, or guaranteed or insured by UBS AM SG, UBS AG, UBS Asset Management or any of their subsidiaries, associates or affiliates or distributors of the Sub-Fund and are subject to investment risks, including the possible loss of the principal amount investment. Past performance of the Sub-Fund, the management company and the portfolio manager and any past performance, prediction, projection, forecasts or information on the economic trends or securities market are not necessarily indicative of the future or likely performance of the Sub-Fund or the management company or the portfolio manager or a guarantee of future trends. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. No responsibility can be accepted by the management company or the portfolio manager to anyone for any action taken on the basis of the analysis. No representation or promise as to the performance of the funds or the return on your investment is made. Units of the Sub-Fund are not available to U.S. persons.

The information about the Sub-Fund provided in this document does not constitute an offer or solicitation to deal in units of the Sub-Fund or investment advice or recommendation. It is for informational purposes only. This document was prepared without regard to the specific investment objective(s), financial situation or the particular needs of any person. It is based on certain assumptions, information and conditions available as at the relevant date(s) and may be subject to change at any time without notice. Nothing in this document should be construed as advice or a recommendation to buy or sell units in the Sub-Fund. Investors may wish to seek independent advice from a financial adviser before making a commitment to invest in the Sub-Fund). In the event an investor chooses not to seek advice from a financial adviser, the investor should consider whether the Sub-Fund is suitable for him.

© UBS 2022. The key symbol and UBS are among the registered and unregistered trademarks of UBS.

All rights reserved.

*Please refer to the Prospectus for more information on the risks associated with investments in financial derivative instruments and the Sub-Fund's volatility.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.